Holding Out Hope For The Future

2022.10.04 01:42

[ad_1]

Ten days ago, the seasons changed. We went from Summer to Fall.

Growing up in the Midwest (Ohio), I have always loved the Fall. Not necessarily the cold weather that follows it, but the season which begins in late September is by far the most beautiful. Rich in colors. Some of the other things I enjoy in the Fall include:

The days are still mild, but the nights begin to get cool.

Daylight gets shorter, and darkness arrives sooner, but it’s a great time to binge-watch new shows.

College and Pro football kick off a new season. It’s fun to watch new superstars emerge.

Baseball playoffs begin the excitement of the road to the World Series. (Our team, the Cleveland Guardians, recently clinched the pennant).

The September-October volatile stock market period usually comes to an end.

The Thanksgiving holiday is approaching soon. I love this holiday!

While Fall is a season, it also has numerous other pertinent meanings:

fall

VERB

- move downward, typically rapidly and freely without control, from a higher to a lower level:

“five inches of snow fell through the night” ·

- (Of a person) lose one’s balance and collapse:

“He stumbled, tripped, and fell”

- decrease in number, amount, intensity, or quality:

“Imports fell by 12 percent”

NOUN

- an act of falling or collapsing; a sudden uncontrollable descent:

“His mother had a fall, hurting her leg as she alighted from a train”

- a thing which falls or has fallen:

“In October came the first thin fall of snow”

- a decrease in size, number, rate, or level; a decline:

“a big fall in unemployment”

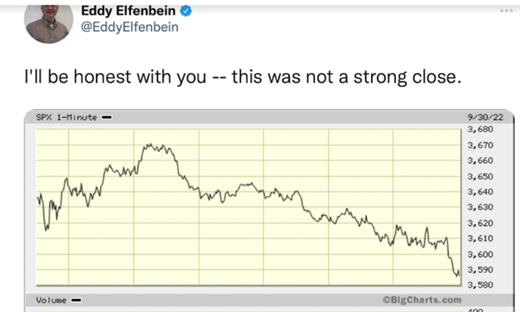

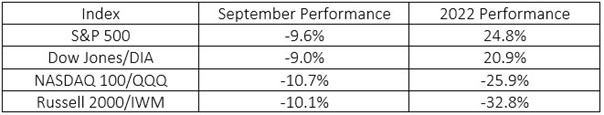

While the lovely autumn season is upon us (Fall), we have also had to experience a falling stock and bond markets. September saw the worst performance in the S&P 500 since March 2020 when we were in the start of the pandemic. And it did not end well this past Friday.

SPX Index Chart

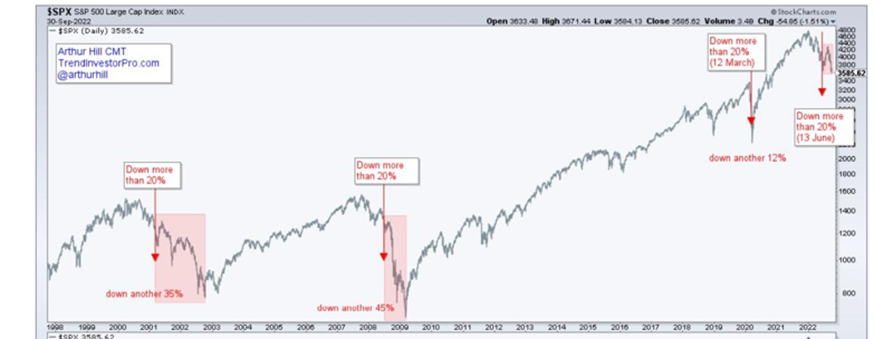

Moreover, we have broken the 200-week moving average on the . In 2011 and 2018 the S&P held here, but in 2008 and 2001, this level marked the beginning of a new wave of selling.

The is now down more than 20%, which means it joins the and S&P 500 as having officially entered a bear market.

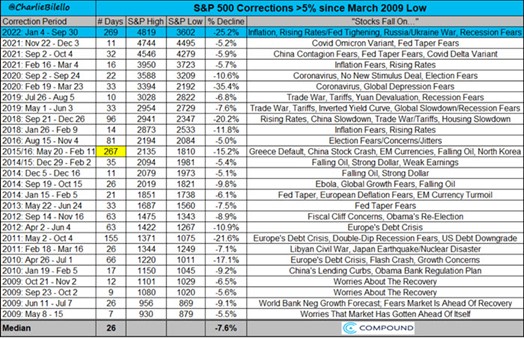

A long-lasting correction. The Fall continues

At 269 days and counting, you would have to go back to March 2009 to find a correction this long in the number of days. The downward grind continues. This is what the numbers look like:

S&P 500 Correction

We are also experiencing falling numbers in consumer spending as well as consumer sentiment, purchasing managers index, and economic growth numbers. Most of these are recent numbers and have motivated the major analysts on Wall Street to reduce their earnings expectations.

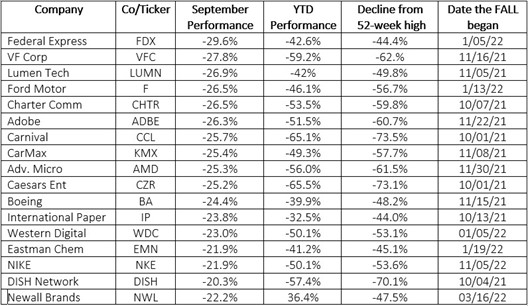

The Generals Are Falling

Towards the latter part of a Bear Market, the largest companies with consistent, steady earnings begin to fall. This is a meaningful part of the contraction that begins to happen as portfolio managers and analysts revise their growth and earnings expectations. September saw a huge downward move in many of the biggest companies.

Earnings

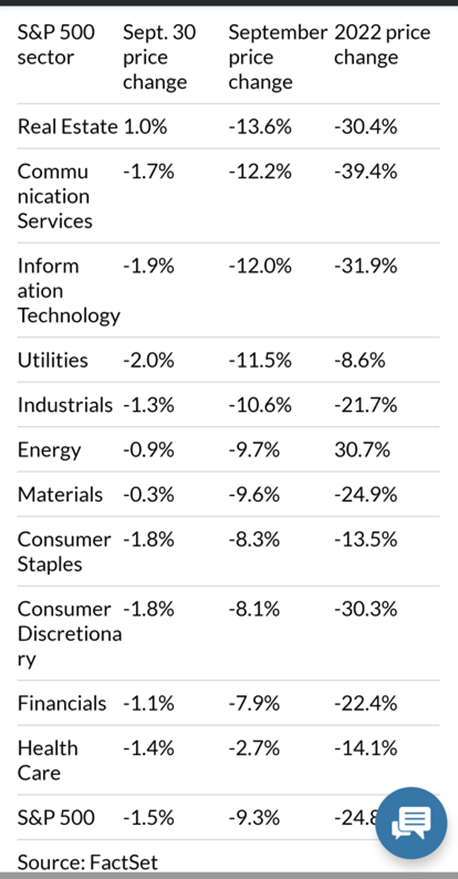

As an indication of how widespread the fall in stocks has been during September, below is a graph of the S&P Sectors with their September and year-to-date performance:

S&P Sectors Year-To-Date Performance

The Fall in September was brutal. See average performance below:

S&P 500 Performance

These are some very large numbers folks.

Yesterday (not including the performance from Friday), our friend Charles Payne commented that so far in 2022 the stock market has lost $13 trillion in value and the bond market, worse at $16 trillion. You ask why would the bond market be worse?

The average fixed income fund is down around 16% year-to-date (less than the stock markets as indicated above), but MANY people have much more in fixed income funds than stocks. Up to now, most people believed that fixed income (bond funds) would be the savior if stocks declined. That relationship (bonds holding up when stocks fall) is broken. Both asset classes have imploded together.

A Note of Caution and Some Hope Too!

We have received calls from interested parties and subscribers asking us if the markets can continue to Fall? Of course. Unfortunately, when the Dow is down by 20% (bear market) it usually falls further. See chart below:

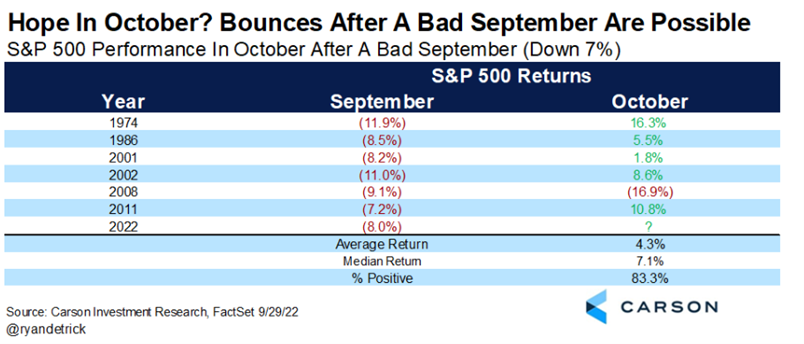

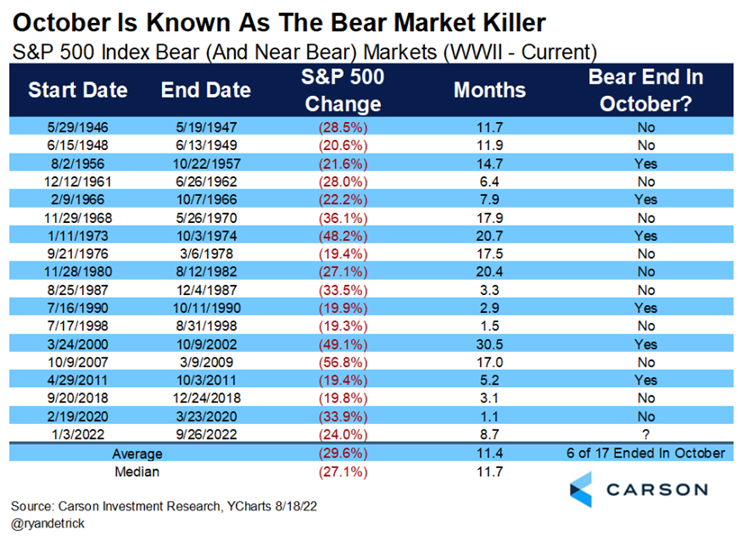

However, there are several statistical reasons to be hopeful about October and the remainder of the year.

We now want to take you thru a couple of hopeful and positive scenarios. These graphs have been taken from an article written by Ryan Detrick CMT of the Carson Group. I have followed Ryan for a long time from my previous involvement working with LPL where he was their Chief Market Technician (CMT) for many years. I credit Ryan’s great work for helping us illustrate some hopeful potential future market behavior.

Hope 1

Historically, stocks have rallied in October after a September that is down more than 8%.

S&P 500 Performance In October

S&P 500 Performance In October

Hope 2

A significant number of bear markets have been stopped in their tracks in October.

S&P 500 Index Bear Markets (WWII – Current)

S&P 500 Index Bear Markets (WWII – Current)

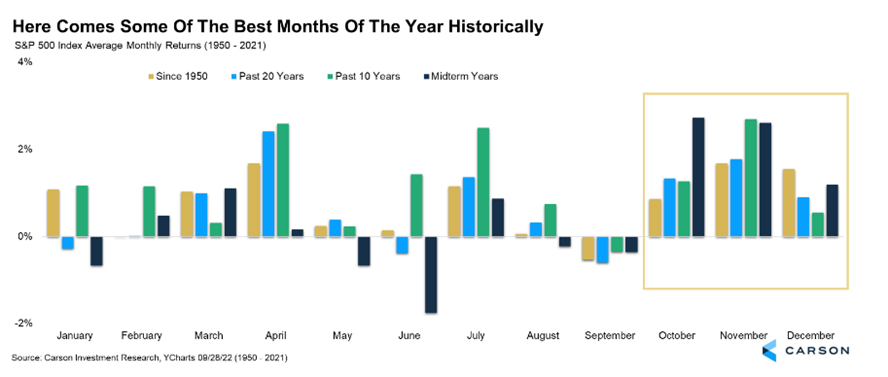

Hope 3

October to December is usually the best period of the year to invest in the stock market.

Historical Best Months for S&P 500

Historical Best Months for S&P 500

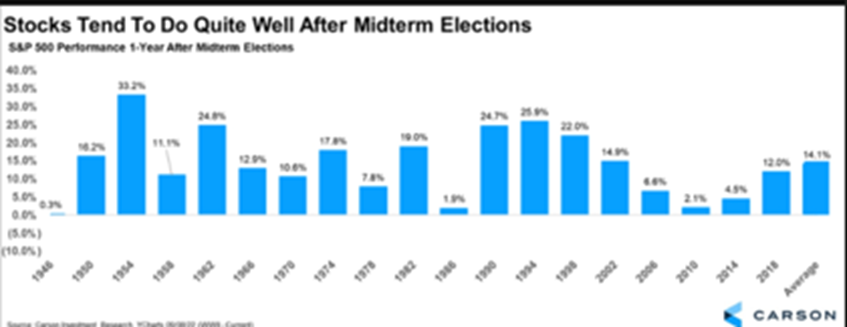

Hope 4

After midterm elections, the market typically does well.

S&P 500 Performance After Midterm Elections

S&P 500 Performance After Midterm Elections

While this upcoming period of October to December has typically been positive, we want to caution you that we are NOT PREDICTING this, but just citing the facts.

This remains a Fed non-accommodative, raising interest rates period. As Mish continually points out, we are in a low or no growth stagflation period. To make money and be successful in your investment portfolio at this time you should have much more of a trader’s mentality.

[ad_2]

Source link