High-Beta Stocks Lead U.S. Equities in 2023, Small-Cap Value Close Behind

2023.02.28 08:39

The strong outperformance of high-beta stocks shows no sign of relinquishing leadership in the US equities market this year, based on a set of ETF proxies through Monday’s close (Feb. 27).

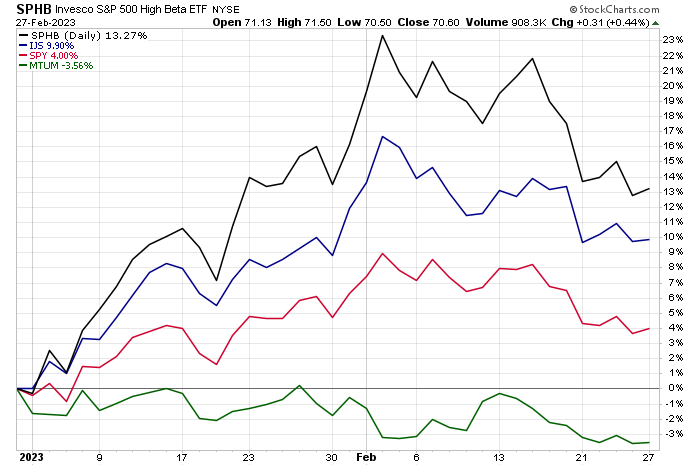

Invesco S&P 500 High Beta ETF (NYSE:) has pulled back modestly from its Feb. 2 peak but continues to post a sizable return premium in absolute and relative terms.

SPHB is up 13.3% year to date, far ahead of the broad market’s 4.0% gain so far in 2023, based on SPDR S&P 500 (NYSE:).

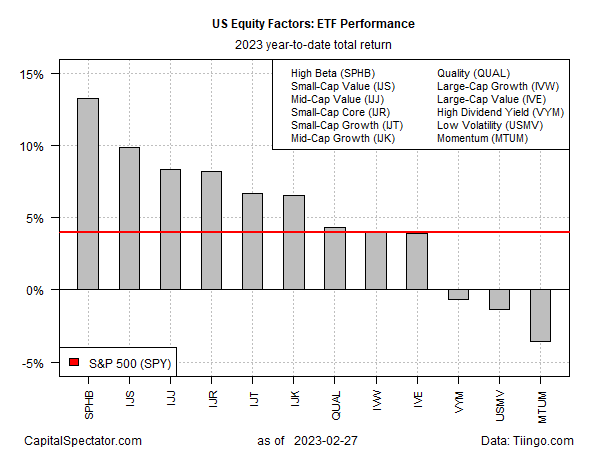

Small-cap value stocks are also enjoying market-beating results this year: iShares S&P Small-Cap 600 Value (NYSE:) is up nearly 10%, second only to SPHB’s 2023 run so far.

Meanwhile, the worst factor performer on our list – the momentum factor – continues to show no sign of recovery this year.

The iShares MSCI USA Momentum Factor ETF (NYSE:) has lost 3.6% in this year’s trading, modestly deeper vs. its performance in CapitalSpectator.com’s previous .

There are now three-factor ETFs underwater for 2023. High dividend yield () and low volatility () have joined momentum as year-to-date losers in recent weeks.

Equity Factors – ETFs YTD Total Returns

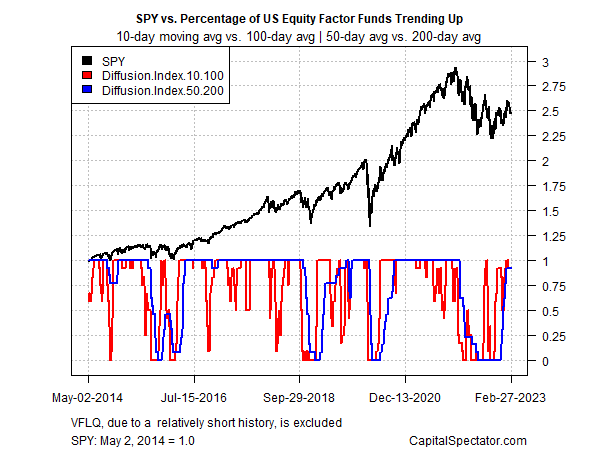

Positive momentum for the factor ETFs overall prevails, based on a set of moving averages that profile the funds listed above. The recent recovery in the upside bias suggests that most of the funds will continue to hold on to positive results for the near term.

SPY vs Equity Factors Trending Up

Adam Sarhan, CEO of 50 Park Investments, said,

“This month will go down in history as the month where the market pulled back to digest a very strong rally you saw at the end of December into most of January. This is a pullback month, it’s a rest month, and that’s good as long as support is defended and support holds, which is last week’s low.”