Hang Seng Index: The Medium-Term Bullish Trend Has Been Damaged

2024.08.12 09:50

- China’s lacklustre core consumer inflation growth for July suggests the current pace of piecemeal stimulus measures is not sufficient to eradicate deflationary pressures.

- The “non-abating” deflationary risk scenario pushed the 10-year China sovereign bond yield to a record low of 2.12% last Monday, 05 August.

- The price actions of the Hang Seng Index have traded below its 50-day and 200-day moving averages.

This is a follow-up analysis of our prior report, “Hang Seng Index: Weak key China data & revival of Trumponomics dampen last week’s bullish tone” dated 15 July 2024.

Since our last publication, the price actions of the have dropped lower as expected; it shed by 8.7% in the past four weeks to print an intraday low of 16,441 on Monday, 5 August.

Overall, the Hang Seng Index has not been able the repeat its prior medium-term bullish feat seen from April to May this year where it rallied by 23% due to the lacklustre macro data out from China and the continuation rhetoric of boosting domestic consumption but without actual concrete forceful stimulus measures follow through from policymakers.

China’s Inflationary Growth Still Reeks of Deflationary Risk

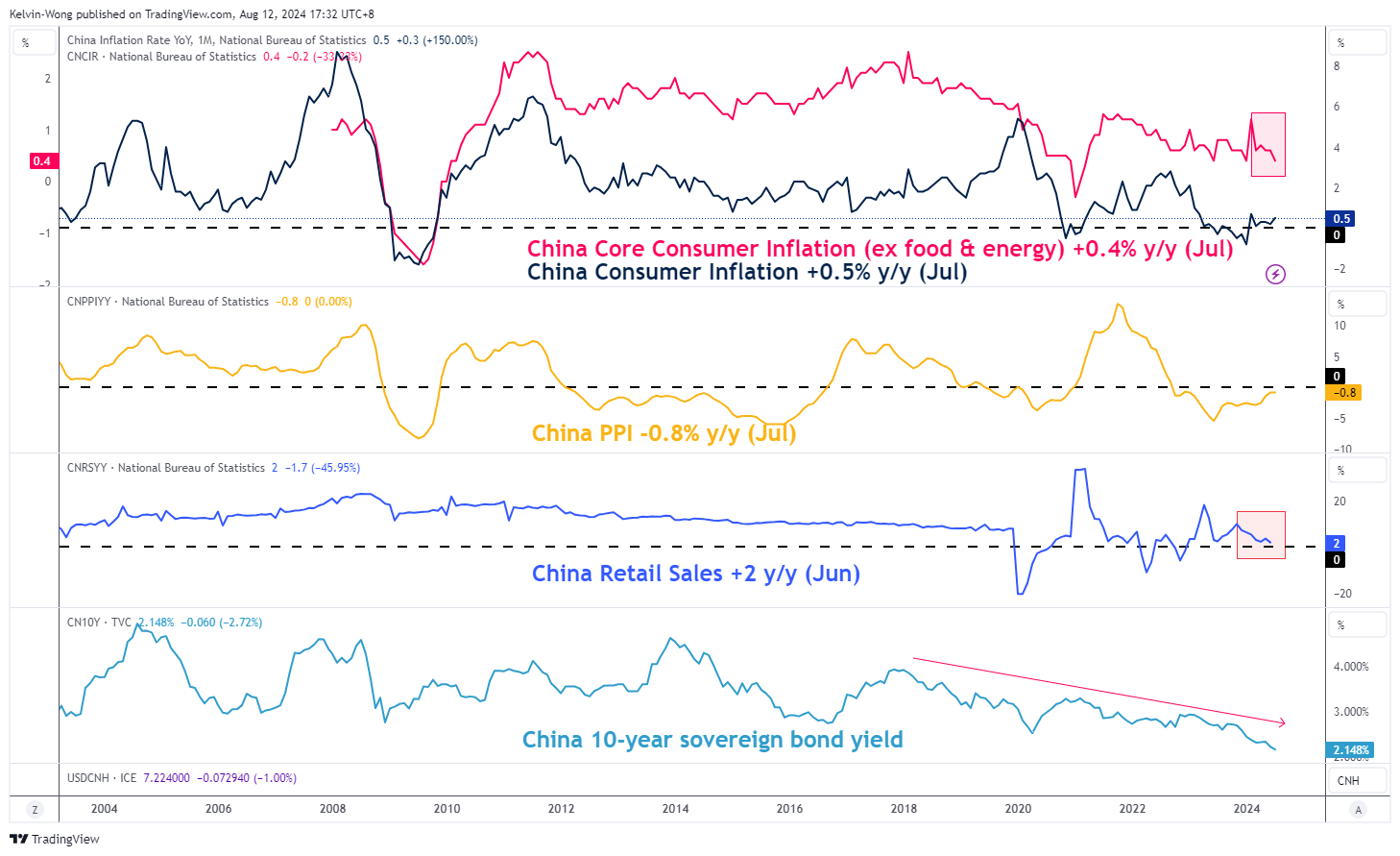

Fig 1: China’s inflation data & 10-year sovereign bond yield trends as of July 2024 (Source: MacroMicro)

Even though the latest China’s headline consumer inflation for July climbed to 0.5% y/y, exceeding expectations of 0.3% and 0.2% recorded in June, the uptick is likely to be driven by seasonal food inflation rather than an improvement in internal demand.

Severe weather conditions in the past months had hit supplies of fresh vegetables and eggs. Fresh vegetable prices climbed 3.3% y/y, after diving 7.3% in the previous month, while egg prices inched up 0.4%, after falling 3.9%.

Overall, the rate that stripped out food and energy-related products inched down lower to 0.4% y/y in July from 0.6% in June, its fifth consecutive month of lacklustre inflationary growth since February print of 1.2% (see Fig 1).

The financial markets responded to the inherent “non-abating” deflationary risk by pushing the 10-year China sovereign bond yield to a record low of 2.15% in July.

It sunk lower last Monday, 05 August to printing a fresh low of 2.12% before recovering to 2.20% at this time of the writing due to verbal and operational intervention by China central bank, PBoC as some rural banks have suspended trading in China sovereign bonds.

Bearish Breakdown Below 200-day MA Triggers Further Potential Downside Pressure

Fig 2: Hang Seng Index medium-term trend as of 12 Aug 2024 (Source: TradingView)

In the lens of technical analysis, the medium-term uptrend phase of the Hang Seng Index from its 22 January 2024 low has been damaged.

The bearish breakdown below the ascending channel support and thereafter its 200-day moving average on 2 August has skewed the probability of its medium-term trend towards the bearish camp (see Fig 2).

The next medium-term support to watch will be at 16,055 on the Hang Seng Index and a break below it exposes the long-term pivotal support of 14,600 (also the secular ascending trendline in place since the August 1998 low).

Only a clearance above 18,000 medium-term pivotal resistance negates the bearish tone for the next medium-term resistance to come in at 18,530 and 19,710.

Original Post