Global Stocks Continue to Rally as U.S. Shares Retreat

2023.01.23 10:48

[ad_1]

Diversifying into equities ex-U.S. has been disappointing in recent years, but January suggests the tide may be turning in favor of global investing strategies.

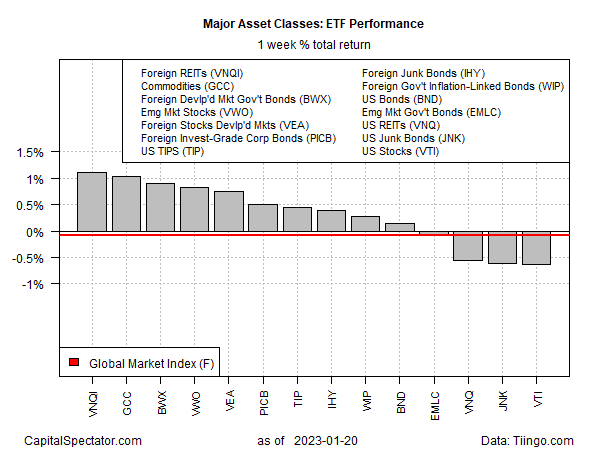

For a third week, non-U.S. shares rallied, offsetting last week’s retreat in US stocks and real estate investment trusts (REITs). The top performer for the major asset classes in trading through Friday, Jan. 20: Vanguard Global ex-US Real Estate (). Last week, the ETF’s 1.1% increase raised it to near its highest close since August.

Stocks in developed () and emerging markets () rallied for a third week, too. The increases contrast with a pullback in US shares (), which look weaker on a technical basis vs. foreign stocks.

Last week’s losses in U.S. shares and REITs contributed to the slight decline in the Global Market Index (GMI.F), an unmanaged benchmark maintained by CapitalSpectator.com.

The index, which ticked down fractionally, holds all the major asset classes (except cash) in market-value weights via ETFs and represents a competitive measure for multi-asset-class portfolio strategies.

Major Asset Classes: ETF Performance 1-Week Returns

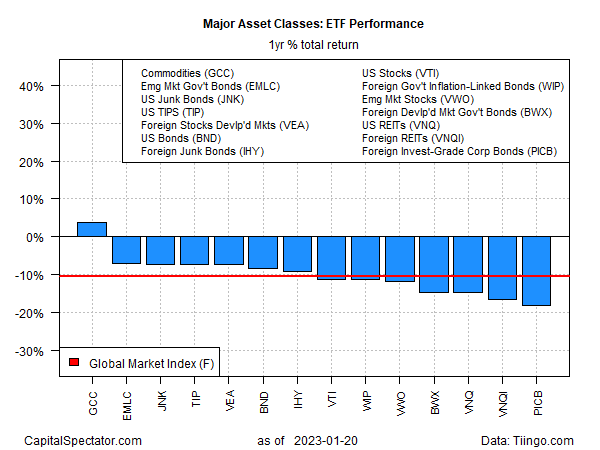

Broadly defined commodities () are still the only slice of the major asset classes with a positive one-year return. The rest of the field continues to post losses at Friday’s close vs. the year-ago levels.

Major Asset Classes: ETF Performance 1-Year Returns

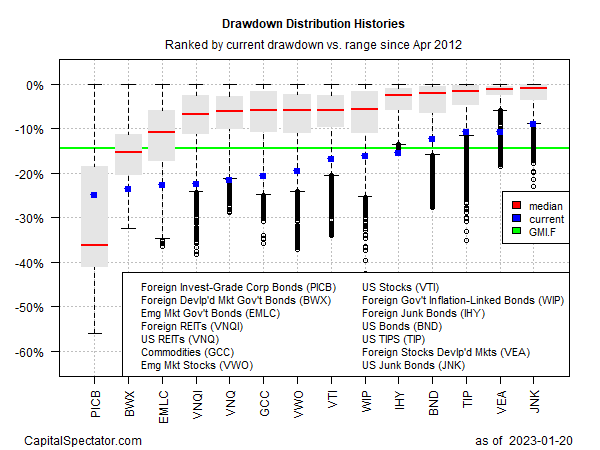

Comparing the major asset classes through a drawdown lens shows relatively steep declines from previous peaks for most markets worldwide. The softest drawdown at the end of last week: U.S. junk bonds () with a 9.1% slide from its last peak.

GMI.F’s drawdown: -14.5% (green line in the chart below).

Drawdown Distribution Histories

[ad_2]