Global Markets Rebound Ahead of Key Reports, But Fundamentals Still Look Iffy

2023.10.24 13:28

Sentiment was a little more cheerful during Tuesday’s session, following Monday’s recovery in stock and bond markets, and the return of the selling in precious metals and markets. European indices and US futures were trading higher as yields dipped further lower after the could not hold above the key 5% level for long on Monday.

Echoing the “risk-on” sentiment, had extended its weekly advance to more than 15% at the time of writing, reaching above $35K for first time since May 2022 with expectations being rife about an imminent approval of a bitcoin ETF by the SEC.

Investors were also looking forward to the release of earnings from Microsoft (NASDAQ:) and Alphabet (NASDAQ:) today ahead of more tech earnings, key economic pointers and the ECB’s rate decision later in the week.

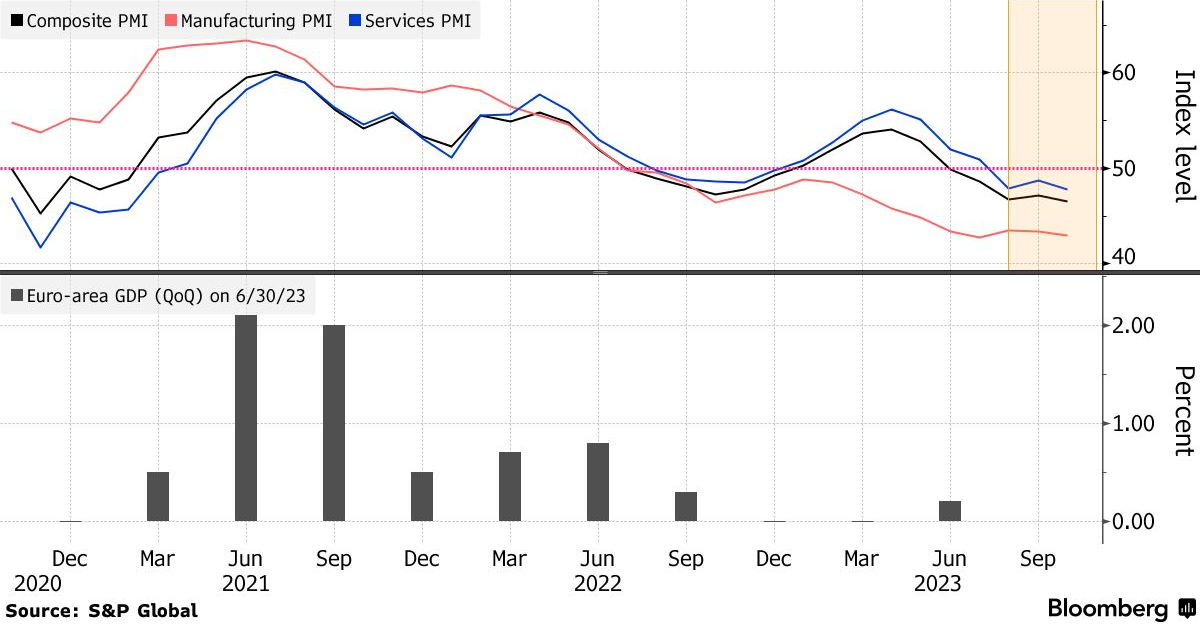

PMIs point to recession in Eurozone

Global PMI data has been consistently very poor throughout much of this year, correctly highlighting a challenging macro backdrop with stagflation and high interest rates holding back the developed economies, most notably the Eurozone. Add the raised geopolitical risks to the equation, sentiment in the services sector was never going to improve materially.

And so, it proved.

The Eurozone services PMI fell 47.8 versus 48.7 previous and expected. The manufacturing PMI was down to 43.0 from 43.4 previously. On a country level, German services PMI fell sharply to 48.0 from 50.3 the month before, while the manufacturing PMI remained depressed at 40.7, albeit improving ever so slightly from 39.6. French PMIs remained well below the expansion threshold of 50.0.

The PMI is a leading indicator of economic health as purchasing managers possibly hold the most current and relevant insight into the company’s view of the economy. The fact that we have not seen any significant improvement in these PMIs argues against a big stock market recovery, but it does cement expectations that the ECB will hold rates unchanged.

Focus turns to US tech earnings

The US earnings calendar is getting busier, with more technology companies set to publish their results following the mixed numbers from the likes of Tesla (NASDAQ:) and Netflix (NASDAQ:) last week. This week, we have the following companies reporting their results:

- Microsoft, Tuesday

- Alphabet, Tuesday

- Meta (NASDAQ:), Wednesday

- Amazon (NASDAQ:), Thursday

- Apple (NASDAQ:), Thursday

Earnings from these big tech giants are expected to grow which explains why the Nasdaq has outperformed some of the other major indices. Tech giants are expected to deliver better profits thanks to cost-cutting, resilient growth and AI prospects. However, the bar is set high, and it wouldn’t take much to disappoint expectations. Equally important will be what these companies will say about future growth. The market is always forward-looking. If they forecast a slowdown in earnings for future quarters, then this could see tech shares struggle to stay afloat.

ECB set to hold policy unchanged

Thursday will be a particularly busy day. As well as those US tech earnings, we will have US GDP (see below) and a rate decision from the European Central Bank to look forward to. Following the ECB’s September meeting, the central bank made it clear that they won’t be hiking rates in October, as the central bank will want to get fresh information on Bank Lending Survey, Q3 GDP and a new round of staff projections.

But as we have seen, the trend of soft data has continued while the flare up in Middle East tensions have made it even easier for the ECB to pause its hiking. So, the focus will be on clues about the ECB’s December meeting, and beyond. All told, I don’t expect to see any support coming for the euro from this meeting, but stocks may find at least some short-term support if Lagarde and co turn out to be surprisingly dovish.

US GDP among data highlights from world’s largest economy

We will have lots of important data in the US economic calendar this week, including PMIs from the manufacturing and services sectors (late today), GDP (Thursday) and Core PCE Price Index (Friday). Among these, GDP is likely to garner most of the attention as investors assess the likelihood for one more rate increase from the Fed.

The economy is expected to have growth by 4.5% on an annualised format. If GDP (and most other US macro pointers this week) come in higher, then at the very least it would boost the “higher for longer” narrative, while data disappointment could further weaken US bond yields following their drop on Monday when some of the market’s most prominent bond bears, especially Bill Ackman, said that the rout in US Treasuries had gone too far.

Ackman said he dumped his short positions in bonds and that he would be buying short-dated interest rate futures. What I would be interested in is seeing whether the stock markets would decouple from bond markets or not.

Could stocks fall despite a rise in US bond markets?