Global Economy Could Lose $4 Trillion in Output, IMF Chief Warns

2022.10.06 11:42

[ad_1]

(Bloomberg) — The global economy is at increasing risk of recession and it could lose $4 trillion in output through 2026, a “massive setback” roughly equivalent to the size of Germany’s economy, the International Monetary Fund’s top official said.

The situation is “more likely to get worse than to get better,” Managing Director Kristalina Georgieva said in prepared remarks for an IMF event Thursday in Washington. She cited uncertainty that remains “extremely high” after Russia’s invasion of Ukraine and the pandemic, and warned that “there could be even more economic shocks.”

The head of the crisis lender spoke ahead of its annual meetings next week, when finance ministers and central bankers will converge on the US capital to seek solutions for global challenges such as persistent inflation, record debt that emerging developing nations are struggling to service, climate change and food security.

The IMF estimates countries accounting for about a third of the global economy will experience at least two consecutive quarters of contraction this or next year, Georgieva said.

“Even when growth is positive, it will feel like a recession because of shrinking real incomes and rising prices,” she added.

The IMF currently projects global economic growth of just 3.2% in 2022 and 2.9% in 2023. Georgieva said the latter estimate will be lowered next week.

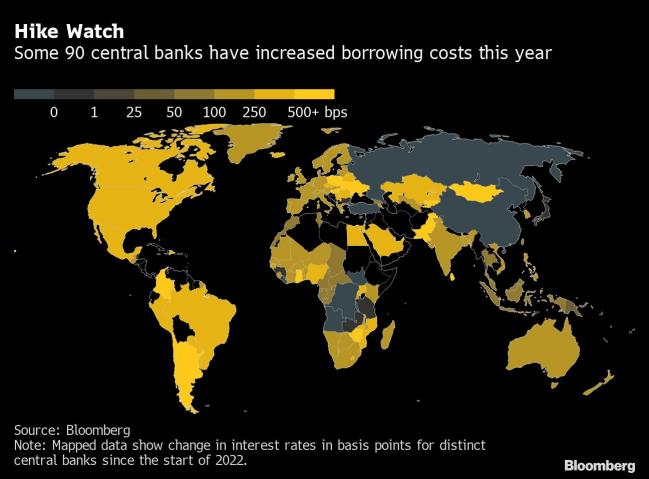

Georgieva called on policymakers to “stay the course” to bring down inflation as a means of stabilizing economies.

“This is the right thing to do: Act decisively even as the economy inevitably slows,” she said. “This is not easy, and it will not be without pain in the near term. But the key is to avoid much greater and longer-lasting pain for everybody.”

She also warned that the cost of a policy mis-step will be high.

“Not tightening enough would cause inflation to become de-anchored and entrenched — which would require future interest rates to be much higher and more sustained, causing massive harm on growth and massive harm on people,” she said. “On the other hand, tightening monetary policy too much and too fast — and doing so in a synchronized manner across countries — could push many economies into prolonged recession.”

Other priorities include deploying “temporary” and “targeted” fiscal measures focused on lower-income households, and supporting emerging markets, the IMF chief said. Large creditors such as China and the private sector have a responsibility to act to reduce the risk of debt crises in such countries, she added.

Georgieva also cautioned against “fragmentation” and urged stronger international cooperation, particularly in addressing issues of food insecurity and climate change.

©2022 Bloomberg L.P.

[ad_2]

Source link