Getting The Recession They Want

2022.06.24 10:06

The chair of the Federal Reserve, Jerome Powell, appeared before the U.S. Senate Banking Committee yesterday and acknowledged that a recession could result from the Fed’s battle against inflation.

“It’s certainly a possibility,” he said.

In the recent past, however, Powell dismissed the possibility as very unlikely. Now he is talking about the challenges of reducing inflation without causing a sharp economic downturn.

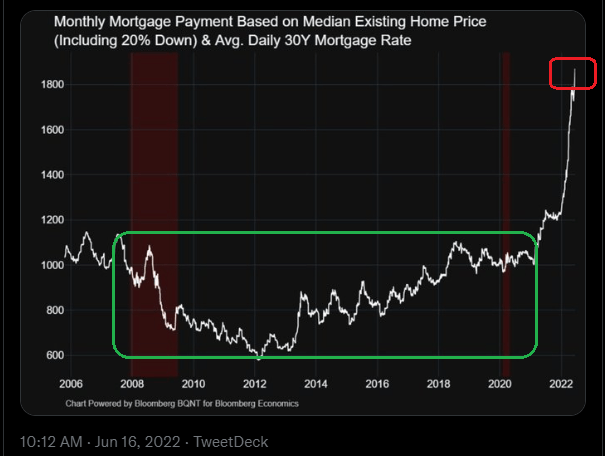

Pulling money out of the financial system (a.k.a. “quantitative tightening” or “QT”) and hiking the overnight lending rate are already exacting a heavy toll. Home demand has all but been destroyed, now that millions of prospective buyers cannot afford the principal and interest.

Monthly Mortgage Payment

Monthly Mortgage Payment

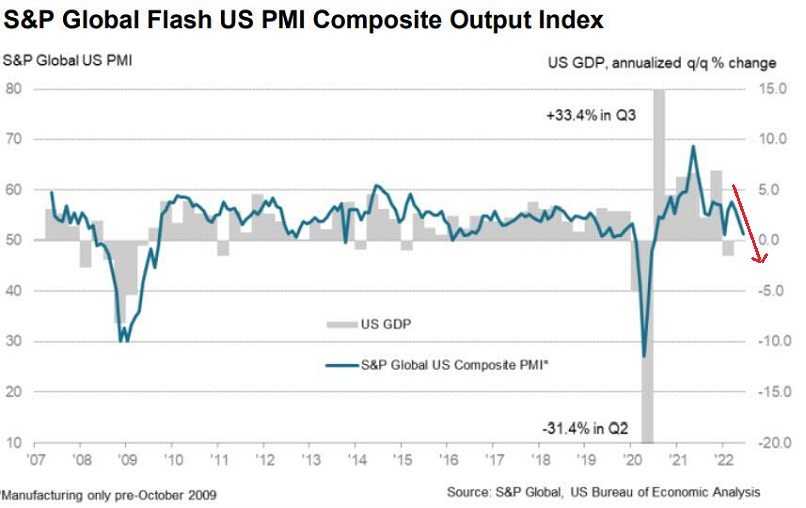

More critically, business activity is rapidly slowing down. In some areas, we’re already looking at outright economic contraction.

S&P Global US PMI Index Chart

S&P Global US PMI Index Chart

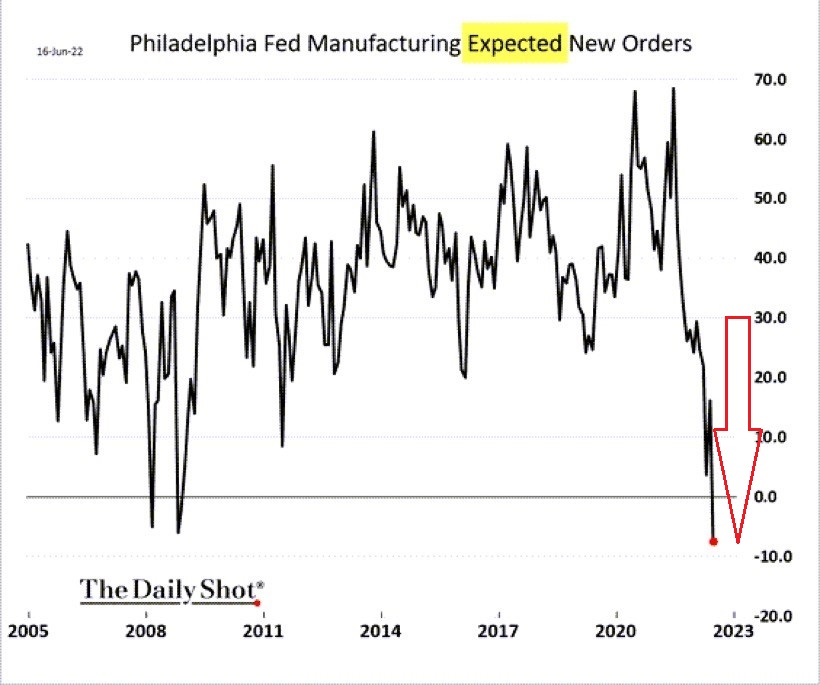

Philadelphia Fed Manufacturing Expected New Orders

Philadelphia Fed Manufacturing Expected New Orders

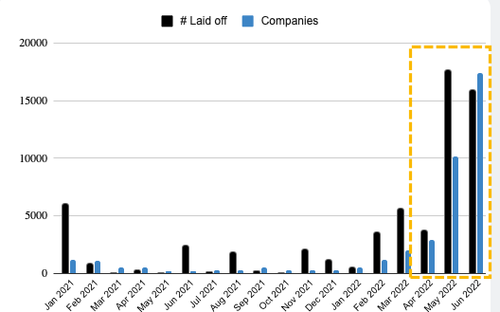

Yet, Fed committee members are unlikely to change course on the inflation front until something breaks. What something(s)? The financial markets would have to malfunction or unemployment would have to spike.

Signs of breakage in employment are beginning to emerge. For example, layoffs are on the rise.

US Employment Data

US Employment Data

On the flip side, the overall numbers of workers who wish to work remains robust.

Isn’t the $15 trillion in wealth evaporation — a 20% financial market erosion — enough for the Fed to rethink its path? Probably not.

The Fed may not intervene until the market(s) become illiquid; that is, securities/assets can no longer be bought or sold quickly or easily. Depreciation is not the same as illiquidity.

Still, it is near impossible to believe that the Fed would ignore a stock market retreat of 30%, 40%, or 50%. Having endured the 2000-2002 collapse (-51%) as well as the 2008 financial crisis (-56%), it is reasonable to suspect that the central bank would leave the inflation fight to prop up assets well before a “halving.”

Of course, that does not mean the Fed will succeed at stopping a snowball from continuing to roll down a mountain. The depth and duration of the recession will factor in as well.

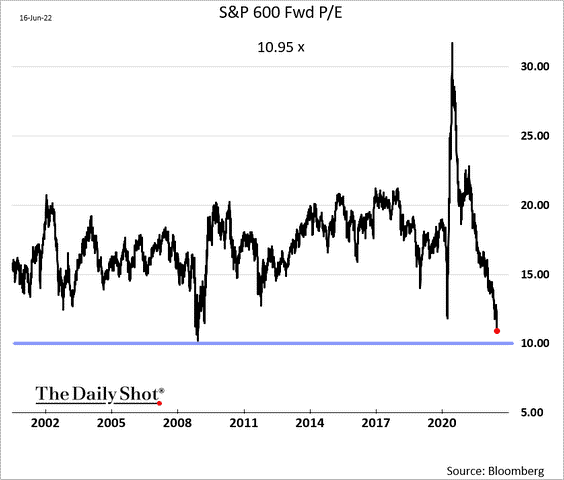

If it is shallow, and the Fed starts to manipulate rates lower once again, expect small-cap stocks to be early cycle winners. On the other hand, if the recession is deep, make sure that you know how to tread water.

S&P 600 Forward P/E Chart

S&P 600 Forward P/E Chart