German exports beat expectations despite cooling global economy

2022.10.05 06:04

[ad_1]

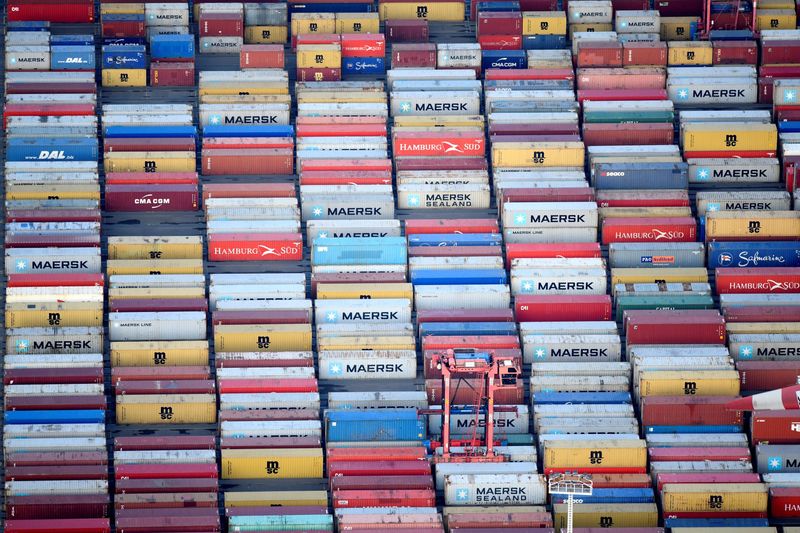

© Reuters. FILE PHOTO: Containers are seen at a terminal in the port of Hamburg, Germany November 14, 2019. REUTERS/Fabian Bimmer/File Photo GLOBAL BUSINESS WEEK AHEAD

BERLIN (Reuters) -German exports rose slightly more than expected in August despite a cooling global economy, rising interest rates and material shortages, the statistics office said on Wednesday.

Stronger demand from the United States and China helped push exports to 133.1 billion euros ($132.59 billion) in August, up 1.6% from the previous month.

Imports also increased more than expected, rising 3.4% to 131.9 billion euros, the seventh month in a row of growth.

A Reuters poll had predicted a month-on-month rise in both exports as well as imports of 1.1%.

Analysts welcomed August’s numbers but warned that amid a gloomy economic outlook, exports could become a drag on growth.

High energy costs due to the war in Ukraine are slowing domestic production, which will have a negative effect on exports, said VP bank’s head economist Thomas Gitzel.

“With its strong export industry, the German economy is particularly exposed to global economic adversity,” he said.

Germany’s seasonally adjusted trade surplus came in below expectations in August, at 1.2 billion euros, according to the statistics office, versus analysts’ forecasts of 4 billion euros.

“The war in Ukraine has succeeded in delivering what nothing else had managed before: letting the notorious German trade surplus disappear,” said ING economist Carsten Brzeski.

“However, unfortunately, it is not a ‘good’ disappearing of the trade surplus, driven by stronger domestic demand, but rather a ‘bad’ disappearing, driven by high energy prices and structurally weaker exports,” he added.

A detailed table of German exports and imports is available on the statistics office website.

($1 = 1.0038 euros)

[ad_2]

Source link