German companies see risks from economic policy, energy prices -DIHK

2023.10.26 04:06

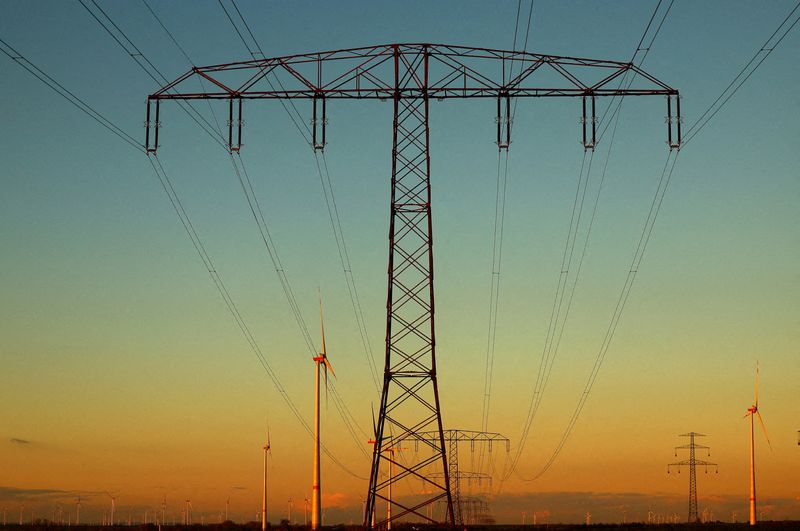

© Reuters. FILE PHOTO: Electrical power pylons with high-voltage power lines are seen next to wind turbines near Weselitz, Germany November 18, 2022. REUTERS/Lisi Niesner/File Photo

BERLIN (Reuters) – German companies see numerous risks to business at the moment including economic policy, high energy and raw materials prices, a lack of skilled workers and weak domestic demand, the DIHK Chambers of Commerce and Industry said on Thursday.

A DIHK poll of more than 24,000 companies showed that of those surveyed, 51% see current economic policy as a problem for their own development.

The German economy has been struggling since the end of 2022. In addition to poor economic conditions there are structural and permanent challenges such as demographic changes, climate change and high energy prices.

According to the survey, only 13% of companies expect business to improve in the next 12 months, while 35% expect a deterioration.

“So far, we see no signs of a self-sustaining upswing,” said DIHK Managing Director Martin Wansleben at the presentation of the DIHK business survey. “On the contrary, companies have revised downwards both their investment plans and their employment intentions.”

The DIHK forecasts a 0.5% contraction in gross domestic product in 2023, and Wansleben said he expected the economy to stagnate.

The current business situation is assessed positively by more companies (30%) than negatively (21%). However, the business outlook for the coming 12 months is currently dominated by negative expectations in almost all sectors, the survey showed.

“When it comes to companies’ investment decisions, it is the long-term perspective that matters,” Wansleben said.

Only 24% of industrial companies want to expand their investments in Germany, while 36% are planning to reduce them.

Overall, the risks and uncertainties faced by companies continue to increase. “Companies are now ticking off more than three (3.1) business risks on average, while before the pandemic, the average was 2.4,” Wansleben said.

The survey showed that apart from the economic policy framework, companies are worried about energy and raw material prices, the shortage of skilled workers and domestic demand.