GBPUSD aims for a bullish breakout

2023.03.28 06:12

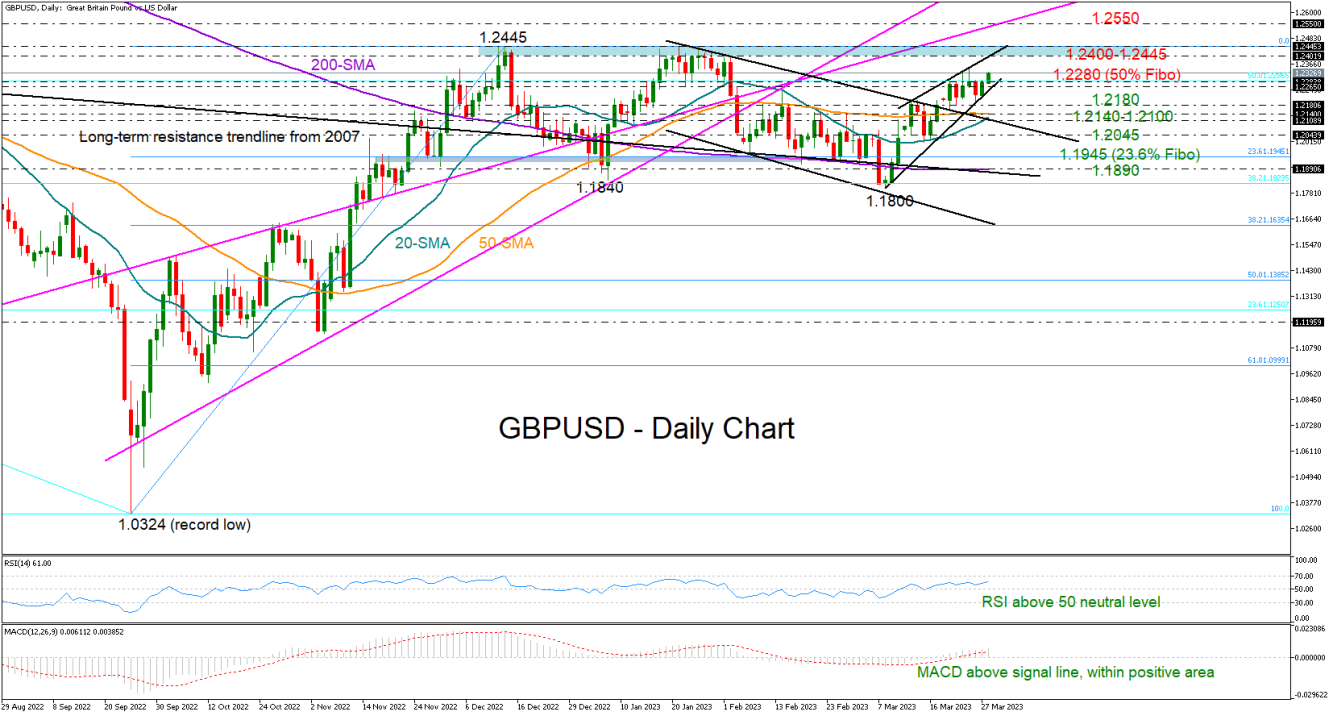

GBPUSD was stubbornly pushing for a close above the 1.2280 bar during Tuesday’s early European trading hours despite six consecutive failed attempts.

From a technical perspective, the short-term bias remains skewed to the upside as the RSI and the MACD are clearly fluctuating within the bullish area. Yet, the former is maintaining a sideways trajectory, suggesting that some caution is warranted.

If the bulls successfully climb above the 1.2280 wall, which coincides with the 50% Fibonacci retracement of the 2021-2022 downtrend, the next barrier might occur within the 1.2400-1.2445 zone. Another step higher could face some congestion around 1.2550 before speeding up to 1.2665-1.2700. The 1.2800 area could be the next destination.

Alternatively, a flip below the short-term support trendline at 1.2260 may cause a quick decline to 1.2180. Even lower, the 20- and 50-day simple moving averages (SMAs) and the upper boundary of the broken channel could provide a footing to keep the price within the 1.2100 territory. If they fail, the sell-off could intensify towards 1.2040.

In brief, GBPUSD is aiming for a bullish continuation, though only a sustainable move above 1.2280 would boost buying appetite.