GBP/USD Uptrend Moving as Planned Six Months Later

2023.07.18 05:07

It’s been over six months since we last wrote about . At the start of 2023, the Pound was hovering around 1.2100, up nearly 17% from the all-time low it had fallen to in September 2022. Inflation was already showing signs of slowing down, but the political and financial chaos left by Liz Truss made macro predictions quite unreliable.

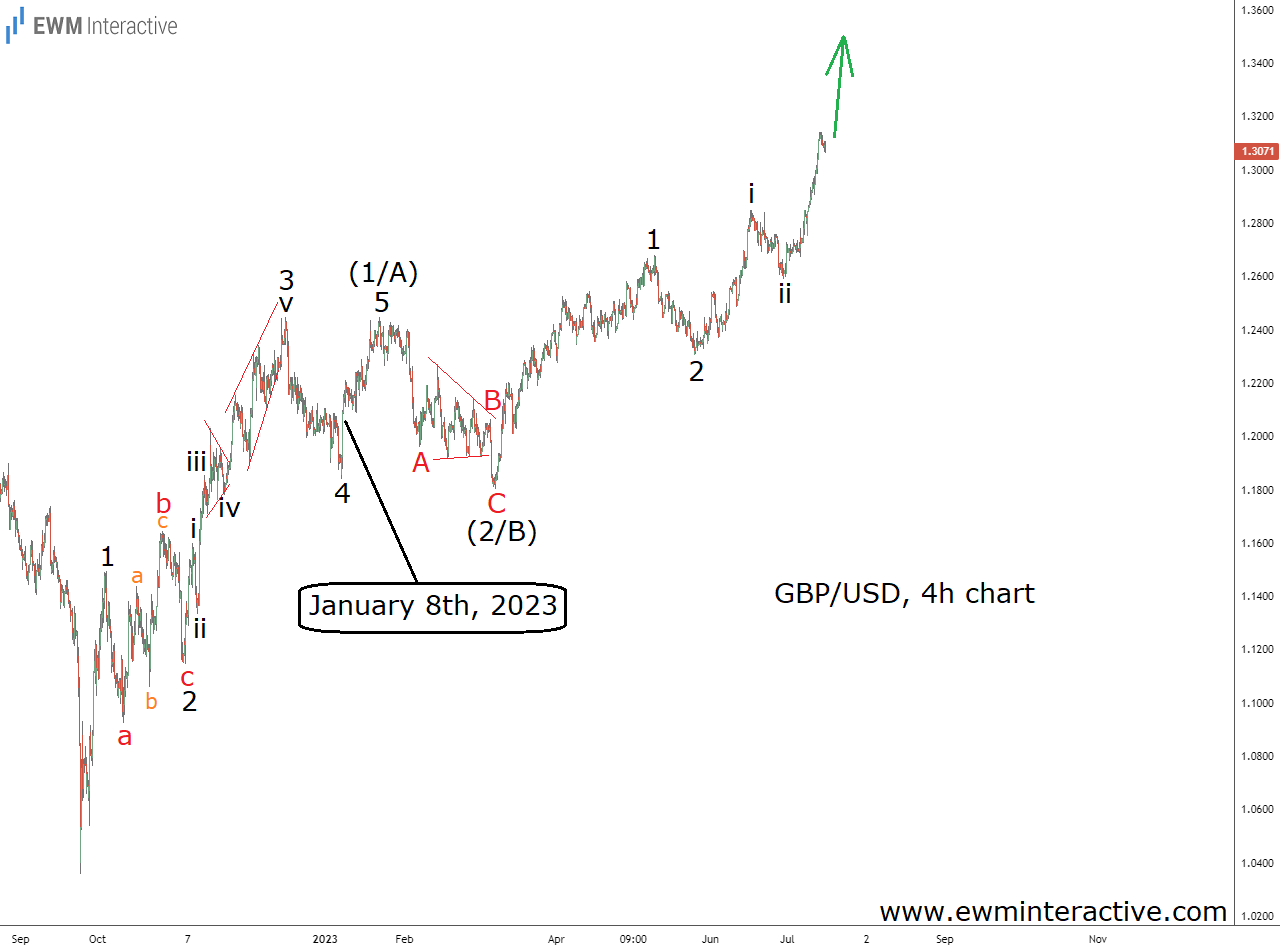

So we turned to Elliott Wave analysis instead. On January 8th, 2023, we thought GBPUSD was about to “confirm its Elliott Wave turnaround” soon. See, in financial markets, prices move in waves which form repetitive patterns. A five-wave pattern called an impulse only occurs in the direction of the larger trend. Three-wave patterns, on the other hand, move against the bigger trend and are therefore called corrective.

In order to confirm the direction of the trend, we had to spot a complete five-wave impulse. That’s what we thought was going to emerge on the 4-hour chart of GBPUSD back in January.

Similar Elliott Wave setups occur in the crypto, commodity and stock markets, as well. Our Elliott Wave Video Course can teach you how to recognize them yourself!

The 4h chart revealed that the recovery from 1.0360 wasn’t an impulse yet. It looked like waves 1-though-4 were in place. And despite the fact that fifth waves are never guaranteed, the sharp bounce in the first week of the new year suggested wave 4 was over. So, we thought wave 5 was only a matter of time. If this count was correct, GBPUSD was going to exceed the top of wave 3 at 1.2447 soon.

This, however, wouldn’t mean that joining the bulls near 1.2450 would be a good idea. According to the Elliott Wave theory, a three-wave correction follows every impulse before the trend can resume. Much better buying opportunities were likely to present themselves in wave (2/B). Then, wave (3/C) would lift the pair much higher over the next several months. Those several months have now passed and we think it is time to take another look.

Wave 5 really did exceed the top of wave 3, but only by a pip. It reached 1.2448 on January 23rd. Wave (2/B) took the shape of a simple A-B-C zigzag, where wave B was a triangle correction. It dragged the pair down to 1.1803 on March 8th. Wave (3/C) to the upside has been in progress ever since. Last week, it touched 1.3142 before pulling back below 1.3100 as of this writing.

Judging from the updated chart above, the bulls seem determined to continue pushing GBPUSD higher. It looks like wave iii of 3 of (3/C) is under construction. If this analysis is correct, the pair seems poised to finally recoup its 2022 losses. Higher levels can be expected as long as it trades above 1.2591.

Original Post