GBP/USD Tests Key Descending Trendline

2023.11.02 06:23

- slightly higher today as market digests Fed meeting

- It tests again the July 14 aggressive descending trendline

- Momentum indicators remain muted ahead of next key event

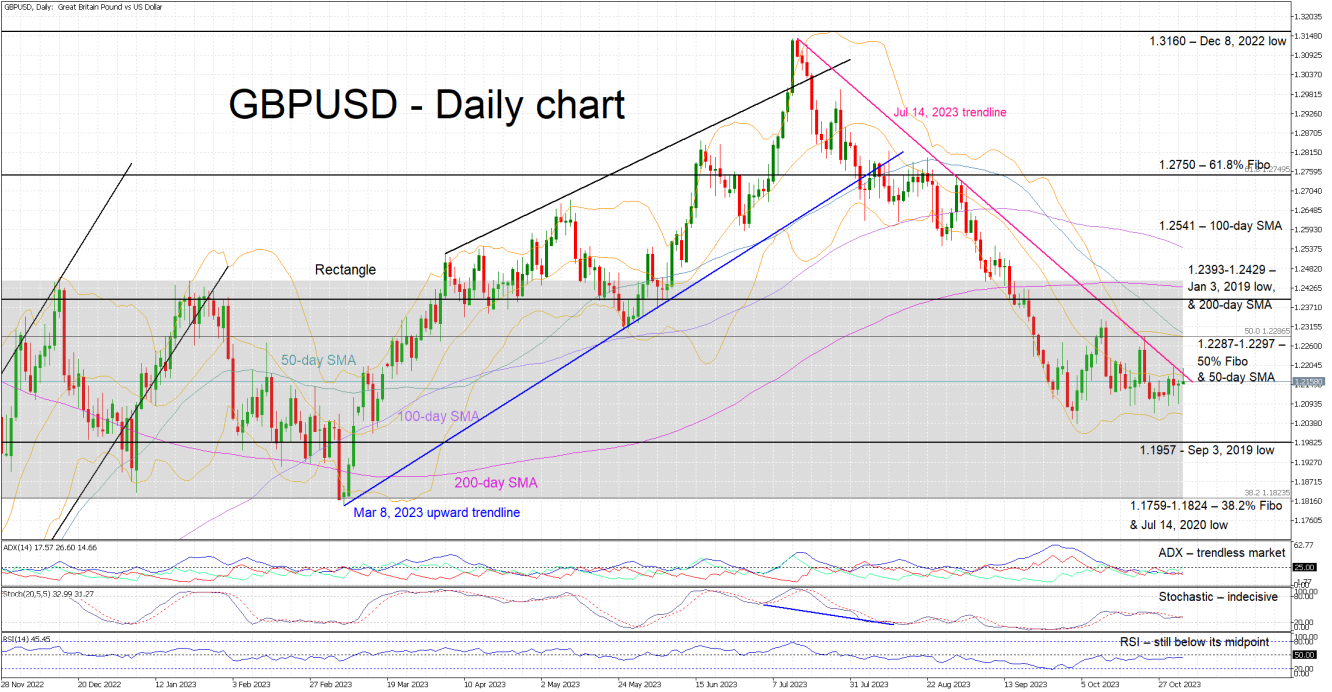

GBPUSD is trading slightly higher, testing the resistance set by the July 14 downward sloping trendline that has defined the downleg since the July 14 high at 1.3141. The pair appears to have recently found a bottom just above the 1.1967 area with volatility slowing down ahead of this week’s key events.

Momentum indicators confirm the current market indecisiveness.

The RSI continues to hover a tad below its midpoint with the Average Directional Movement Index (ADX) remaining stuck below its threshold and thus signaling the absence of a strong trend in the market. More interestingly, the stochastic oscillator continues to battle with its moving average, close to its midpoint. The outcome of this battle could determine the next leg in GBPUSD.

Should the bulls feel confident, they could try to finally break the July 14 downward sloping. They could stage a move towards the 1.2287-1.2297 area that is defined by the 50-day simple moving average (SMA) and the 50% Fibonacci retracement of the June 1, 2021 – September 26, 2022 downtrend. Even higher, the 1.2393-1.2429 area could prove a stronger resistance area than currently expected.

On the flip side, the bears could try to defend the July 14 descending trendline and then gradually push GBPUSD towards the September 3, 2019 low at 1.1957. If successful, they could stage a move towards the 1.1759-1.1824 area, populated by the 38.2% Fibonacci retracement, the July 14, 2022 low and the lower boundary of the 1-year long rectangle.

To conclude, GBPUSD bulls have to overcome a key descending trendline if they aim to recover part of the losses incurred on the way down after the July 14 high.