GBP/USD Remains Bearish in Very Short-Term

2024.07.02 06:33

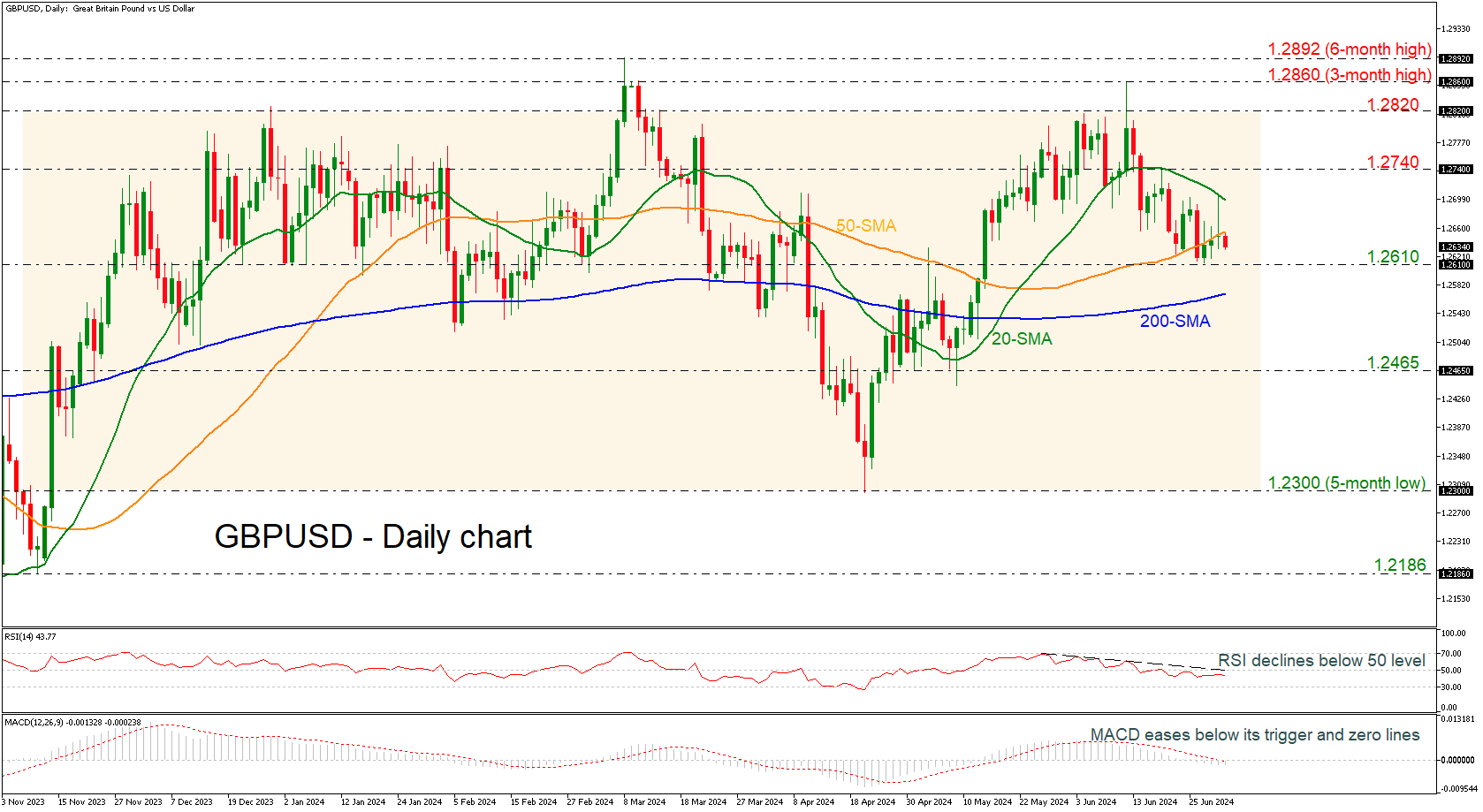

- GBP/USD’s recent bounce off 1.2300 runs out of steam

- RSI and MACD hold beneath mid-levels

started a bearish wave again after the spike towards the three-month high of 1.2860, sending prices beneath the 20- and the 50-day simple moving averages (SMAs). The market is ready to retest the mid-level of the long-term trading range at 1.2610.

Short-term momentum indicators are also pointing to a continuation of the bearish bias. The RSI is still developing beneath its downtrend line and the neutral threshold of 50, while the MACD is standing beneath its trigger and zero lines with weak momentum.

Further losses should see the immediate 1.2610 support ahead of the 200-day simple moving average (SMA) at 1.2570. A drop lower could take the bears until the 1.2465 region ahead of the lower boundary of the range at 1.2300.

In the event of an upside reversal, the 20-day SMA is the first resistance to focus on before hitting the 1.2740 resistance. A break above this level the pair could retest the upper boundary of the sideways channel at 1.2820.

To sum up, GBP/USD has been in a trading range since mid-November and in the very short term is looking bearish.