GBP/USD Rally Shows No Signs of Stopping With 1.3280 Target in Sight

2024.08.28 05:52

- US Consumer Confidence “beat” expectations, but the deterioration in consumers’ view of the labor market is the more salient development for markets.

- The gap between consumers seeing jobs as “plentiful” vs. “hard to get” has historically been a good leading indicator for the unemployment rate.

- GBP/USD has rallied from below 1.27 earlier this month to trade above 1.32 as of writing, a 500+ pip rally with rates rising in 13 of the last 15 trading days.

The US economic calendar is also relatively quiet but there are still some releases worth keeping an eye on. Earlier yesterday, the Conference Board released its monthly survey. While the headline reading came out better than expectations (103.3 vs.100.9 anticipated), the headline reading was never the main focus for traders.

Instead, traders were more concerned with deterioration in the labor market; coincidentally, the Federal Reserve has also explicitly shifted its focus to the health of the jobs market, making these subcomponents of the survey particularly market-moving in the current environment.

Specifically, 32.8% of consumers said that jobs were “plentiful” (down 0.6% from last month) and 16.4% said jobs were “hard to get” (up 0.1% from last month). The gap between these two measures has historically been a good leading indicator for the unemployment rate, and traders have therefore taken the opportunity to sell the , making it the weakest major currency on the day so far.

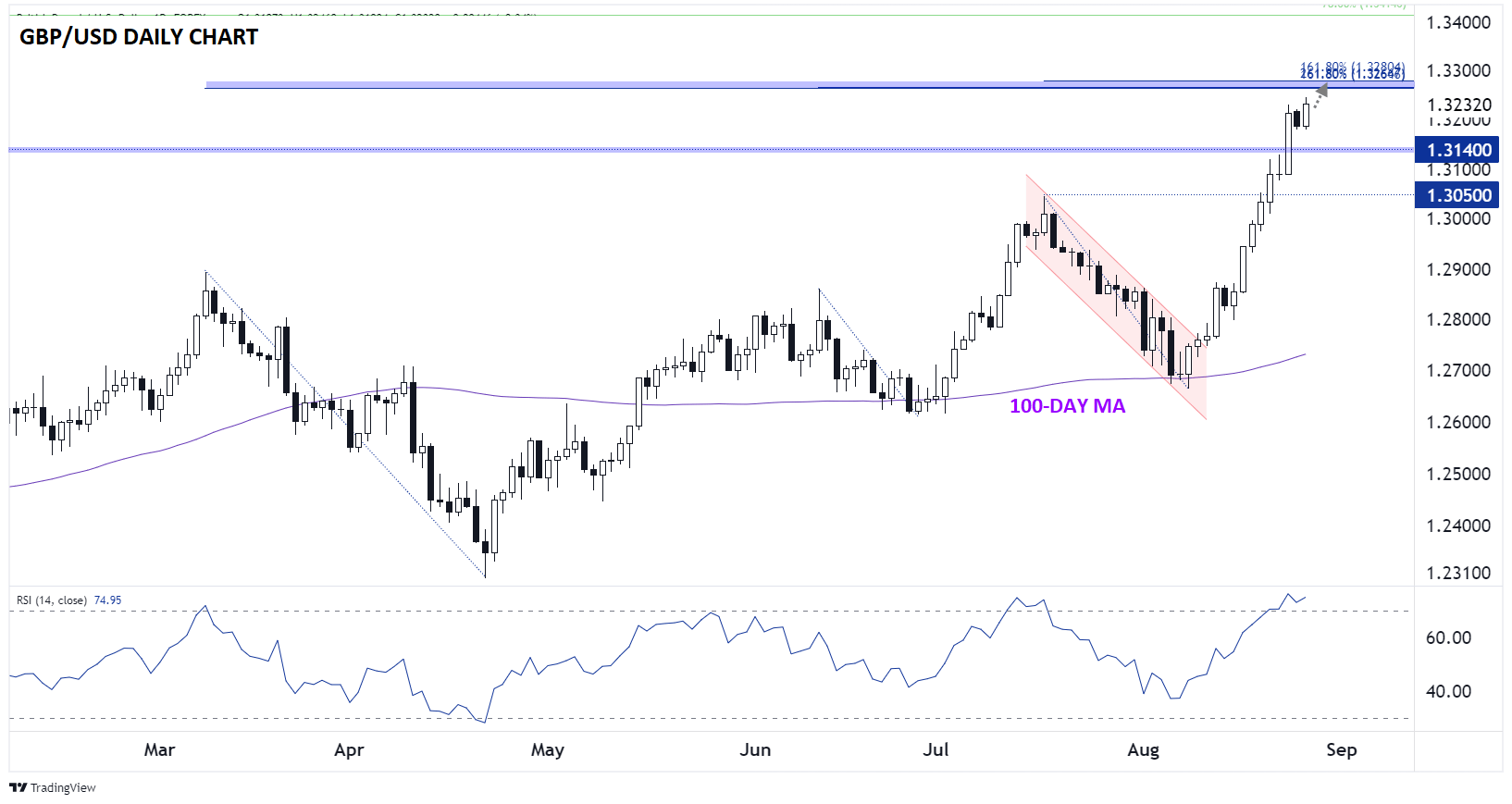

British Pound Analysis – GBP/USD Daily Chart

Turning our attention to the daily chart, has been on an absolute bullish tear over the last 3 weeks. The pair has rallied from below 1.27 earlier this month to trade above 1.32 as of writing, a 500+ pip rally with rates rising in 13 of the last 15 trading days.

Source: TradingView, StoneX

Not surprisingly, the pair is clearly overbought after such a strong move, but that’s no guarantee that it will necessarily pull back yet. In fact, looking at the nearby technical levels of note, there’s a case that GBP/USD could extend its rally a bit further toward the confluence of Fibonacci extensions in the 1.3270-80 zone before taking a breather.

From a bigger picture perspective however, any near-term dips toward previous-resistance-turned-support at 1.3140 may be seen as buying opportunities for traders who missed the initial breakout. Only a move back below that level would call the long-term breakout into question.

Original Post