GBP/USD Plunges Near 6-Month Low

2024.11.26 03:45

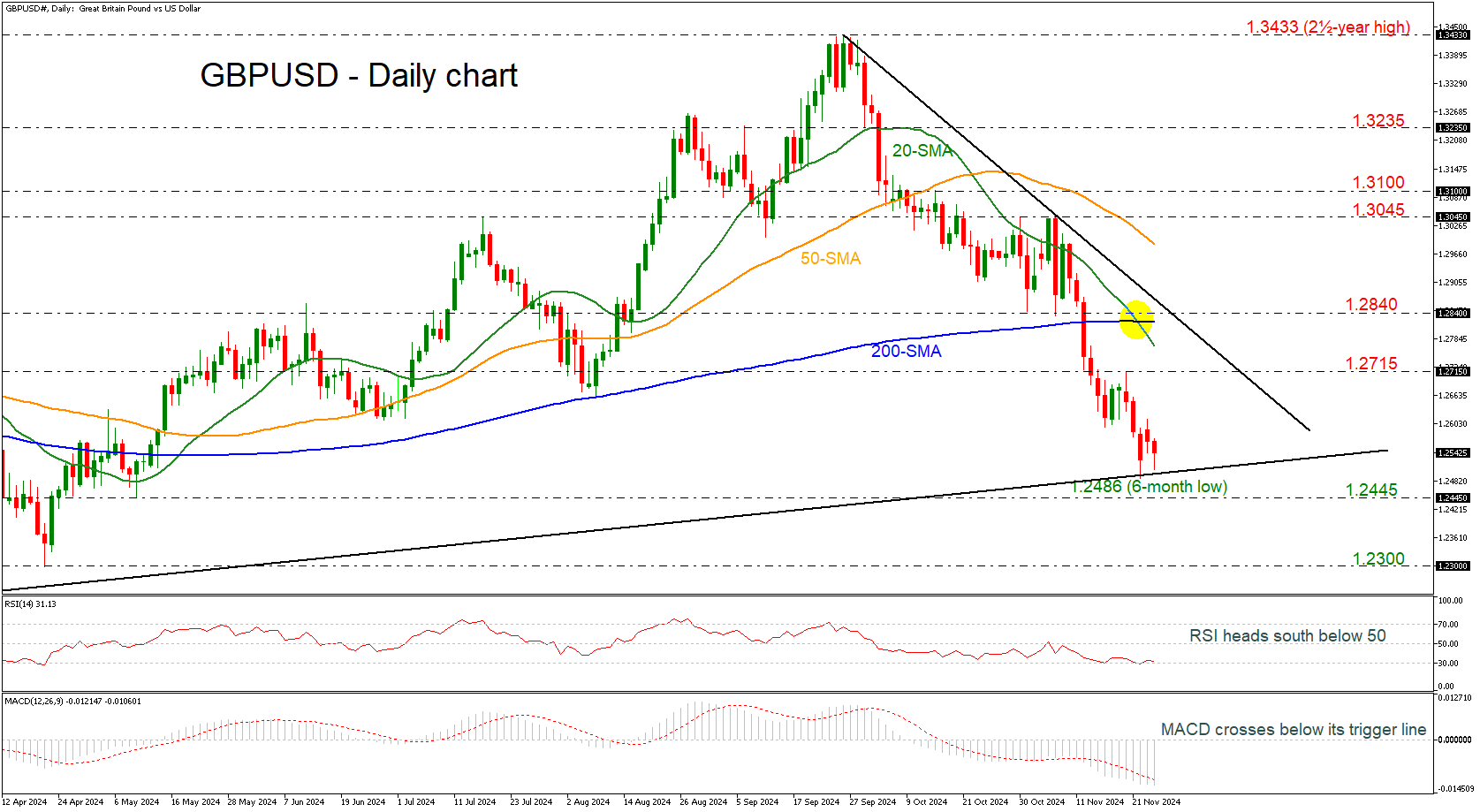

- GBP/USD falls for 8 consecutive weeks

- 20- and 200-day SMAs post death cross

- MACD and RSI suggest more losses

recorded the eighth straight negative week after the pullback from the 1.3433 level, losing more than 7%. The price posted a fresh six-month low of 1.2486 on Friday, meeting the long-term ascending trend line.

More aggressive selling interest would switch the broader outlook to a bearish one, resting near the 1.2445 support, taken from the lows on May 9. Even lower, the bears would gain control, pushing the pair towards the psychological mark of 1.2300.

In case of a bounce off the uptrend line, then the price may test the 1.2715 resistance area, ahead of the 20-day simple moving average (SMA) at 1.2770 and, more importantly, the 200-day SMA at 1.2820.

The momentum oscillators are confirming a bearish structure as the RSI is pointing down near the oversold zone, while the MACD is still extending its negative steam below its trigger and zero lines. The 20- and 200-day SMAs created a death cross, confirming the falling movement.

In summary, GBP/USD has been trending downward in the short term, but a break below 1.2445 could also alter the long-term outlook.