GBP/USD Faces Pivotal Test at 1.27 – Key CPI Data Set to Drive the Next Major Move

2024.08.13 04:44

Following last week’s market turmoil, currency pairs are showing signs of stabilization as investors await crucial economic data. The pair is in focus this week, with inflation readings from both the US and UK set to influence its trajectory.

While Investors an interest rate cut in the US next month, the size of the cut remains uncertain. Should data come in stronger than expected, expectations could shift toward a 50 basis point reduction.

Conversely, UK inflation forecasts will also be critical. If rises to 2.3% as projected, the Bank of England might pause further rate cuts and await additional data before making any moves.

As the GBP/USD approaches the 1.27 support level, traders should keep a close eye on these inflation reports.

The data will provide vital clues about the future actions of the US and UK central banks, indicating how traders should position themselves for potential moves in the currency pair.

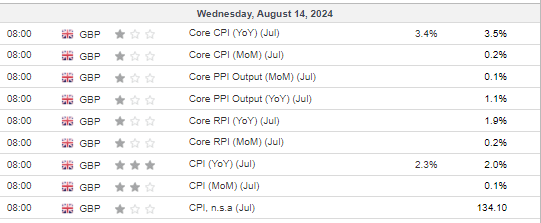

UK Inflation Outlook: Key Data to Drive Bank of England’s Next Move

Recent inflation data suggest the UK might be nearing its inflation target. The Bank of England (BoE) has responded by cutting interest rates by 25 basis points, though the decision was close, with a 5-4 vote in favor of the cut.

As a result, predicting further rate cuts remains uncertain. The next inflation report will be crucial, with market expectations anticipating a rise to 2.3% in the YoY CPI print.

On a positive note, is projected to decline slightly, marking progress toward the central bank’s target. Additionally, upcoming growth data will be significant, as it also impacts BoE’s decisions.

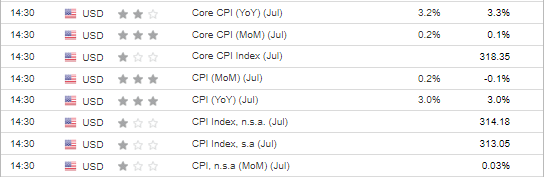

US Inflation: Important, but Other Indicators Are Closely Watched as Well

Recent macroeconomic events highlight that the market now reacts more to weaker economic data signaling a potential US recession. While inflation remains significant for markets, other indicators like the , the , and have been closely scrutinized as well.

Traders are waiting for July US figures due later in the day and consumer price (CPI) numbers on Wednesday to gauge the chance of outsized rate cuts.

The CPI data is expected to show that headline and core prices rose 0.2% month-on-month.

Forecasts suggest that inflation dynamics in July remained largely unchanged for the YoY figures, while signaling that the core figure may tick lower slightly.

Technical View: GBP/USD at a Crucial Juncture

The GBP/USD currency pair has been consolidating within a corrective phase for less than a month, finding support around the 1.27 level. The pair is currently experiencing an upward movement, but its future trajectory will hinge on Wednesday’s data.

If the year-over-year US CPI readings fall below the 3% mark, it could weaken the and trigger a broader rebound, potentially targeting the 1.31 range where long-term highs are situated.

Conversely, a drop below 1.27 would open the door for further declines, potentially reaching around 1.24.

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month.

Try InvestingPro today and take your investing game to the next level.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.