GBP/USD Faces Challenges in Breaking Through Key 1.3000 Level

2024.07.16 12:35

- GBP/USD struggles to break above the 1.3000 level despite softer US data and a dovish comment from Fed Chair Powell.

- UK inflation data will be crucial in determining whether GBP/USD can break above 1.3000.

- Technical analysis suggests GBP/USD may struggle to break above 1.3000 due to option barriers and overbought RSI.

is hovering just below the psychological 1.3000 level, with Fed Chair Powell’s remarks at the Economic Club of Washington yesterday failing to spark momentum.

The gained slightly amid political uncertainty in the US and the Republican nomination announcement. Markets do seem to be buoyed by the prospect of a Trump Presidency providing support to the US Dollar and long dated Treasury yields.

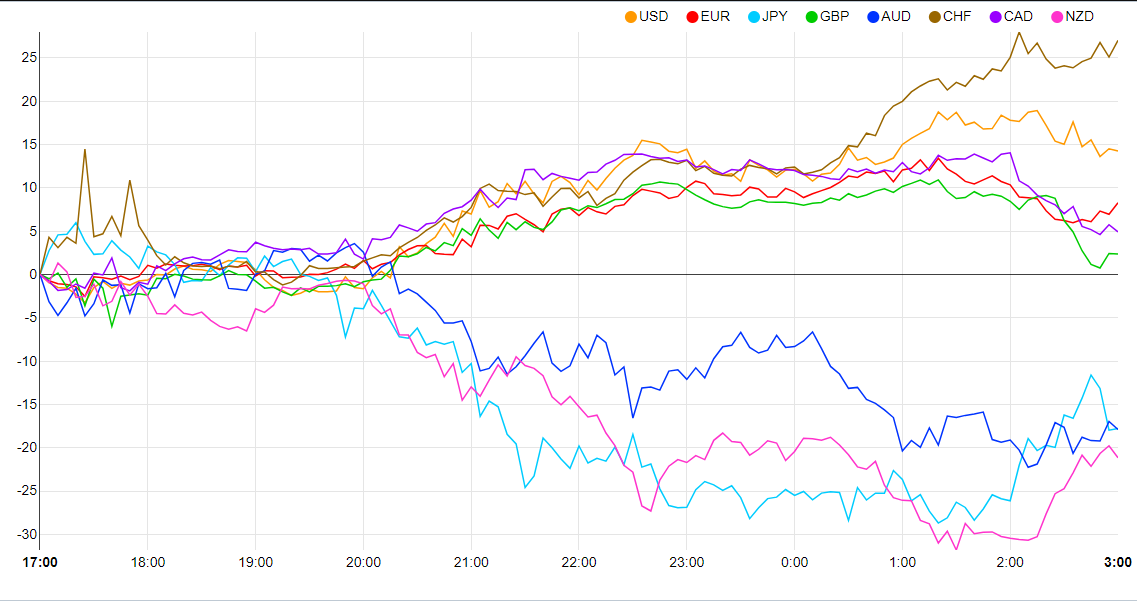

Currency Strength Meter, July 16, 2024

Source: FinancialJuice (click to enlarge)

Last week’s rally in GBP/USD was driven by softer US data, particularly the US report. During his speech at the Economic Club yesterday, Fed Chair Powell maintained a largely neutral stance but made one notably dovish comment.

He mentioned that the Fed had been waiting for additional confirmation that inflation was on the right track in Q1, which did not materialize. However, he noted that the three readings in the second quarter and one from last week have added some confidence.

Powell’s comments regarding last week’s data may partly explain the US Dollar’s resilience and Cable’s hesitation near a significant psychological level.

The Week Ahead: US Retail Sales, UK Inflation and Employment Data Ahead

The economic calendar for the upcoming week is packed with high-impact UK data releases. UK inflation data is of particular importance, as the Bank of England’s 2% target was met in the June 19 release. Market participants are keen to see if inflation can maintain this level, especially amid rumors of a potential uptick in UK inflation during the second half of 2024.

If the inflation rate hovers around or below the 2% year-over-year mark, sterling’s momentum could stall, preventing GBP/USD from sustainably rising above the 1.3000 level.

Conversely, any indication of increased inflation might serve as the catalyst to propel GBP/USD past this key psychological threshold.

US retail sales data is due later today, but it’s not typically a key market mover in my analysis. I anticipate any reactions to the retail sales data to be short-lived, potentially causing volatility without leading to sustained market movements.

Technical Analysis of GBP/USD

From a technical perspective, GBP/USD has struggled to surpass the psychological 1.3000 level, reinforced by numerous option barriers, keeping buyers at bay for now.

As with any resistance area, repeated tests of the 1.3000 level increase the likelihood of an eventual breakout. However, considering the current setup and the upcoming UK inflation data, there is potential for a deeper retracement toward the 1.2900 mark.

Tomorrow’s UK inflation data could be crucial for cable’s next move, especially as the RSI remains in overbought territory.

Support

Resistance

Source: TradingView.com

Original Post