GBP/USD Eyes 2024 High, EUR/GBP Rebound on Horizon: Key Levels to Watch Before ECB

2024.06.04 06:31

- ECB decision this week could affect euro pairs, with EUR/GBP in focus.

- EUR/GBP is at a critical support level, and the ECB’s decision could trigger a rebound.

- Meanwhile, GBP/USD is on an upward trend and could attack new highs for 2024.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

The European Central Bank is expected to its first interest rate cut in years this week.

While the market has already priced in a 25 basis point cut, the key details will lie in the accompanying and the ECB’s guidance on future monetary policy.

This is where the currency pair becomes interesting. With the UK focused on the upcoming July elections, its central bank is unlikely to take any major actions.

This leaves the euro as the main driver of the EUR/GBP pair, which is currently testing a key support level and could be poised for a rebound.

Beyond EUR/GBP, is also worth watching. The British Pound has the potential to attack new highs for 2024.

Let’s take a look at the two aforementioned currency pairs for some interesting trade opportunities.

GBP/USD Poised to Test 2024 Highs

July kicks off with a clear upward move for the GBP/USD pair, driven primarily by a weakening . Buyers successfully broke above 1.28, signaling their intent to challenge this year’s highs near 1.29.

The key resistance level to watch remains the aforementioned peaks around 1.29. On the downside, the critical support area sits at 1.27, which recently fueled the current buying momentum.

If this support breaks and the uptrend line is breached simultaneously, sellers may target 1.2630 for support.

EUR/GBP: Can Inflation Resurgence Upend ECB’s Plans?

While a rate cut this week seems almost certain, questions surround the ECB’s future actions.

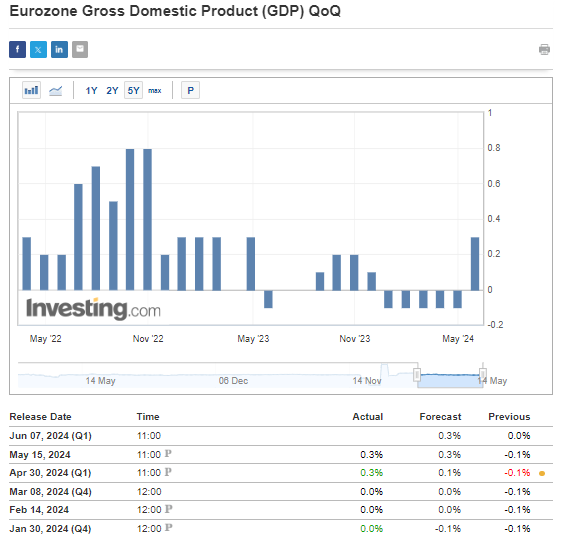

Stagnant economic growth, hovering around 0% for months, suggests the bank should prioritize stimulating the economy through lower interest rates.

However, rising inflation could complicate the ECB’s plans and force a reassessment of its strategy.

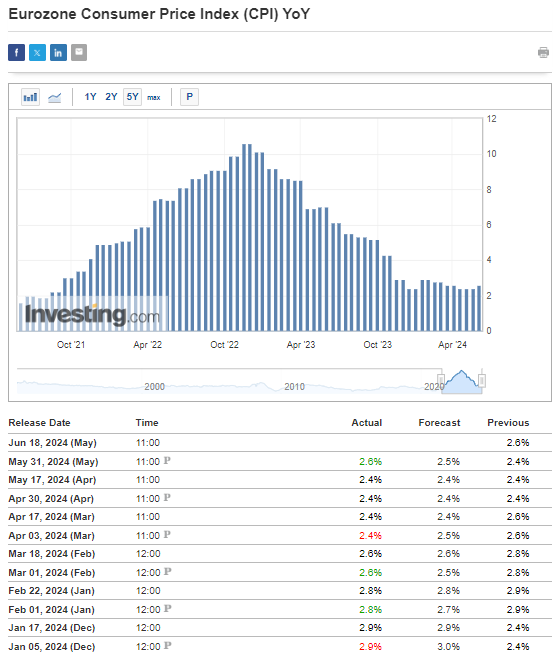

So far, this scenario has been supported by data, which has been below the 3% limit and relatively close to the inflation target since late 2023.

However, the latest readings may have introduced a bit more uncertainty for ECB officials, as both consumer and rose relative to forecasts and previous data.

As a result, market expectations of further cuts have melted to just one more, which may limit any further depreciation of the euro.

This also makes it likely that the post-decision announcement may have a more neutral tone and emphasize the need to wait for further data to decide on future cuts.

EUR/GBP Technical View

The EUR/GBP currency pair is back at a critical support level of around 0.85. This area has acted as a springboard for buyers several times in the past year, successfully triggering rebounds.

If the euro can hold above 0.85, the next target for buyers becomes the resistance zone near 0.86 euros per pound.

The ECB’s upcoming decision is also in focus. If they announce just one interest rate cut, with plans to monitor economic data before making further adjustments, it could increase the likelihood of the euro strengthening.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.