GBP/USD: Deep Retracement Looms Below 1.2850

2023.07.25 03:55

- The market has priced in 99% odds of a 25bps interest rate hike from the Fed this week…but only about a 33% chance of another rate increase this year.

- Traders will key into the FOMC’s monetary policy statement and Chairman Powell’s presser for market-moving tidbits about future policy.

- GBP/USD is having a look below 1.2850 support – the rising trendline and 50-day EMA near 1.2725 could come into play next.

It’s the season of paradoxes:

- It’s the middle of summer, but parents are already planning for “back to school.”

- The only movies that succeed in theatres nowadays are sequels, but “Barbenheimer” is dominating the weekend box office.

- And there are three normally “high impact” central bank meetings, but every trader already “knows” what the Fed, ECB, and BOJ will do this week.

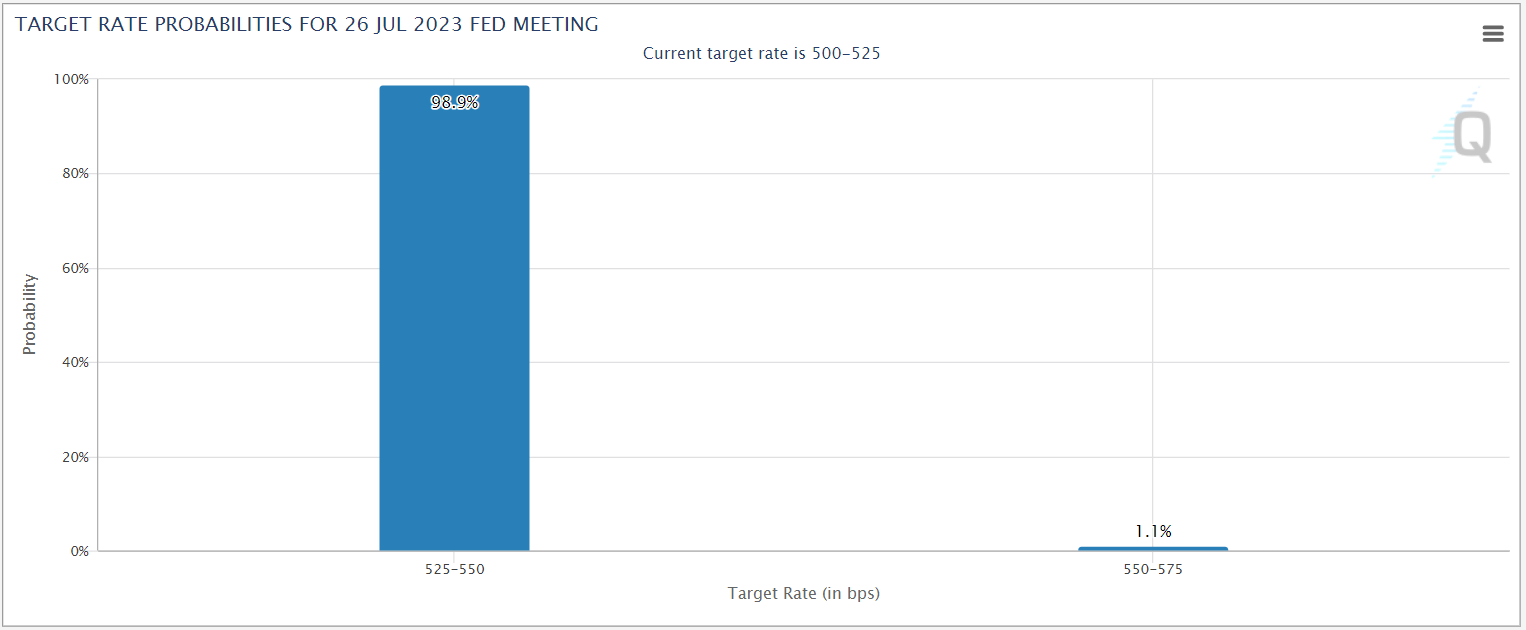

Keying in on the US central bank today, the CME’s FedWatch tool shows traders are pricing in a 99% chance that Jerome Powell and Company will interest rates by 25bps on Wednesday, as hinted around the June FOMC meeting and reiterated since:

Fed Target Rate Probabilities

Fed Target Rate Probabilities

Source: CME FedWatch

Assuming the Fed doesn’t want to upset the apple cart (and there’s no suggestion that central bankers do), the interest rate decision is unlikely to lead to much volatility in the market. That said, the communication around the decision will be closely scrutinized.

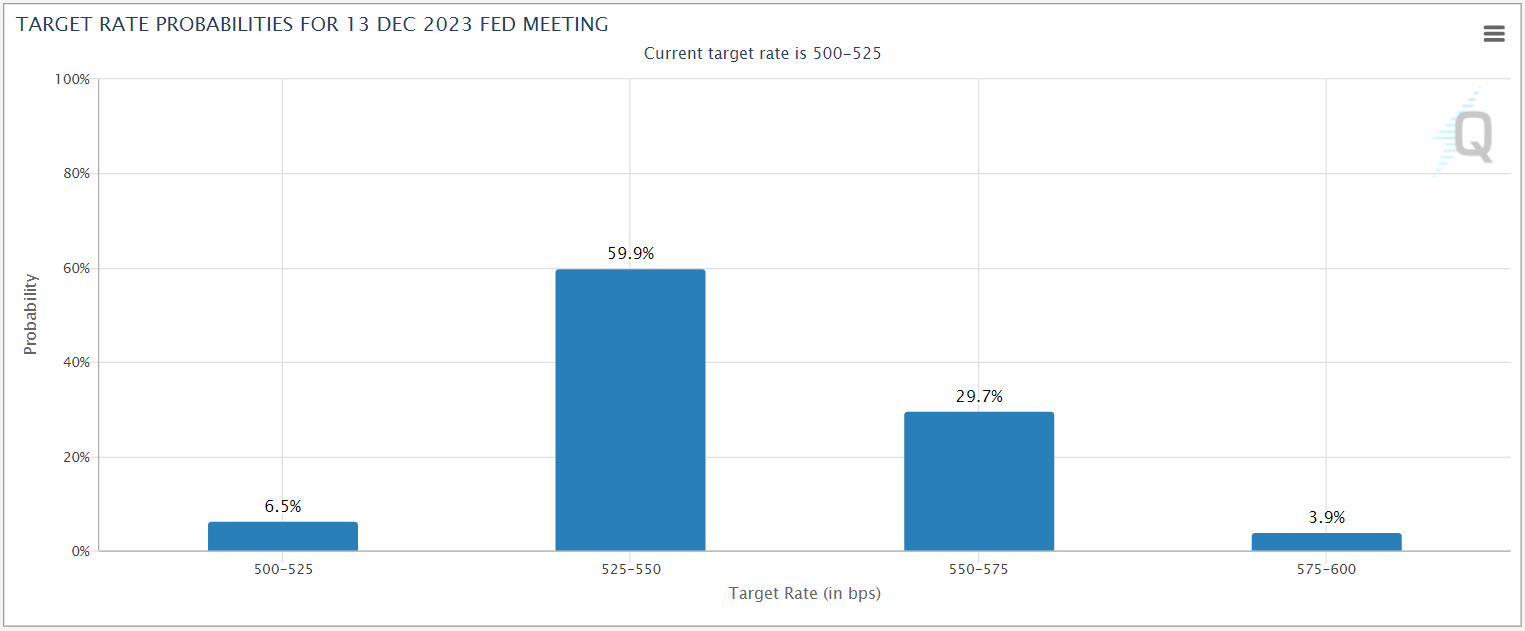

At their June meeting, Fed policymakers implied that two more 25bps interest rate hikes were likely this year, but the market is skeptical; traders are pricing in only a 1-in-3 chance of another rate hike after this week’s (presumed) move:

Fed Target Rate Probabilities – 13th Dec 2023

Fed Target Rate Probabilities – 13th Dec 2023

Source: CME FedWatch

With no updates to the Fed’s economic forecasts scheduled, all eyes will be on any changes to the central bank’s monetary policy statement and crucially, Fed Chairman Jerome Powell’s press conference. If Powell hints at additional tightening in September or November, traders may adjust their priors, leading to strength in the greenback and weakness in equity indices.

Meanwhile, a more balanced or outright dovish could convince dollar bears and index bulls to press the markets further as the end of the most aggressive rate hike cycle in recent history may finally be at hand.

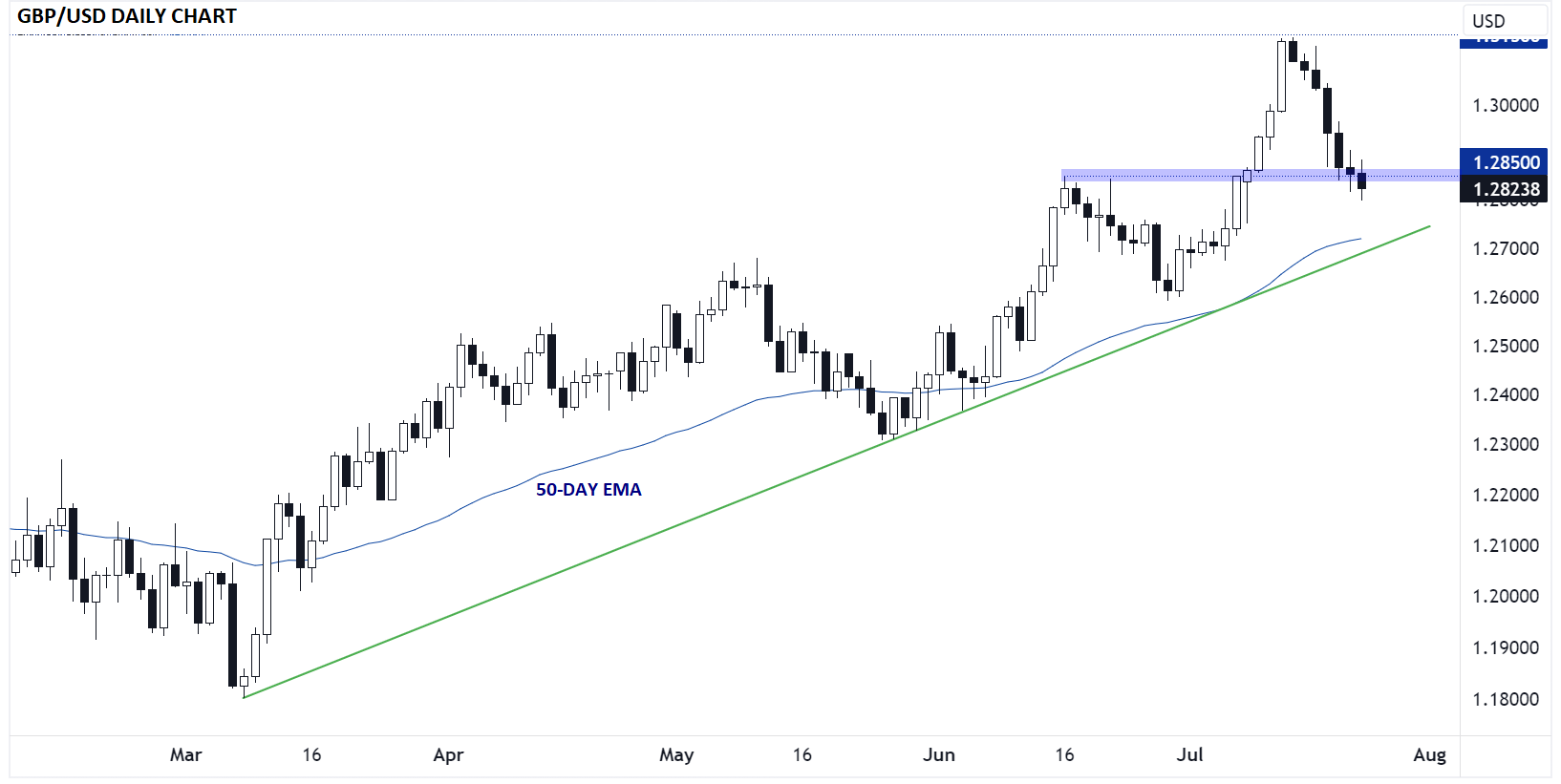

GBP/USD Daily Chart Analysis

Source: TradingView, StoneX

As the chart above shows, traders aren’t particularly concerned about the Fed meeting. is trading at a two-week low under previous-resistance-turned-support at 1.2850, potentially opening the door for a deeper retracement toward rising trend line support and the 50-day EMA near 1.2725 if the Fed comes off as relatively hawkish.

Meanwhile, a more dovish Fed statement and press conference could reinvigorate the GBP/USD uptrend; in that scenario, a move back above 1.2850 could open the door for a recovery rally toward 1.30 as the market-expected interest rate divergence between the two countries narrows.

Original Post