GBP/USD: Business Activity in the UK’s Construction Sector Recovering

2024.05.08 05:39

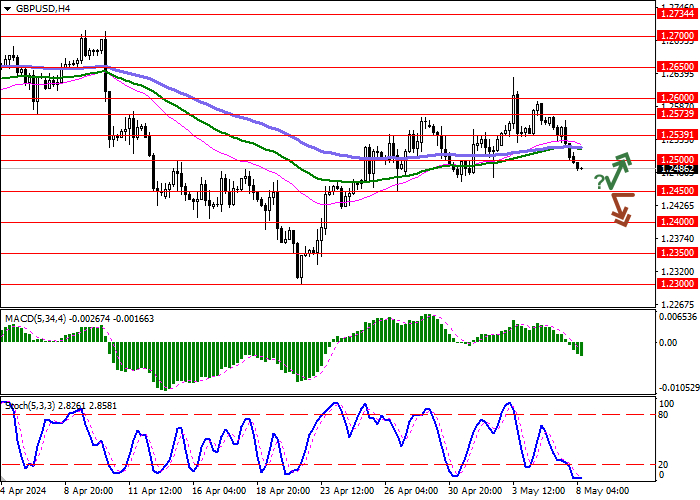

The pair is testing the 1.2480 level to the downside, maintaining the previously established downward momentum amid the absence of positive macroeconomic data from the U.S. and the UK.

The UK construction sector’s business activity index served as a boost for the pound. In April, it rose from 50.2 to 53.0 points, beating the forecast of 50.4 points. The Halifax house price index increased by 0.1% instead of the previous month’s -0.9% decline, although analysts expected 0.2%. House prices are close to stabilizing as investors anticipate an interest rate cut that should benefit the construction sector. However, data from the British Retail Consortium (BRC) for April shows a 4.4% drop in sales, indicating that families are still controlling their spending, which could slow economic growth.

In the U.S., economic data has been mostly negative. The IBD/TIPP economic optimism index fell from 43.2 to 41.8 points, below the expectation of 44.1. Consumer credit volumes also dropped from $14.12 billion to $6.27 billion in March, against an expectation of $15.0 billion. The market is focused on speeches by Federal Reserve members, including Philip Jefferson, Susan Collins, and Lisa Cook.

On Thursday, the Bank of England will meet. Analysts expect interest rates to remain unchanged at 5.25%, but the statement should provide insights into the bank’s outlook on the economy and the next steps.

Support and Resistance Levels:

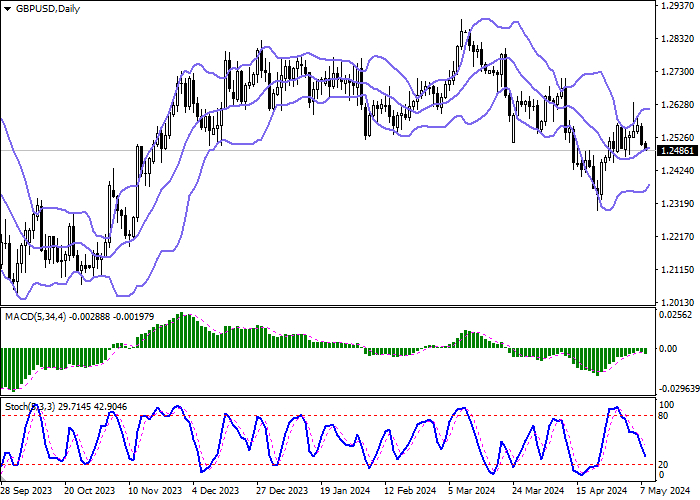

On the daily chart, the “Bollinger Bands” indicator is trying to adjust horizontally, with the price range narrowing from the bottom, suggesting mixed short-term trading. The MACD is turning downward, suggesting a new sell signal, while the Stochastic is dropping steadily, nearing lows and indicating a risk of pound depreciation.

3rd party Ad. Not an offer or recommendation by Investing.com. See disclosure here or

remove ads

.

Resistance: 1.2500, 1.2539, 1.2573, 1.2600

Support: 1.2450, 1.2400, 1.2350, 1.2300

Trading Scenario:

Recommendation: SELL STOP

Entry Point: 1.2450

Take Profit: 1.2350

Stop Loss: 1.2500

Alternative Scenario:

Recommendation: BUY STOP

Entry Point: 1.2500

Take Profit: 1.2600

Stop Loss: 1.2450

These scenarios provide short-term strategies to capture market movements based on the current support and resistance levels.