GBP/USD Breaks Down Ahead of BoE, NFP

2023.08.03 04:17

GBP/USD Takeaways

- The market is split on whether the BOE will hike 25bps or 50bps at its meeting tomorrow, as well as about how high the central bank will ultimately raise rates.

- Friday’s NFP report could also inject volatility into GBP/USD.

- GBP/USD is breaking below key support in the mid-1.2700s, potentially clearing the way for more downside if the BOE is dovish and/or NFP comes out better than expected.

GBP/USD Fundamental Analysis

As my colleague Fawad Razaqzada noted yesterday, the big event for the UK is tomorrow’s Bank of England meeting: “The BoE is widely expected to raise rates by 25 basis point to 5.25%, although there is a risk of a repeat of June’s surprise 50 bps hike – because of the fact that UK inflation is much higher than it is in other big economies.”

Indeed, traders are pricing in about a 40% chance of a 50bps rate hike from Andrew Bailey and Company, so regardless of what the BOE decides, a significant portion of traders will be caught offsides, presenting a recipe for volatility in UK assets.

Outside of the interest rate decision alone, traders will also be keen for an update on how the BOE is viewing the economy and the future direction for monetary policy. With traders currently pricing in a peak BOE rate near 5.8% in Q1 2024, any signal that the central bank is flipping to a more “data dependent” path, like we saw from the Fed and ECB last week, could hit the pound particularly hard as traders rein in their expectations for future rate hikes.

Looking a bit further afield, Friday’s US Non-Farm Payrolls report also has the potential to inject some volatility into GBP/USD. Traders and economists are expecting job growth to hold steady near 200K this month, with average hourly earnings anticipated to slow to 0.3% m/m from 0.4% last month. While not as reliable of a leading indicator as it’s been historically, this morning’s ADP Employment report showed a stellar 324K net new jobs created, suggesting that the US labor market remains strong ahead of the release.

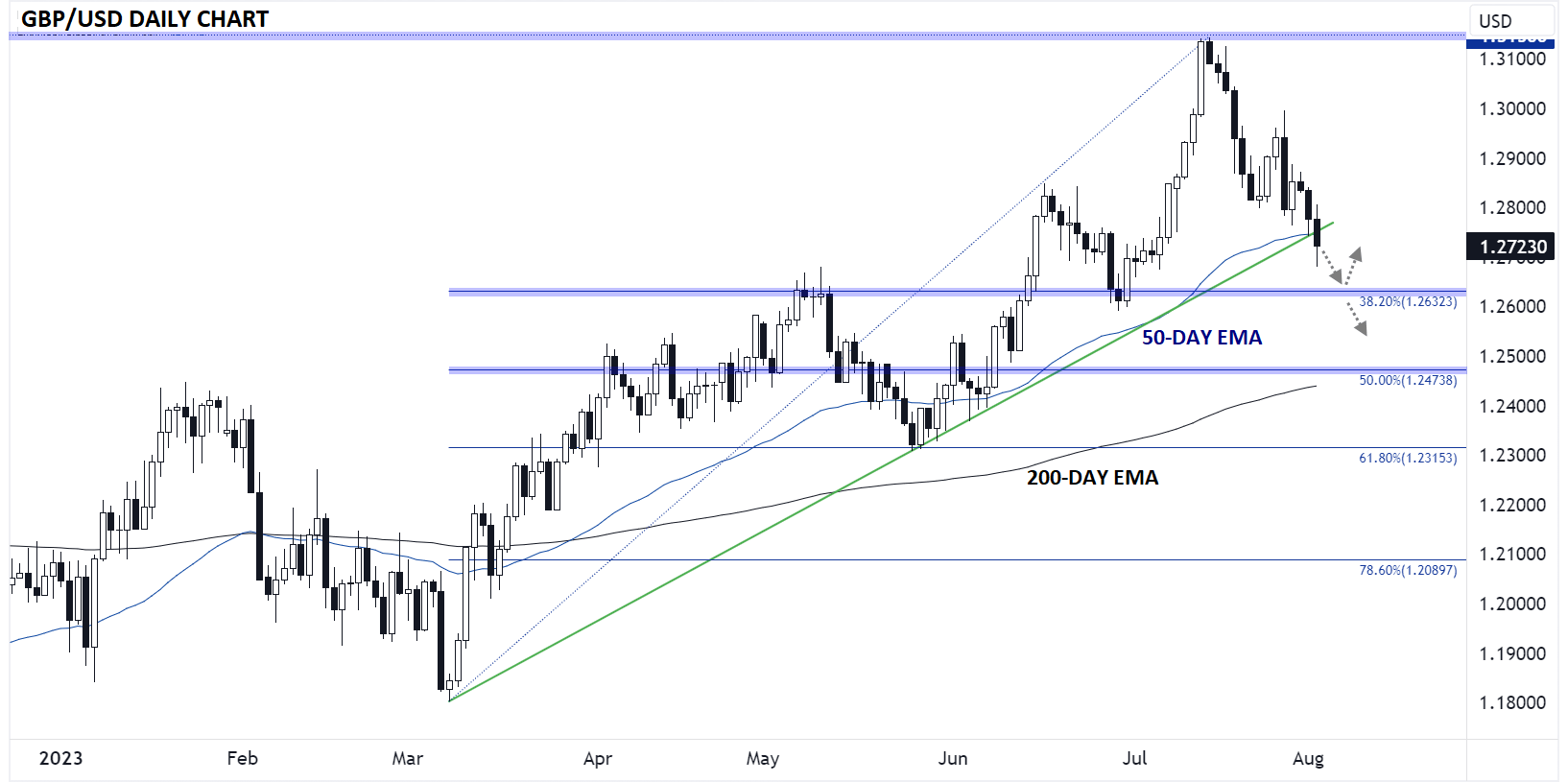

British Pound Technical Analysis – GBP/USD Daily Chart

Source: TradingView, StoneX

Looking at the chart above, cable is making a run at a big breakdown ahead of the BOE. With the greenback rising on the back of surging yields and a strong ADP report, GBP/USD is slicing through support at its 50-day EMA and bullish trend line near 1.2750. From a purely technical perspective, the pair may now have room to extend its drop toward the 38.2% Fibonacci retracement of the March-July rally at 1.2630 next, with the confluence of the 200-day EMA and 50% retracement below 1.2500 as the next potential target to watch.

Of course, the BOE (and NFP) have the potential to turn the pair around on a dime, so bulls will be hoping today’s price action is merely a “fakeout” and rates will ultimately recapture the 50-day EMA and head toward last week’s high near the 1.30 level. One way or another, GBP/USD traders will know a lot more about the outlook for the pair at the end of the week!

Original Post