GBP/USD: Breakdown Below 1.30 May Trigger Larger Decline Amid Rising Rate-Cut Bets

2024.10.22 04:41

Last week’s unexpected numbers from the UK sparked volatility in the pair. These surprising figures might just push the Bank of England (BoE) to execute another cut at its November meeting.

A 25-basis-point cut seems all but certain, especially with Chancellor Rachel Reeves trying to fill a £40 billion gap through possible tax hikes and spending cuts.

With all this in play, the GBP/USD pair could potentially drop below the key 1.30 support level, which could indicate further declines.

BoE and Fed Moves Hint at a GBP/USD Slide

Both the BoE and the Fed have started cutting interest rates, but recent US economic data has cooled down for aggressive cuts, strengthening the in the process.

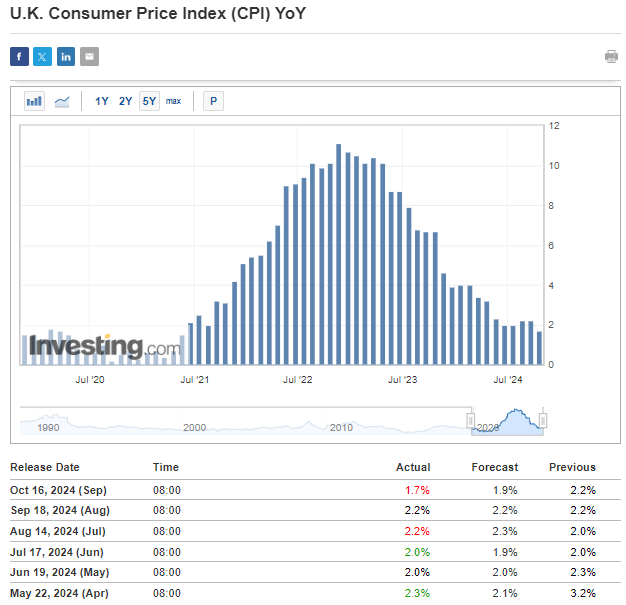

Meanwhile, UK inflation at 1.7% year-over-year came in below the expected 1.9%, well below the BoE’s inflation target.

Looking ahead, it’s becoming more likely that we’ll see another rate cut in December. BoE Governor Andrew Bailey has even suggested the bank might take bolder steps if inflation keeps dropping.

Goldman Sachs analysts also see UK interest rates slipping to 2.75% by November 2025, a small tweak from their last forecast.

If next month surprises us with a bigger cut, the pound might lose more ground to the US dollar.

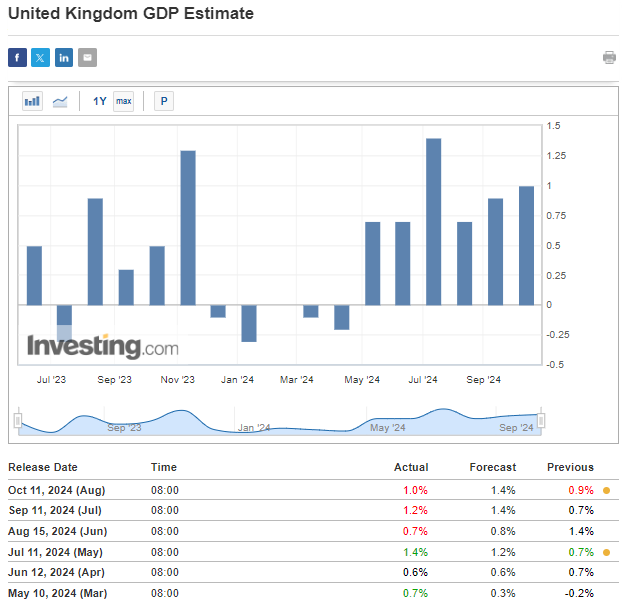

Add to that the latest growth figures at only 1% year-over-year—well below the forecasted 1.4%—and there’s a stronger case for the BoE to be more aggressive.

GBP/USD Hovering Around 1.30 – For Now

Right now, GBP/USD is hanging around the 1.30 mark, not making any bold moves.

This has led to a bit of a waiting game, as traders expect a breakout to guide the next direction, especially if it heads south towards the support level just below $1.29 per pound.

As we move through the week, keeping tabs on these movements could uncover some exciting opportunities, particularly if global pressures tip the scales in favor of the US dollar.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.