GBP/USD: Bank Of England’s Bipolar Policy Spikes Volatility

2022.10.12 06:18

[ad_1]

The Bank of England’s frenzy of emergency bond market support is rocking the currency market boat, leaving as one of the protagonists on FX.

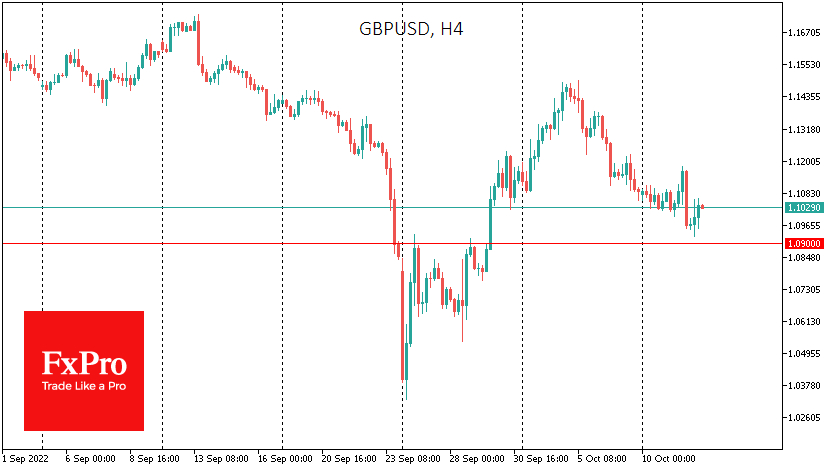

GBP/USD 4-hour chart technical analysis.

GBP/USD 4-hour chart technical analysis.

The Bank of England extended emergency support to the debt market yesterday to include inflation-linked bonds in its buying list, triggering GBP/USD to rise from 1.10 to 1.1180 intraday. But in the evening, Governor Bailey reminded that the emergency measure remains temporary, and these extended purchases will end on Oct. 14 as planned.

These statements triggered mini chaos in the debt market and took more than 2.3% off the pound from its peak to bottom on Wednesday morning at 1.0923. This bipolar policy is perplexing, although it makes a certain sense.

The Bank of England insists on leaving emergency market support temporary, while the market wants an extension of the support programs, although it makes little use of it. The Bank of England issued bids for £40bn over the two weeks of the program but bought £5bn.

Distressed pension funds are in no hurry to sell bonds, simply hoping that the very presence of a “buyer of last resort” will drive up prices — a habit developed in the markets over the past decades.

UK 10-years gilts yields shoot up

UK 10-years gilts yields shoot up

Remarkably, the FX market is greeted by news of an extension of the QE program or a “flexible approach” to bond purchases with GBP buying. Conventional logic suggests that buying assets on the balance sheet is a net issue for the pound, increasing its supply, which is harmful to the exchange rate. But now bond purchases are lowering the heat on the UK debt market, bringing buyers back into the pound.

Locally GBP/USD is gaining support on declines in the 1.0900 area, reassuring that the exchange rate has already passed its low point in September. It is worth being prepared for the Bank of England to accelerate short-term interest rate hikes to support the attractiveness of the short-term debt market. But in the meantime, periodic interventions at the far end of the curve are not ruled out.

Overall, this is a positive strategy for the pound, although frequent shifts between support and constraint regimes create volatility in the pound and increase risk premiums in the markets.

[ad_2]

Source link