GBP/USD Attempts Rebound From 2-Month Low

2023.08.29 06:07

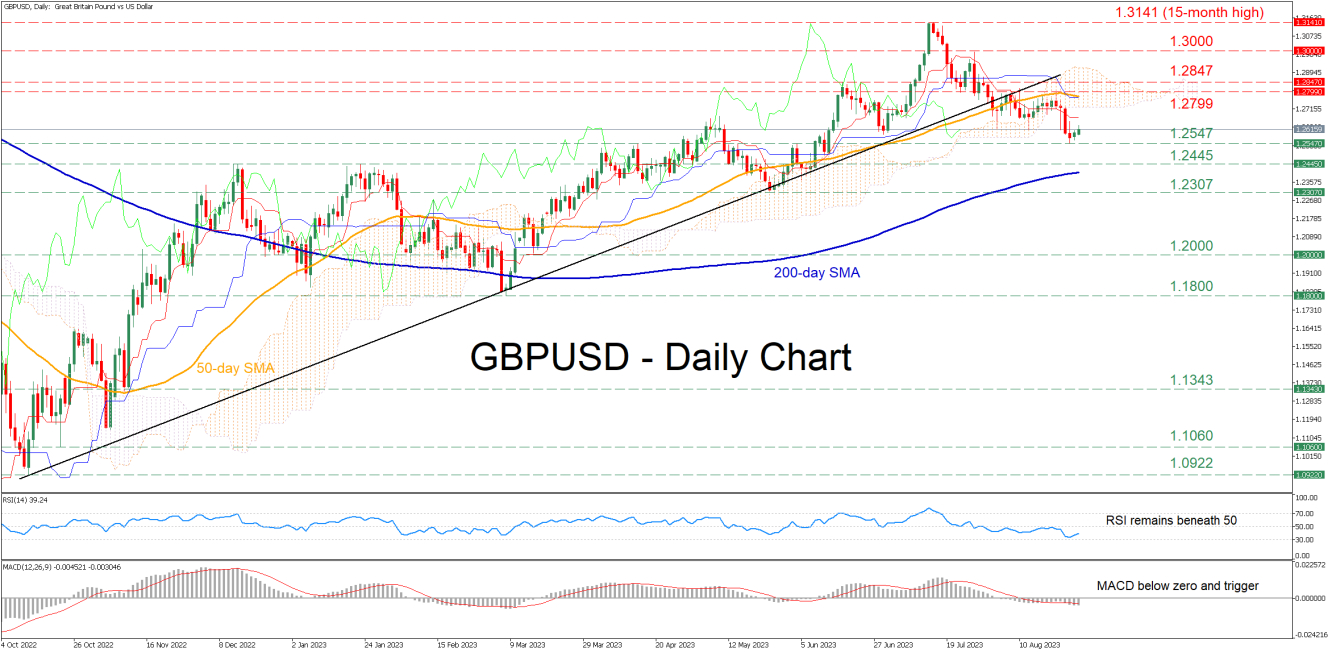

GBPUSD had been in a prolonged uptrend since October 2022, storming to a fresh 15-month high of 1.3141 on July 14. However, since then, the pair has been experiencing a prolonged downside correction, with the price falling to a fresh two-month low of 1.2547 last Friday before recouping some losses.

The short-term oscillators currently suggest that near-term risks are tilted to the downside. Specifically, the RSI is positively charged but remains well within the negative zone, while the MACD is found below both zero and its red signal line.

Should the bears attempt to push the price lower, the recent two-month bottom of 1.2547 could act as immediate support. Failing to halt there, the pair might extend its retreat towards the December-January resistance zone of 1.2445, which could serve as support in the future. Even lower, the May bottom of 1.2307 may provide downside protection.

On the flipside, if the pair manages to halt its retreat and storm back higher, the bulls could attack the recent resistance of 1.2799. Breaking above that zone, the pair could advance towards the June peak of 1.2847 before the 1.3000 psychological mark appears on the radar. A violation of territory could pave the way for the 15-month peak of 1.3141.

In brief, it seems that the GBPUSD’s pullback is starting to lose steam, but it’s too early to call for a reversal. Nevertheless, the short-term decline could accelerate in the case that the pair records a fresh lower low.