Fresenius cuts FY outlook on higher costs at dialysis business

2022.07.28 03:30

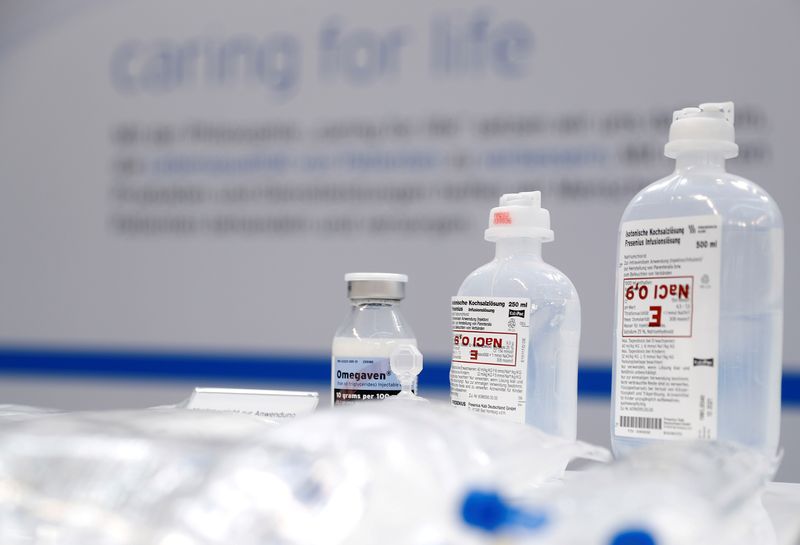

FILE PHOTO: Samples of products of Fresenius and Fresenius Medical Care are on display during the company’s annual news conference at their head quarters in Bad Homburg Germany, February 20, 2019. REUTERS/Kai Pfaffenbach

(Reuters) -German healthcare group Fresenius SE (ETR:FREG) cut its full-year earnings outlook due to cost inflation at its kidney dialysis subsidiary Fresenius Medical Care (NYSE:FMS) (FMC (NYSE:FMC)), it said late on Wednesday.

In an unscheduled statement, the healthcare group said it expects group sales to grow in a low-to-mid single-digit percentage range in 2022, down from its previous forecast of a mid-single-digit percentage range.

The company expects group net income to decline in a low-to-mid single-digit percentage range, it added.

Fresenius, which runs dialysis centers and hospitals, makes generic drugs and helps plan hospital construction projects, reported a 5% drop in net income to 450 million euros ($458.96 million) while group revenue rose by 8% to 10.2 billion euros.

FMC, the world’s largest provider of dialysis treatments, also cut its 2022 earnings outlook and withdrew its 2025 targets. It now expects sales growth at the lower end of the previous forecast range and a decline in net income in the high teens percentage range this year.

FMC said increased staff shortages, higher turnover rates and growing reliance on contract labour in the United States pushed costs further, in addition to non-wage cost and supply chain disruptions which also took a toll on earnings.

It said no longer expects to achieve organic revenue growth in North American Health Care Services this year.

“At the end of the first quarter we assumed extended labour shortages but clearly did not expect such a significant and rapid deterioration,” FMC Chief Financial Officer Helen Giza said in a statement.

FMC’s net income fell by 33% in the second quarter year-on-year to 147 million euros, despite a 10% rise in revenue in the quarter, preliminary results showed.

The company said new Chief Executive Carla Kriwet will takeover from Rice Powell, who is retiring on Oct.1, earlier than previously planned.

In February, parent company Fresenius increased its cost savings target to at least 150 million euros per year after tax, up from a previous goal of more than 100 million euros.

Fresenius Chief Executive Stephan Sturm said earlier this year that FMC could be sold over the longer term but only if a very attractive price was offered.

He has also been looking for external investors to help finance a takeover or merger involving hospitals unit Helios, though Fresenius intends to keep the majority of shares.

Both Fresenius and FMC were due to release detailed results on Aug. 2.

($1 = 0.9805 euros)