Ford Investors to Relive the 2008 Experience

2023.07.14 04:43

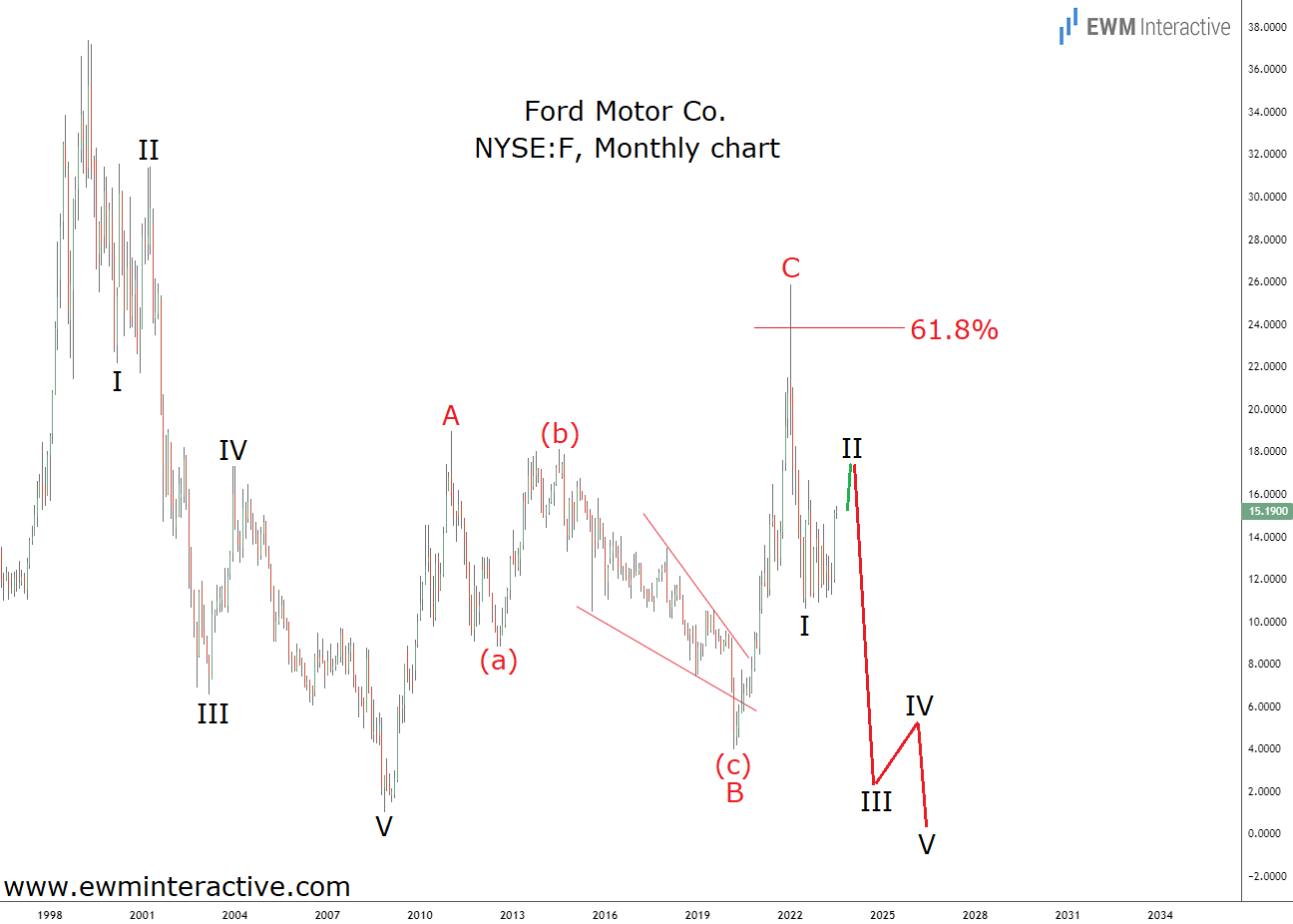

The past three years have been a real roller-coaster ride for Ford Motor Company (NYSE:) investors. The stock dipped below $4 a share in midst of the Covid-19 panic in March, 2020. Company revenue fell 19% that year and spent the following two trying to return to pre-pandemic levels. The stock, meanwhile, had risen more than six-fold by January, 2022, to nearly $26.

Currently hovering around $15.20, investors are wondering what’s next for this boring, yet apparently quite volatile name. Our search for answers takes us back almost seven years, when we wrote about Ford in late-August, 2016. Little did we know that the stock would be following our Elliott Wave trajectory through a global pandemic, a major war in Europe and the biggest inflationary crisis in over 40 years.

This was the chart we shared with readers nearly seven years ago, in August, 2016. Ford stock was trading around $12.50 a share back then. The sharp recovery from $1 to $19 between late-2008 and early-2011 looked like a five-wave impulse, marked (1)-(2)-(3)-(4)-(5). This meant that the rest of the chart must be depicting a three-wave correction.

It seemed to be a simple (a)-(b)-(c) zigzag, whose wave (c) was still in progress as an ending diagonal. It made sense to expect more weakness in waves 3 and 5 of (c), before the uptrend could resume. Once wave (c) was over, the bulls were supposed to lift Ford stock above $19. Given all the things that happened after this analysis was posted, even we’re surprised by how accurate it turned out to be.

Waves 3, 4 and 5 completed the ending diagonal pattern in wave (c) in March, 2020. As expected, the bulls returned with a vengeance and pushed Ford to as high as $25.87 in January, 2022. The 2008 Financial Crisis nearly bankrupted the company, so understandably, 2022’s recession worries dragged the stock down significantly again.

But in order to better understand Ford ‘s weakness, perhaps we have to examine the bigger picture. You may have noticed that we’ve now labeled the post-2008 recovery as an A-B-C retracement. The chart below explains why this is so.

Original Post