FOMC Preview: Brace Yourselves, a Hawkish Pivot Is Coming

2024.05.01 07:54

The Federal Reserve will announce its highly anticipated monetary policy at 2:00 PM ET today and investors are on edge amid worries that the U.S. central bank will strike a more hawkish tone than expected as policymakers contend with a recent uptick in inflation.

The FOMC is not publishing updated ‘dot-plot’ economic forecasts, and so investors will instead have to parse through commentary from Fed Chairman Jerome as hopes of a summer start to interest rate cuts fade away.

Thus, a lot will be on the line when Powell delivers his latest remarks amid signs that inflation is not only sticky but also picking back up.

By the way, if you are looking to pick stocks that may thrive amid persistent inflation and in a high interest environment, our predictive AI stock-picking tool can prove a game-changer. For less than $9 a month, it will update you every month with a timely selection of AI-picked buys and sells, giving you a significant edge over the market.

Subscribe now and position your portfolio one step ahead of everyone else!

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

What To Expect:

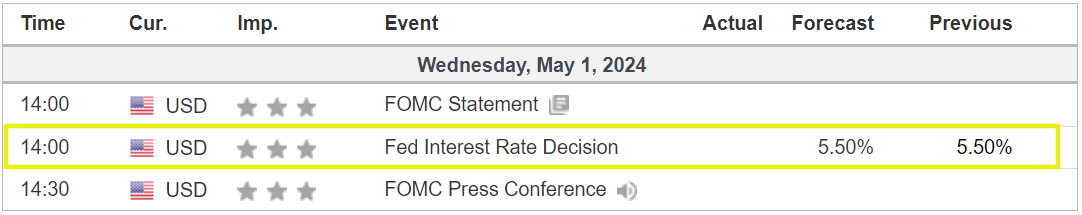

The Fed is all but certain to keep interest rates unchanged after its May FOMC policy meeting on Wednesday afternoon.

That would leave the benchmark Fed funds target range between 5.25% and 5.50%, where it has been since July 2023.

Source: Investing.com

Fed Chair Powell will hold what will be a closely watched press conference half an hour after the conclusion of the FOMC meeting at 2:30 PM ET, as investors look for fresh clues on his views on inflation and the economy and how that can impact interest rates in the months ahead.

When Powell last spoke in mid-April, he warned that has not made the progress that was expected and that monetary policy needs to be restrictive for longer.

“The recent data have clearly not given us greater confidence [that inflation is moving towards the central bank’s 2% goal] and instead indicate that it’s likely to take longer than expected to achieve that confidence,” Powell told a forum in Washington on April 16.

Coming into 2024, investors were expecting multiple rate cuts. However, stubbornly high levels of inflation and signs of a resilient economy have continually pushed back that possibility.

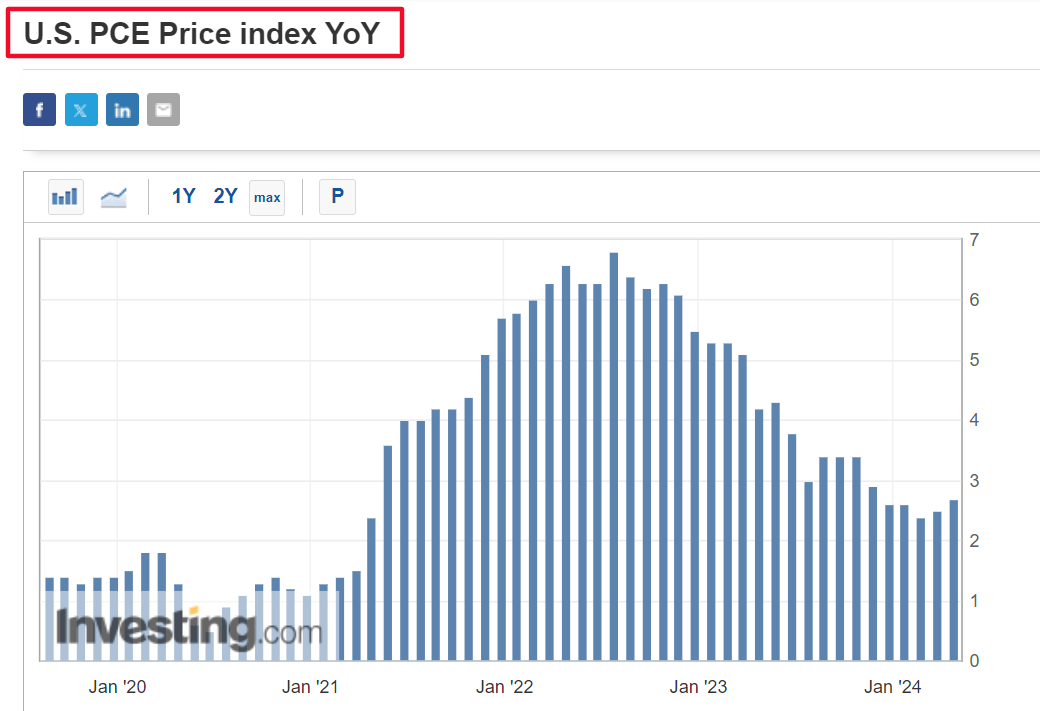

Since the start of the year, the Fed’s favored inflation metric – the – has actually accelerated, hitting an annual rate of 2.7% in March.

Source: Investing.com

At the same time, the labor market has remained robust, and the economy continues to hold up better than expected even as borrowing costs are at 23-year highs.

In light of the recent data, traders do not see a greater-than-50% chance of an interest rate cut until the Fed’s meeting in December, according to the Investing.com .

Prediction: The Fed’s Inflation Battle Is Not Over Yet

While the Fed is all but certain to leave rates unchanged, I believe there is a substantial risk that Jay Powell could strike a hawkish tone in his post-meeting news conference as inflation remains well above the central bank’s 2% annual target.

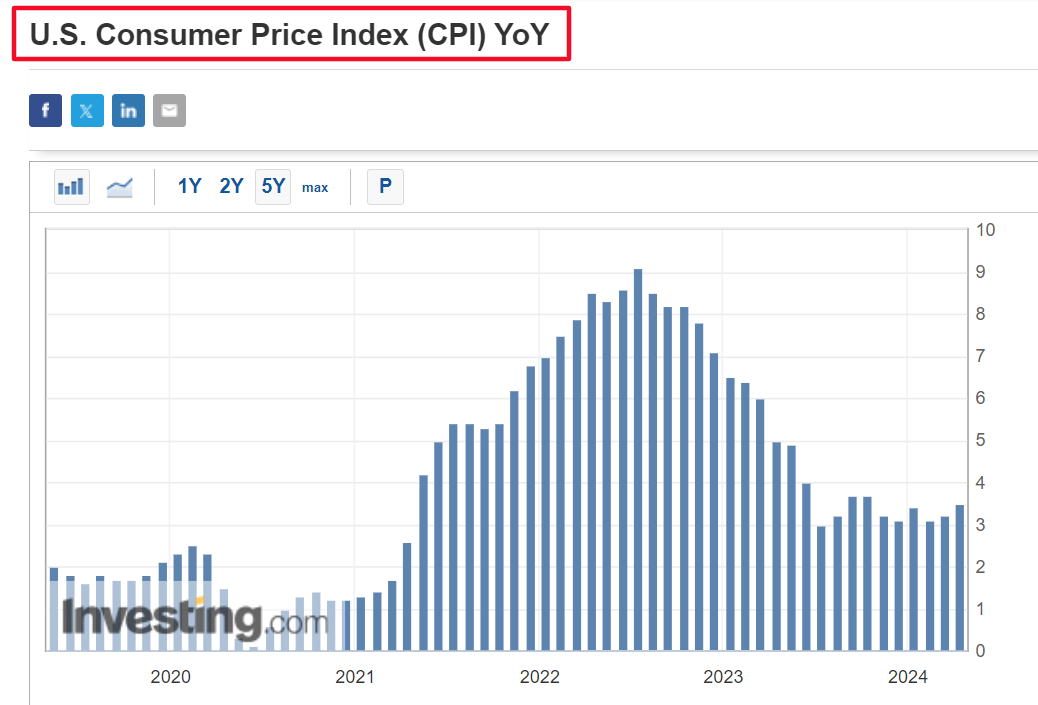

While CPI has come down significantly from a 40-year high of 9.1%, the decline in inflation that began in the summer of 2022 has all but stalled in recent months, highlighting the challenge faced by the Fed in the ‘last mile’ of its fight against rising consumer prices.

Source: Investing.com

The ‘last mile’, which is often the hardest to bring under control, refers to the final 1% or 2% of excess inflation that the Fed needs to overcome to meet its 2% goalpost.

In addition, a resilient labor market, solid economic growth, and healthy consumer spending mean there is no huge rush to lower interest rates anytime soon.

As such, Powell will attempt to push back against market expectations for rate cuts and reiterate that borrowing costs will remain higher for longer.

The bottom line is this is not an environment conducive to cutting interest rates. If anything, the Fed has more room to raise interest rates than to cut them, presuming it follows the numbers.

Contrary to the consensus view, I think the Fed will be on hold for the rest of 2024 and a rate cut would likely only come in Q1 2025 as inflation takes longer to return to the Fed’s target than many had hoped.

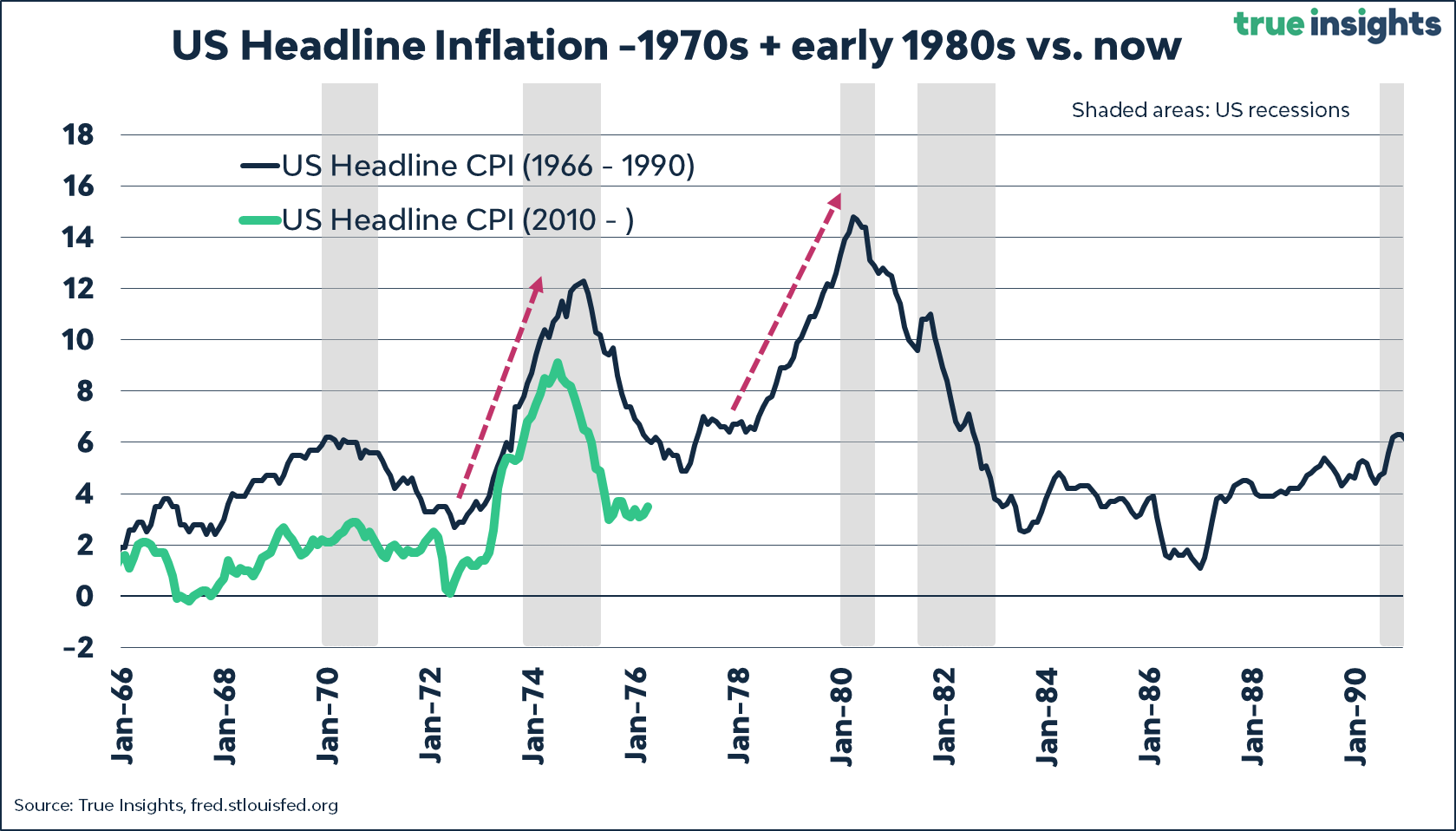

The U.S. central bank is at risk of committing a major policy error if it starts to ease too soon, which could see inflationary pressures begin to reaccelerate back towards last year’s highs.

Source: True Insights, FRED | St. Louis Fed

That could lead to a second wave of inflation similar to the one in the 1970s, when former Fed Chair Arthur Burns cut rates too soon, resulting in the worst economic downturn in the U.S. since the Great Depression.

As such, stubborn inflation and resilient economic activity through the first few months of the year have left the Fed little reason to cut rates in the near term, with the possibility of rate hikes even coming back into consideration.

What To Do Now:

Any indications or major shifts in the Fed’s statement and tone of Powell’s press conference could trigger significant market movements in the , , , , Treasurys, , and even .

Taking that into consideration, traders are advised to remain vigilant, exercise caution, and diversify portfolios to hedge against potential market fluctuations.

Given that markets have moved higher on the prospect of a dovish Fed this year, a shift to a hawkish stance could be considered a threat to the market rally.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy an extra 10% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Whether you’re a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of elevated inflation and high interest rates.

- ProPicks: AI-selected stock winners with proven track record.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Fair Value: Gain deeper insights into the intrinsic value of stocks.

- Advanced Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

Disclosure: At the time of writing, I am long on the S&P 500, and the via the SPDR S&P 500 ETF (SPY), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies’ financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.