First Republic shares rise after days of brutal selloff

2023.03.21 12:30

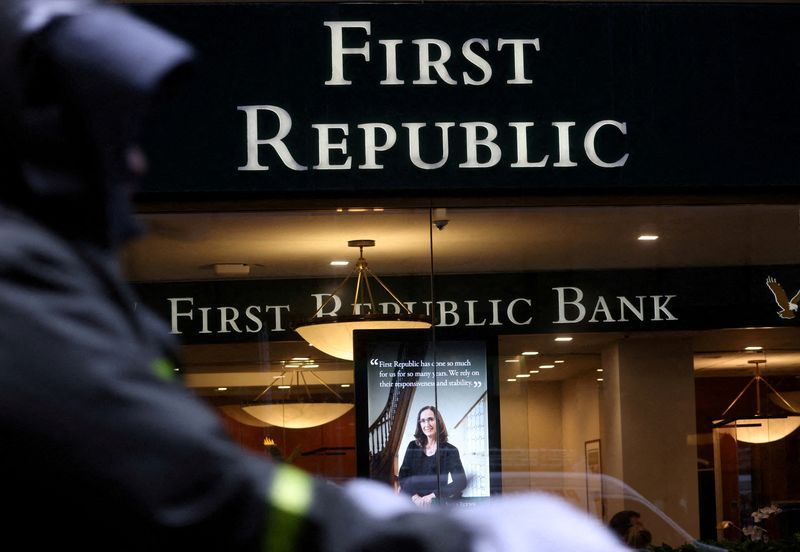

© Reuters. FILE PHOTO: A First Republic Bank branch is pictured in Midtown Manhattan in New York City, New York, U.S., March 13, 2023. REUTERS/Mike Segar/File Photo

By Medha Singh

(Reuters) -Shares of First Republic Bank (NYSE:) jumped nearly 40% on Tuesday, recouping some losses after hitting their record lows as signs of more support for the beleaguered lender boosted investor sentiment.

JPMorgan Chase & Co (NYSE:) CEO Jamie Dimon is spearheading discussions to raise new capital for the bank or a consortium takeover if another sale does not happen in the near term, CNBC reported.

San Francisco-based First Republic’s stock is the worst performer among U.S. regional lenders after shedding 90% of its market value in March following the implosion of Silicon Valley Bank.

First Republic was the second most traded stock by retail investors at 11:30 a.m. ET, according to J.P.Morgan data.

U.S. banking system is stabilizing, but further steps to protect bank depositors may be warranted if smaller institutions suffer deposit runs, U.S. Treasury Secretary Janet Yellen said.

For now, the U.S. government will step in and protect depositors, 50 Park Investments CEO Adam Sarhan said.

“If that happens, these stocks will not go to zero … (which) means they are very cheap right now so value investors are attracted and buying at these low levels,” Sarhan added.

First Republic was last trading at $16.83, a day after missing out on a broader rally in bank stocks even as large U.S. lenders infused $30 billion to allay fears over its funding.

Fears of contagion in the regional banking sector triggered a market rout last week that has not been seen since Russia invaded Ukraine, a Bank of America (NYSE:)’s Global Fund Manager Survey showed.

“The stocks are more inexpensive today than they were during the pandemic, and if you don’t buy banks here, we aren’t sure when you do,” Baird analysts said, adding that the market is currently pricing in 40-50% permanent reduction in return on assets, which are “beyond silly.”

Other lenders extended their rebound, with the banking index up 4.1%.

Despite Tuesday’s recovery, some investors were skeptical of First Republic’s stability.

“We believe First Republic remains in crisis,” said Jason Benowitz, senior portfolio manager at CI Roosevelt.

The volatility in its shares reflects shifting probabilities, including a bank failure that might leave the stock worthless, a recapitalization that would likely be highly dilutive relative to book value, or a sale that might be also highly dilutive, Benowitz said.