First Republic Bank deposits fall 41%, shares slide

2023.04.24 16:33

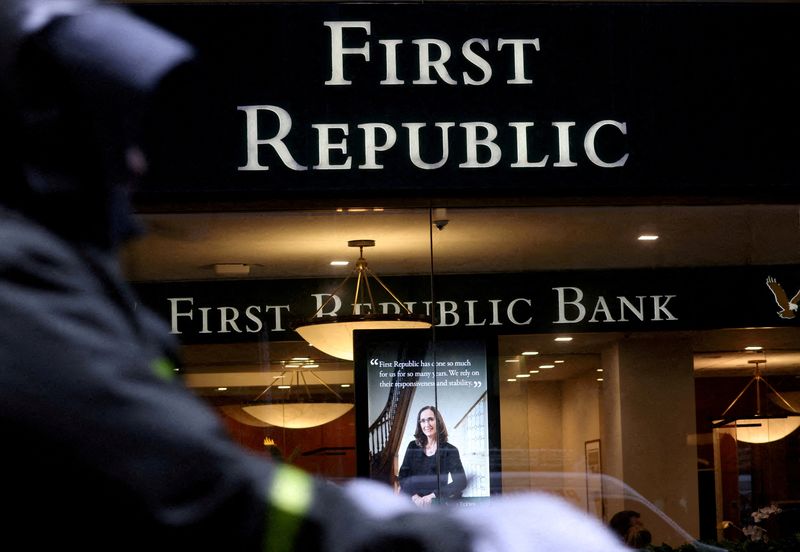

© Reuters. FILE PHOTO: A First Republic Bank branch is pictured in Midtown Manhattan in New York City, New York, U.S., March 13, 2023. REUTERS/Mike Segar

(Removes reference to higher interest payment in paragraph 1)

(Reuters) -First Republic Bank’s profit beat market expectations for the first quarter, but its deposits fell 41%, sending its shares down 13% in extended trading.

Its deposits fell to $104 billion from $176 billion in the fourth quarter. The lender also said it expects to reduce its workforce by nearly 20-25% in the second quarter.

The lender came into intense focus after Silicon Valley Bank (SVB) and Signature Bank (OTC:) collapsed last month, shaking the confidence in U.S. regional banks and prompting customers to move billions of dollars to bigger institutions.

As the turbulence roiled markets, First Republic received $30-billion lifeline in combined deposits from U.S. banking behemoths, including Bank of America Corp (NYSE:)., Citigroup Inc (NYSE:)., JPMorgan Chase & Co (NYSE:) and Wells Fargo (NYSE:) & Co.

Small U.S. banks shed $177.5 billion in deposits in March from the previous month, according to data from the U.S. Federal Reserve.

The lender earned $1.23 a share in the first three months ended March compared with $2 a year ago. Analysts had estimated the company to earn 85 cents for the quarter, according to Refinitiv data.