Financial Markets On Edge As U.S. Dollar Tests Important Level

2022.10.11 12:39

[ad_1]

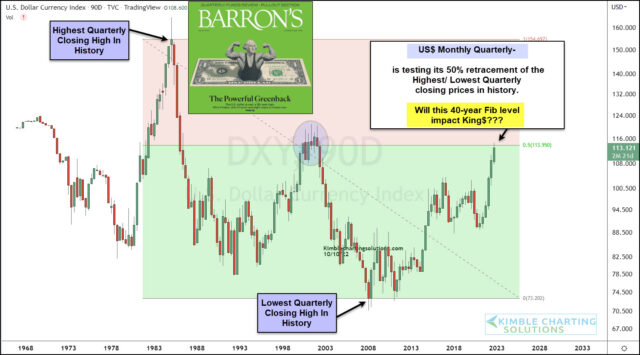

The index has propelled higher out of a double bottom formation that began in 2008, and nothing has slowed down King Dollar for nearly 14 years.

The latest show of strength in the US dollar has the financial markets on edge. After all, Forex is the largest market in the world.

Today we take a look at a long-term quarterly chart of the US dollar index and share a key insight that investors will want to pay attention to.

In the chart below, we take the all-time highest quarterly close and all-time lowest close to calculate some Fibonacci retracement levels. As you know, we are very tuned into the applied Fibonacci analysis.

U.S. Dollar Quarterly Chart

And what do you know, King Dollar is currently testing the 50% Fibonacci retracement level. A strong move over this level would further spook the markets and offer the US dollar some room to run higher, while a move lower (or consolidation) may serve to calm markets.

Make no mistake, what King Dollar does from here should have a huge impact on markets. Watch that 40-year Fibonacci level. And stay tuned.

[ad_2]

Source link