Filecoin The Latest Crypto To Soar In Market Bounce

2022.08.01 14:50

Despite the bleak macroeconomic environment, sentiment in the crypto market has shifted bullish over the past few days. Filecoin appears to benefit from the latest resurgence.

Key Takeaways

- Filecoin has rallied over the past week. It’s up 19.4% on the day.

- The surge comes following a shift in sentiment in the crypto market despite growing macroeconomic tensions.

- Traders remain divided on whether the market bottom is in.

Filecoin’s FIL is up 19.4% today.

Filecoin Jumps on Market Rally

Filecoin is outperforming the rest of the cryptocurrency market.

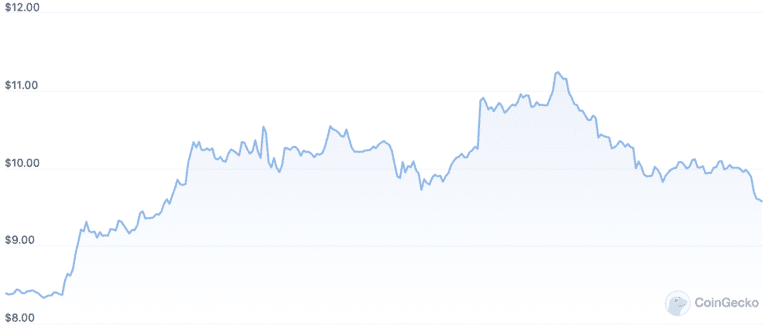

FIL/USD Chart.

FIL/USD Chart.

The decentralized storage network’s FIL token has jumped 19.4% today, outpacing most major crypto assets like Bitcoin and Ethereum. Several other tokens, including Polkadot’s DOT and Kusama’s KSM, have also rallied, though Filecoin is today’s strongest performer on crypto’s top 100 leaderboards. Per CoinGecko data, it’s currently trading at $9.90, up 75% over the past week.

The uptick comes during a volatile period in the crypto market. Prices have trended for months amid macroeconomic tensions, market exhaustion, and the collapse of giants like Terra and Three Arrows Capital, but the market started showing hints of a recovery in July. Last week, the Federal Reserve hiked interest rates by another 75 basis points. At the same time, the Bureau of Economic Analysis revealed that the U.S. economy had shrunk for a second consecutive quarter, signaling the start of a “technical recession.” While such developments would typically be seen as negative for risk-on assets, the crypto market soared last week, suggesting that the market may have priced in macro uncertainty.

Crypto Market Bounces Back

Bitcoin closed July in the green after a brutal May and June, posting its best monthly performance since October 2021. Meanwhile, Ethereum has taken the lead in the market in recent weeks amid growing anticipation for its milestone “Merge” event, tentatively scheduled to go live in mid-September. When Bitcoin and Ethereum rise, liquidity tends to flow to other crypto assets with lower market capitalizations, which is partly what’s allowed the likes of Filecoin to rally as confidence returns.

Interestingly, some of the strongest performers have been those linked to Ethereum’s so-called “Merge trade.” Ethereum Classic’s ETC, for instance, has jumped 44.4% over the past week, likely because the narrative surrounding its Proof-of-Work consensus mechanism has strengthened (the Ethereum fork will continue to use Proof-of-Work after its more famous sibling turns on Proof-of-Stake), leading Ethereum’s soon-to-be-redundant miners to flock to the network. LDO, the governance token for the liquid staking protocol Lido, is up 31.3% over the same period.

With many crypto assets showing bullish strength, some market participants have raised questions about whether “the bottom,” term crypto enthusiasts use to refer to the lowest price point of the bear cycle could be in, but traders remain divided. While some of Crypto Twitter’s top traders assert that the bottom is in, others say they are bearish due to the macroeconomic environment and nature of previous bear markets (if Bitcoin and the rest of the market rallied for the rest of the year, the recent slump would be the shortest bear market in crypto’s history).

The global cryptocurrency market capitalization is around $1.1 trillion, roughly 63.3% short of its November 2021 peak.