Fibonacci Support to Finally Put a Floor Under Ubiquiti Stock?

2023.08.14 09:29

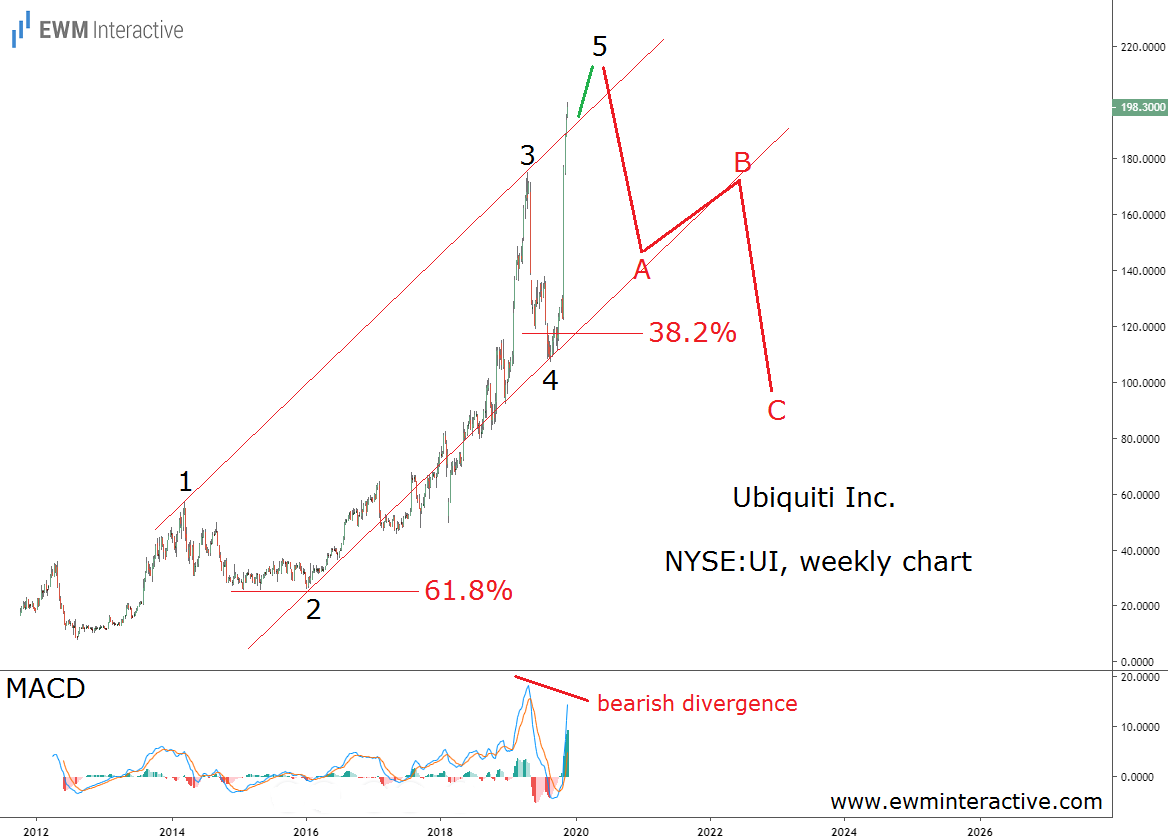

When we last wrote about Ubiquiti (NYSE:), in late-November, 2019, it wasn’t a positive call at all. The stock was hovering just under $200 a share following a phenomenal surge from $7.80 in 2012. Such strong and long-lasting bull markets often make investors forget that the price can go down, as well. Elliott Wave analysis, however, suggested that a significant drop was precisely what we should be preparing for. Here is the chart this bearish take was based on.

Ubiquiti Stock Weekly Chart

Ubiquiti Stock Weekly Chart

Similar Elliott Wave setups occur in the Forex, crypto and commodity markets, as well. Our Elliott Wave Video Course can teach you how to recognize them yourself!

Nearly four years ago, the weekly chart of Ubiquiti revealed that the rally from under $8 to over $198 was a five-wave impulse. According to the theory, this pattern, labeled 1-2-3-4-5 here, is always followed by a correction, which usually erases most of the fifth wave. Besides, there was a strong bearish MACD divergence between waves 3 and 5. So instead of joining the bulls in the vicinity of $200, we thought that “we can expect a decline to roughly $110 once wave 5 is over.” Apparently, the market somehow already knew what was coming.

Ubiquiti Stock Weekly Chart

Ubiquiti Stock Weekly Chart

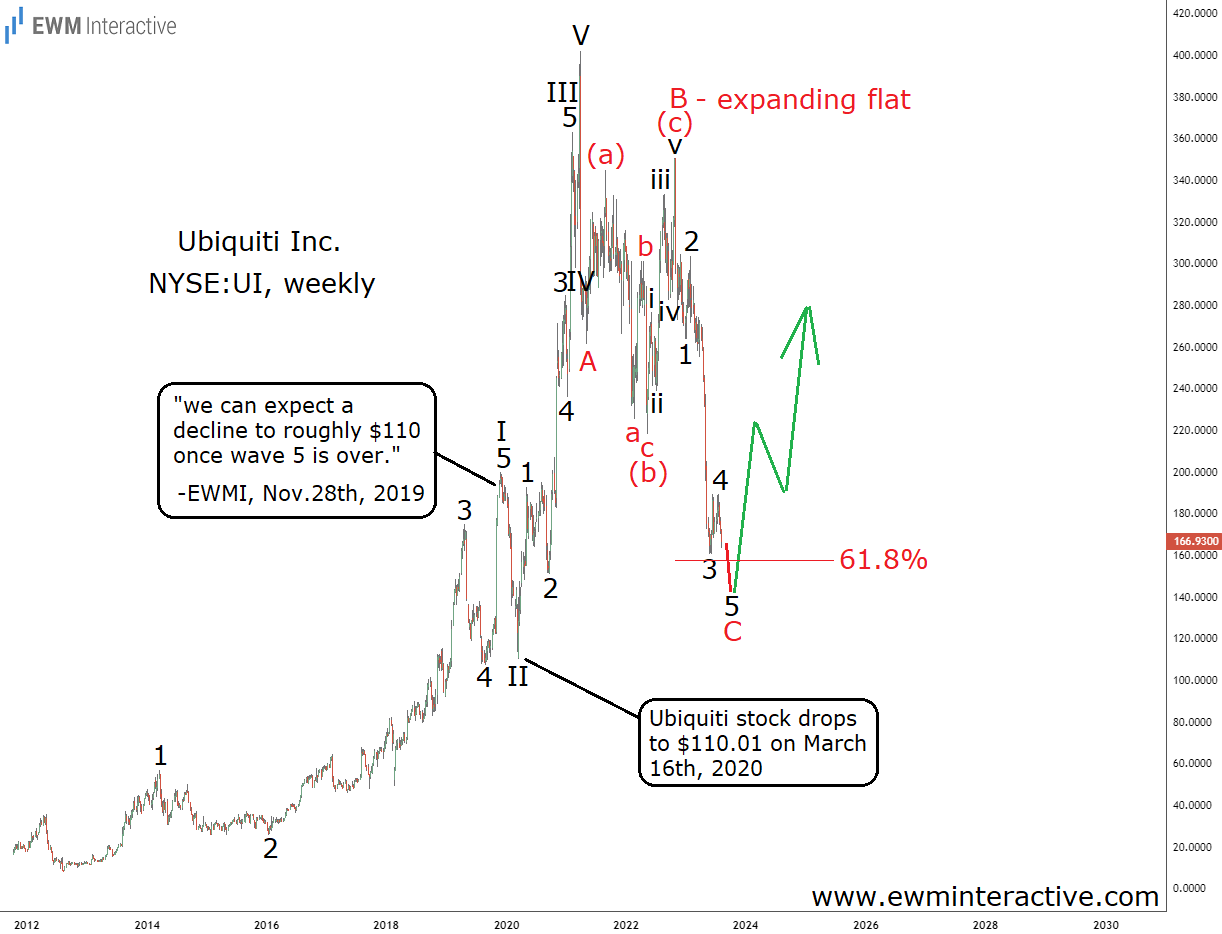

Wave 5 ended at $199.91. Over the following three and a half months, Ubiquity didn’t stop falling until it plunged to $110.01 on March 16th, 2020. It might look like a minor pullback now, but in reality this was a 45% crash in the midst of the Covid-19 panic. Elliott Wave analysis managed to put us ahead of it all.

Fortunately for investors, the support of wave 4 (and the Fed’s massive stimulus) proved strong enough to trigger the next big wave higher. Waves III and V, interrupted by a dip in wave IV in between, lifted Ubiquiti to an all-time high of $401.81 in late-March, 2021. What a difference a single year can make!

Alas, just like the impulse which ended in 2019 was followed by a notable correction, so was the one ending in 2021, only bigger. UI closed below $167 last week, down 58.5% from its 2021 record. The structure of this decline looks similar to a simple A-B-C zigzag, with an (a)-(b)-(c) expanding flat in wave B. Wave C looks like an almost complete impulse, marked 1-2-3-4-5 and already approaching the 61.8% Fibonacci support level.

If this count is correct, the 5-3 wave cycle that began in August, 2012, is almost complete now, 11 years later. All else equal, once a correction is over, the preceding trend resumes. The stock might drop by another $20-$30 a share in wave 5 of C, but a bullish reversal would then make sense.

On the other hand, keep in mind that Ubiquiti trades at a forward P/E of 24, which is not exactly a bargain valuation. For this reason we’d abstain from adding the name to our stock portfolio, despite the bullish Elliott Wave setup. There are currently 18 other positions in it, which we believe offer a much better risk/reward profile.

Original Post