Ferrari Continues to Move Higher: Overpriced or a Buying Opportunity?

2024.10.10 05:54

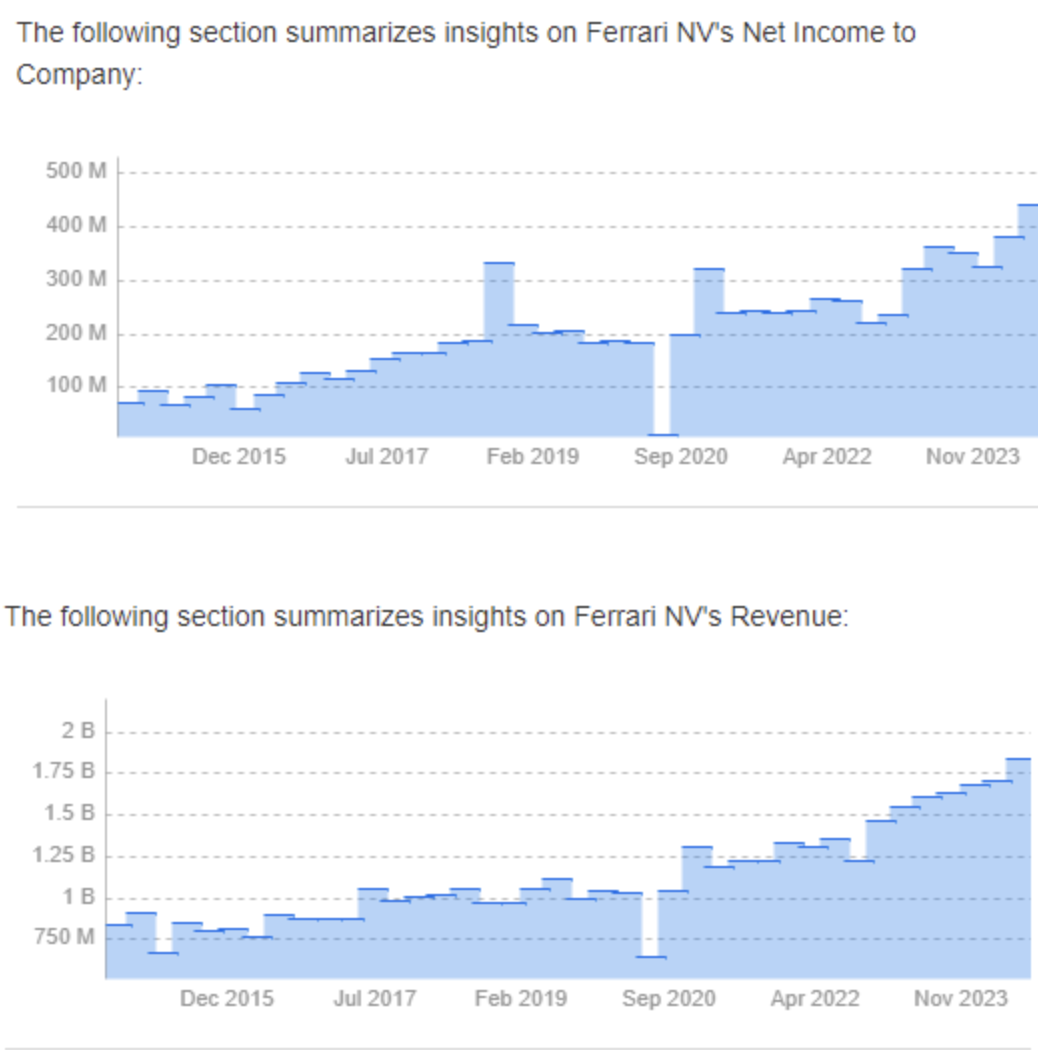

Ferrari (NYSE:) has long been a symbol of luxury and exclusivity in the automotive market, and its recent financial performance seems to reflect this enduring reputation. With its stock price experiencing a significant upward trend, especially following the strong Q2 2024 results, Ferrari is clearly continuing its successful trajectory. This positive outlook is largely driven by its consistent growth in both revenue and net profits.

Several factors contribute to this rosy financial picture. Firstly, Ferrari’s emphasis on quality, craftsmanship, and exclusivity ensures a loyal customer base willing to invest in its high-end products. Additionally, the company’s strategic expansion into new markets and its introduction of innovative models have likely helped sustain its growth momentum.

Looking forward, if Ferrari can maintain its focus on innovation and exclusivity while exploring new opportunities in markets such as hybrid and electric vehicles, it could continue to perform well financially. Additionally, the broader luxury market’s resilience during economic fluctuations might further support Ferrari’s stock performance. Of course, potential investors should also be mindful of external factors such as macroeconomic conditions and competition, which could impact Ferrari’s future prospects.

The impressive results are primarily attributed to the sales of Ferrari’s flagship 296 GTS model, along with a stable order structure for at least the next two years, creating ideal conditions for continued growth.

For Ferrari customers, higher prices do not equate to lesser value. Since the target audience is wealthy, price competition becomes less significant in shaping demand. Customers prioritize factors such as model uniqueness, technical specifications, and vehicle history, which make them feel they’ve acquired something truly exceptional. In this specific segment, higher prices can actually increase demand due to the Veblen Effect: the more expensive the item, the greater the prestige associated with it, amplifying the desire to own it among the wealthiest clients.

Ferrari’s commitment to maintaining this trajectory is evident in the second quarter of 2024, with car deliveries totaling 3,484 units. This does not negatively impact financial results, as further confirmed by fundamental indicators detailed in the subsequent paragraph.

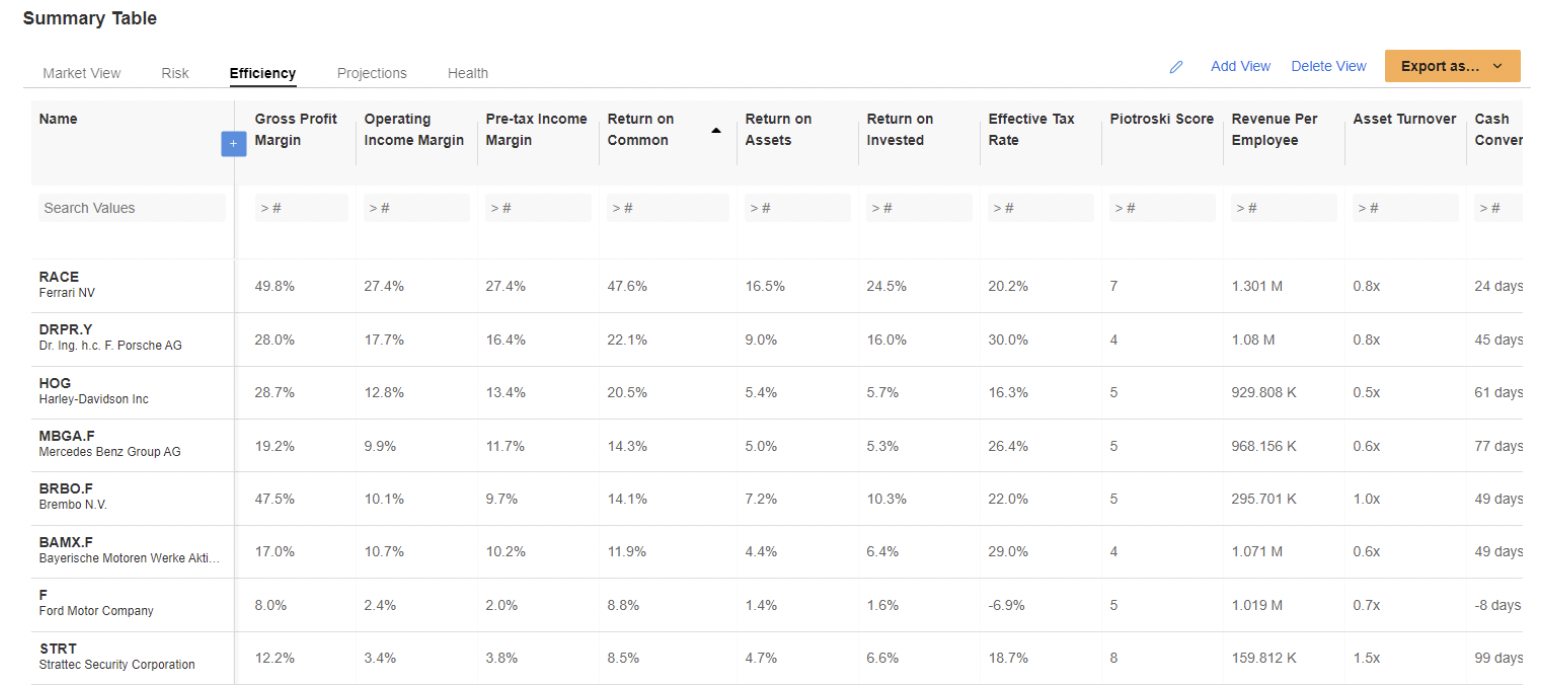

Ferrari outpaces competitors in efficiency metrics. Beyond traditional net profit and revenue figures, investors may be attracted to other fundamental indicators that are above the sector average and leading competitors. This includes gross margin, profitability, return on capital, and the Piotroski score, where Ferrari holds a strong leadership position in the comparison.

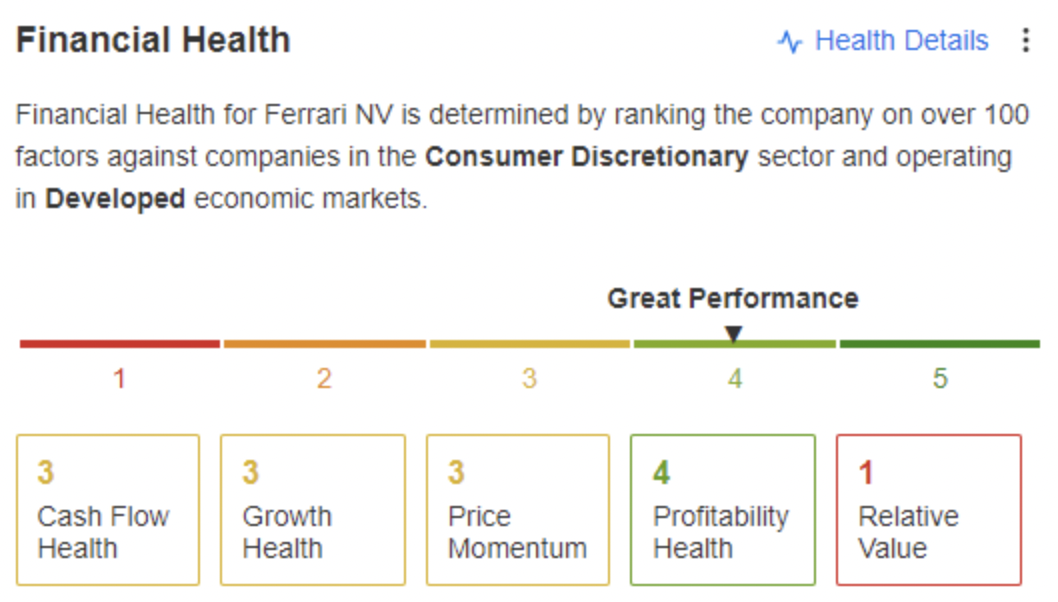

The ideal summary of the financial situation is a high level of the financial condition indicator, which shows 4 on a 5-point scale.

Watch out for a deeper correction

After hitting new historical highs, Ferrari’s US stock, though primarily listed on its home exchange in Milan, is experiencing a corrective phase. This movement is currently heading towards the nearest support level, situated around $440 per share.

If this support level is breached and the stock falls below the upward trend line, it could indicate an extreme corrective scenario, potentially leading to targets below $400, as suggested by the InvestingPro fair value indicator.

Such a broad-based recovery could materialize if there is a shift in stock market sentiment, triggering a global rebound. In the longer term, considering the robust fundamentals of RACE, any declines could be an opportunity to seek a buying position at a more favorable price.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor’s own risk. We also do not provide any investment advisory services.