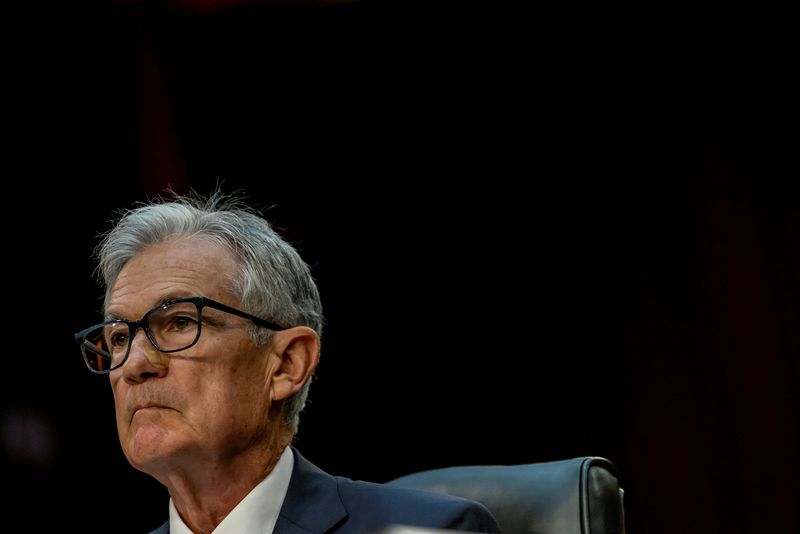

Fed’s Powell touts progress on inflation

2024.07.15 15:37

(Reuters) – Federal Reserve Chair Jerome Powell said on Monday the three U.S. inflation readings over the second quarter of this year do “add somewhat to confidence” that the pace of price increases is returning to the Fed’s target in a sustainable fashion, remarks that suggest a turn to interest rate cuts may not be far off.

“In the second quarter, actually, we did make some more progress” on taming inflation, Powell said at an event at the Economic Club of Washington. “We’ve had three better readings, and if you average them, that’s a pretty good place.”

“What we’ve said is that we didn’t think it would be appropriate to begin to loosen policy until we had greater confidence” that inflation was returning sustainably to 2%, Powell continued. “We’ve been waiting on that. And I would say that we didn’t gain any additional confidence in the first quarter, but the three readings in the second quarter, including the one from last week, do add somewhat to confidence.”

Powell also said he does not see the U.S. economy hitting major economic turbulence or an outright recession.

Powell’s remarks are likely his last until his press conference following the Fed’s July 30-31 meeting.

COMMENTS:

MARC CHANDLER, CHIEF MARKET STRATEGIST, BANNOCKBURN GLOBAL FOREX, NEW YORK

“The market is feeling confident and they were feeling confident before (Powell) spoke about a September rate cut, so I don’t think he really put it on the table, but it’s clearly that it is on the table. This is part of how the business cycle works. Just as the business cycle stops growing, as the economy stops growing, people talk about a soft landing. And the soft landing is sort of just like an early phase of the down cycle. And so Powell could made a stronger case that we’ve achieved a soft landing and now let’s avoid a hard landing. That’s the kind of logic that is going to be unfolding now.”

THOMAS SIMONS, US ECONOMIST, JEFFERIES, NEW YORK

“It was pretty much as expected. I think that his stance shifted very incrementally towards the potential for a rate cut. In the beginning, he’s talking about paying more attention to the labor market side of the dual mandate, and really that is a way of kind of saying that, all right, the inflation part isn’t going to handcuff us anymore if we need to do something because the labor market is weakening. It doesn’t mean that they’re necessarily seeing that right now and feel like the alarms are ringing and they need to cut, but more so that they have more flexibility to adjust policy if they think that they need to.”

BRUCE ZARO, MANAGING DIRECTOR, GRANITE WEALTH MANAGEMENT, PLYMOUTH, MASSACHUSETTS

“There’s been so much speculation in the bond market trying to out-guess the Fed as to when it is going to lower rates, and that has led to extreme volatility in the 10-year and also associated interest-rates sensitive sectors, like housing and small caps…

I think the most recent action with respect to Powell’s comments and the action of the bond market has been, OK, finally we have a clear signal that they’re going to do this, and the only question now is when… but it is coming.”