Fed’s Harker is ready to start methodical course of rate cuts

2024.08.22 13:21

By Michael S. Derby

NEW YORK (Reuters) -Federal Reserve Bank of Philadelphia President Patrick Harker said Thursday he was on board with a September rate cut as long as the data performs as he expects it to, and cautioned that it’s better to focus on the prospect of a steady course of easing rather than on the size of a given policy action.

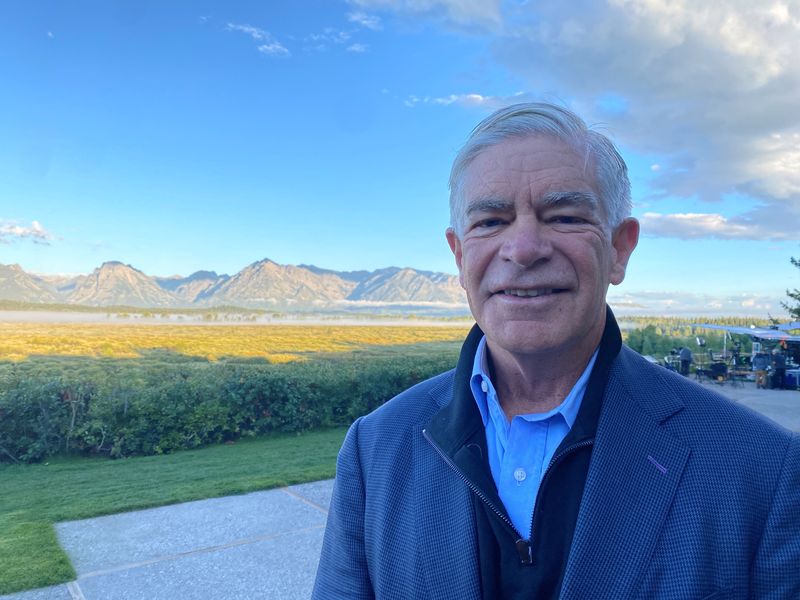

When it comes to an imminent move down in the cost of short-term borrowing, “for me, barring any surprise in the data we’ll get between now and then, I think we need to start this process” of lowering rates, Harker said in an interview with Reuters as he attends the Kansas City Fed’s annual research conference in Jackson Hole, Wyoming.

Harker said the size of any given move was less important than how the overall scope of cuts plays out, noting “I think a slow, methodical approach down is the right way to go.” He said his business contacts are calling for predictable action and do not want the move down in rates to mirror the aggressive increases that defined the campaign that lifted rates from near zero levels in the spring of 2022.

Harker spoke in the wake of meeting minutes released Wednesday for the central bank’s July meeting, and just ahead of a hotly anticipated set of remarks due Friday by Fed Chairman Jerome Powell at the conference.

The minutes said that as of the July Federal Open Market Committee meeting, the “vast majority” of policymakers expect the central bank will cut rates in September if the data does what it’s expected to do.

Financial markets have been broadly expecting the Fed to cut rates and are now pricing in as much as a full percentage point’s worth of cuts in what is now a federal funds rate target range of between 5.25% and 5.5% by year’s end.

The case for easier monetary policy rests on the fact that inflation pressures have been easing and are within spitting distance of the Fed’s 2% target. At the same time, the job market has been moderating, amid an unexpectedly swift rise in the jobless rate to levels above where the Fed expected it to stand this year and next. Some worry that if the Fed keeps its foot too firmly on the brakes it could cause real damage to the hiring landscape.

Harker said that it’s clear that the job market has softened but he said his view was the state of hiring was in the process of normalization. He downplayed the recent jump in the unemployment rate from the low of 3.4% seen at the start of last year to its current 4.3% level, saying “we think that the unemployment rate will peak below 5% somewhere, and that was, that’s what we predicted” given where the long-run potential of the job market likely rests.

Harker flagged the retreat in inflation and even as he supports rate cuts, he acknowledged it will still take time to get price pressures back to the 2% goal, saying “we’re definitely going to move in that direction, probably it’s going to take at least another year or more.”

Harker noted the prospect of easier monetary policy was helping to reinvigorate the moribund housing sector and that as activity returns it should ease the shelter pressures that have been a key driver of upward price pressures.

Harker also said that he was continuing to monitor risks in the commercial real estate sector but didn’t think troubles there so far represent a broad threat to the financial sector.