Fed’s Bostic joins Goolsbee in dovish call to wait and see before resuming hikes

2023.06.21 15:52

© Reuters

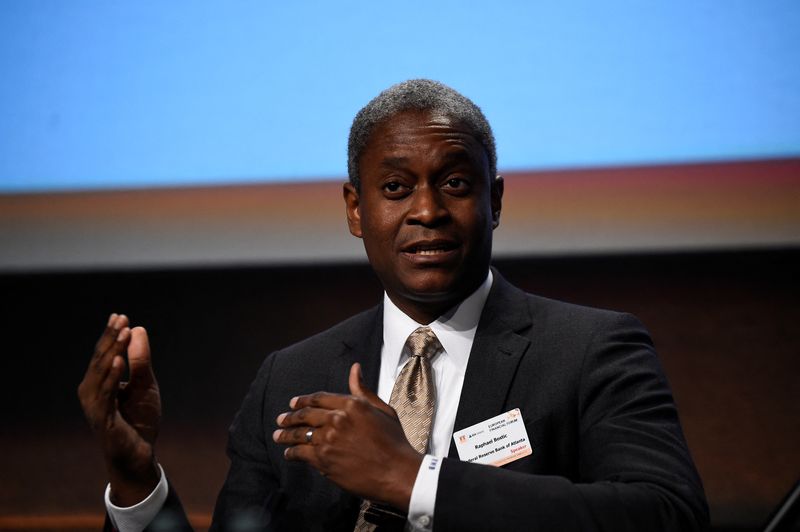

Investing.com — Atlantic Federal Reserve President Raphael Bostic on Wednesday called for more patience on rate hikes to allow the tightening delivered so far to filter through the economy, echoing remarks from Chicago Fed President Austan Goolsbee as tentative signs of division among Fed members on how soon to resume rate hikes emerge.

“If we simply press on with additional rate hikes, we could needlessly drain too much momentum from the economy,” Bostic wrote Wednesday in an essay titled ‘Making Monetary Policy Amid Financial System Challenges.’

Waiting to assess economic data, Bostic argues, shouldn’t be misinterpreted as inaction because if continues to fall in the months ahead, then the real level of rates, which adjusts for inflation, will increase and deliver “passive tightening,” helping curtail inflation toward the 2% target.

While the “clearest risk,” of pausing rate hikes allows inflation the opportunity to rekindle, Bostic said it wasn’t his “baseline forecast.”

Goolsbee Undecided on Rate Hike for July

The remarks come just hours after Goolsbee said he hadn’t yet “decided what should be the rate decision more than a month from now.”

Goolsbee also echoed the need to allow the rate hikes delivered so far to have the desired impact on the economy and inflation.

A “reconnaissance mission is a perfectly appropriate thing to do,” Goolsbee said, adding that it “takes some time for that [rate hikes] to work its way through the economy.”

Dovish Pushback Contrasts With Powell’s Hawkish Stance

The duo of somewhat dovish remarks from Bostic and Goolsbee was in sharp contrast to the hawkish tone from Fed Chairman Jerome Powell as he delivered his testimony before Congress on Wednesday.

The Fed chief talked up the prospect of the Fed following through with two additional quarter point hikes this year to curb still-high inflation.

“That’s pretty good guess of what will happen, if the economy performs as expected,” Powell said, referring to the Fed’s Summary of Economic Projections, released last week, showing that FOMC members were in favor of lifting rates by 0.5% to a range of 5.5% to 5.75%. That was higher than the 5.0% to 5.25% projections released in March.