Fed’s Barkin Wants More Evidence Inflation Is Easing to 2% Goal

2023.04.17 14:28

(Bloomberg) — Richmond Federal Reserve President Thomas Barkin said he wants to see more evidence that US inflation is easing back to the central bank’s goal of 2%.

“I want to see more evidence that inflation is settling back to our target,” Barkin said in an audience discussion at the Richmond Association for Business Economics Monday.

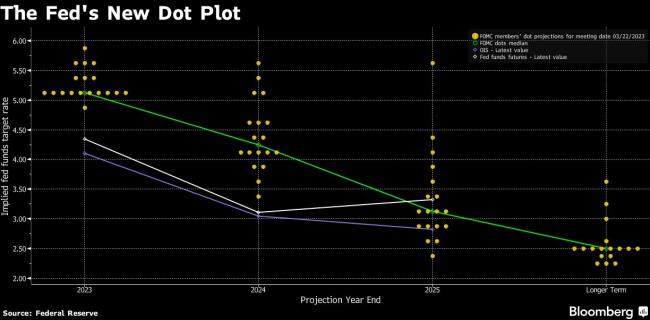

Policymakers have penciled in one additional quarter-point hike this year, and markets are pricing in the likelihood of a final rate increase May 3. While inflation reports last week showed some signs of easing price pressures, most Fed officials who have spoken since have highlighted the need to do more to return price gains to their 2% target.

Officials forecast rates reaching 5.1% this year, implying another 25 basis-point increase from the Fed’s current benchmark target range of 4.75% to 5%.

Asked if the current level of rates around 5% risked hurting part of the economy, Barkin said that this level of borrowing costs was not unusual in a historical sense. That’s with the exception of much of the past decade, when they were near zero until the Fed started its tightening campaign about a year ago.

“Our economy works just fine with rates at this level,” said Barkin, who isn’t a voter on the rate-setting Federal Open Market Committee this year.

While policymakers stress patience in assessing what the collapse of Silicon Valley Bank means for the US economy, there’s not been much change in their rhetoric on the need to cool price pressures.

“I’m pretty reassured by what I’m seeing but you never want to declare victory,” Barkin said about the regulatory response to the bank collapses.

The persistent strength of US employment has surprised economists and policymakers and put pressure on the Fed to keep raising rates. Fed officials who spoke last week underscored the complicated task of cooling inflation without damaging the broader economy.

“The labor market has moved from red-hot to merely hot,” Barkin said.

Separately, the Richmond Fed chief said a lot of other countries are not happy about the dollar being the global reserve currency because the US has “weaponized” the greenback through sanctions on some businesses.

“I think the rest of the world would love to have a different reserve currency,” he said.

(Updates with Barkin comment on current rate level’s effects in fifth paragraph.)

©2023 Bloomberg L.P.