FedEx or Micron – Which Stock Is the Better Buy Ahead of Earnings?

2024.06.20 08:12

- US markets are bullish, with tech leaders like Nvidia driving indices to record highs.

- Positive Q1 2024 earnings have bolstered the ongoing rally, setting the stage for a critical Q2 earnings season ahead.

- Micron and FedEx present contrasting scenarios as the Q1 earnings season concludes.

- Invest like the big funds for under $9/month with our AI-powered ProPicks stock selection tool. Learn more here>>

US markets are experiencing a bull run, with major indexes reaching new highs seemingly every day. Tech giants, led by Nvidia (NASDAQ:), are at the forefront of this surge.

The overall market seems unfazed by the Federal Reserve’s hawkish stance. Positive Q1 2024 earnings have been a key driver of the current rally.

The upcoming Q2 earnings season will be crucial as they may provide enough fuel for the bulls to keep the market charging forward.

Looking ahead, unforeseen events are always a possibility, but the focus remains on the next round of earnings reports. These reports will reveal whether buyers have the ammunition to sustain the bull market.

The tail end of the Q1 2024 earnings season brings two contrasting cases to light: Micron Technology (NASDAQ:) and FedEx Corporation (NYSE:).

Let’s take a look at each case one by one.

Micron Stock Due a Correction?

Micron is a leading AI company that primarily manufactures memory chips. On the wave of increased demand due to the development of the artificial intelligence revolution, the company’s listing is within a strong uptrend.

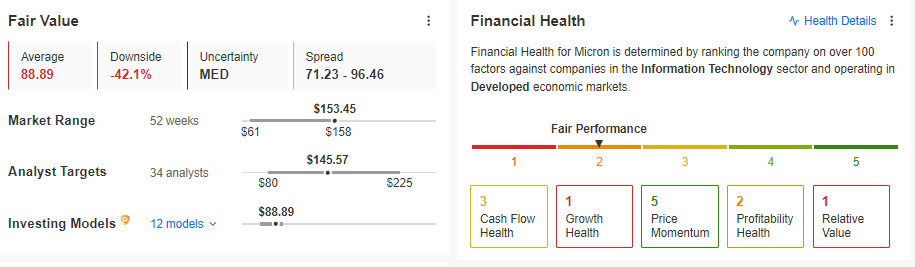

Source: InvestingPro

However, considering the fundamental situation, the company seems overvalued. The fair value index suggests more than 40% overvaluation and poor financial health.

One significant risk factor is the substantial exposure to the Chinese market, which accounts for approximately 25% of total sales. This dependence raises concerns about the stability of this revenue source amid increasing geopolitical tensions. Additionally, fluctuations in demand, coupled with high fixed costs, could jeopardize the stability of potential earnings growth in the long term.

FedEx Earnings: A Potential Turning Point?

Since early April, FedEx’s stock has been in a corrective phase, which eased into a local consolidation starting in June. Investors are eagerly anticipating the upcoming earnings results, which could potentially end this correction.

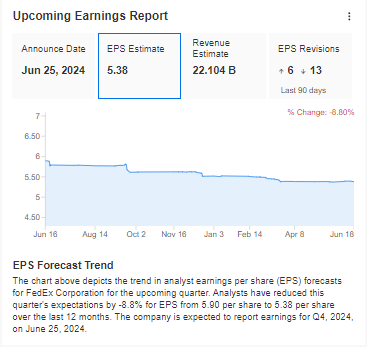

Source: InvestingPro

Notably, the number of downward revisions far exceeds upward revisions. This anomaly might create a buying opportunity if FedEx’s results surpass expectations. From a technical perspective, the demand side could regain control in the $235-245 per share range, where a key demand zone aligns with the largest correction in the uptrend.

A bullish breakout from the current consolidation would confirm this scenario, with an initial target of around $260 per share. Investors will be closely watching for any positive signals that could propel the stock higher.

***

Become a Pro: Sign up now! CLICK HERE to join the PRO Community with a significant discount.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.