Fed Rate Cuts Could Fuel a Rally in Small Caps, but Beware of Economic Headwinds

2024.08.01 03:36

- Small caps are typically more sensitive to interest rates than larger-cap firms since these smaller firms use more external financing for growth.

- Investors should expect a disproportionate impact on small caps from any perceived changes in future Federal Reserve (Fed) policy.

- However, slowing economic activity has a greater impact on small caps relative to larger caps.

- So for now, small-cap investors must work through the portfolio implications of these two competing forces.

Revised Expectations About Interest Rates Set the Stage for Small Caps

Ever since the latest Consumer Price Index () was released on July 11, the most hawkish investor has had to concede that inflation rates were decelerating enough for the to start cutting rates this year. After several disappointing reports earlier this year, more recent inflation reports were more encouraging to investors and set things up for a small-cap recovery.

The most recent and more comprehensive inflation report reiterated the good news. The Fed’s preferred inflation measure, the Personal Consumption Expenditure Index () showed inflation rose a mere 0.07% as goods prices declined 0.17% but were offset by services prices up by 0.20%.

Inflation continues to moderate and is slowly approaching the Fed’s target. The underlying details have improved. Rent prices rose 0.26% month-to-month, back to pre-pandemic averages and goods prices declined for the second consecutive month as consumers reduced demand for goods purchases. Further, services prices are moderating as most services ex-housing have eased or outright declined.

Inflation continues to moderate and is slowly approaching the Fed’s target. We should expect the Fed to highlight the slowdown in hiring as one reason to cut rates at the September meeting. As for business activity, real disposable income per capita continues to rise. This gives consumers the ability to keep spending despite high price levels. So, we are paying more, but we are getting paid more.

Competing Forces on Small Caps

As the market came around to the likelihood that the Fed will cut rates a couple of times this year, risk appetite improved, and small caps rallied. However, investors must work through the implications of the current macro landscape for positioning portfolios for the rest of the year.

Small caps often perform well in a lower interest rate regime, but small caps often feel the impact of a slowing economy As the market came around to the likelihood that the Fed will cut rates a couple of times this year, risk appetite improved, and small caps rallied.

However, investors must work through the implications of the current macro landscape for positioning portfolios for the rest of the year. Small caps often perform well in a lower interest rate regime, but small caps often feel the impact of a slowing economy. See our blog from earlier this month on the big gains for small caps written by our Chief Technical Strategist, Adam Turnquist.

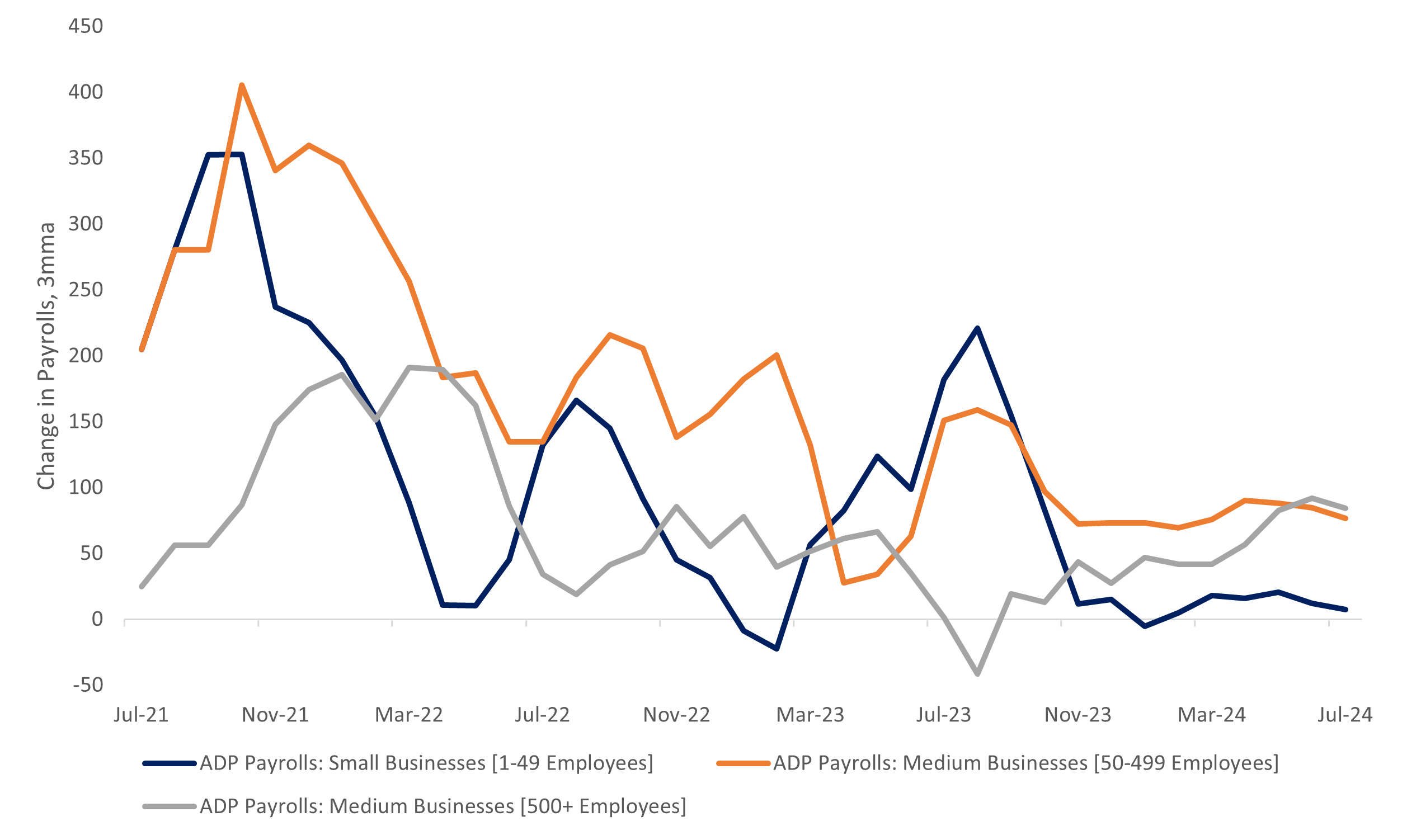

From today’s {{0|}

} release, the slowdown in business activity is more pronounced for small firms. Payrolls at small businesses grew much slower than at larger firms.

Small Firms Grew Payrolls at a Much Slower Pace

Source: LPL Research, Automatic Data Processing (NASDAQ:), 07/31/24

We do believe the Fed will cut interest rates in September and December. Further, if the economy is slowing more than expected, the Fed could cut rates in November as well. Falling interest rates will help small caps, but slowing economic activity has a greater impact on small caps relative to larger caps.

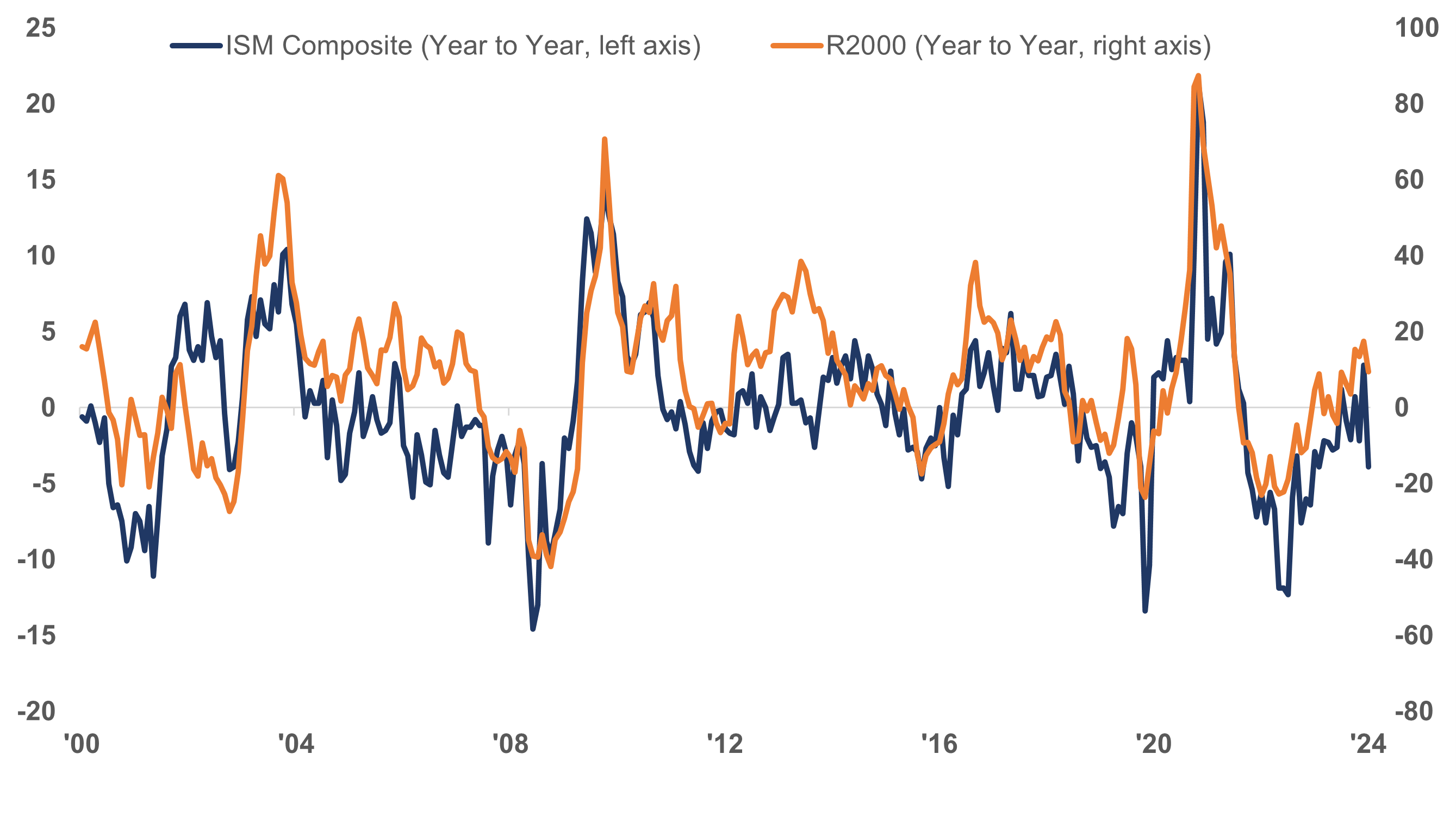

In the last few years, the and the ISM Composite index have had a close connection. Investors should watch the ISM numbers closely as a leading indicator.

Slower Growth Would Signal Headwinds for Small Caps

Source: LPL Research, Institute of Supply Management, WSJ, 07/31/24

Conclusion

Investors are interested in taking more risk as the so-called soft landing looks more likely. We have an economy with low unemployment, with rising wages, decelerating inflation, and a Fed on the cusp of cutting rates. Of course, political uncertainty and headwinds from geopolitical risks could rain on that parade and that’s why investors should exhibit discernment in a market like this. And when challenges come, small-cap firms are the first to feel the weight.

***

Important Disclosures

This material is for general information only and is not intended to provide specific advice or recommendations for any individual. There is no assurance that the views or strategies discussed are suitable for all investors. To determine which investment(s) may be appropriate for you, please consult your financial professional prior to investing.

Investing involves risks including possible loss of principal. No investment strategy or risk management technique can guarantee return or eliminate risk.

Indexes are unmanaged and cannot be invested into directly. Index performance is not indicative of the performance of any investment and does not reflect fees, expenses, or sales charges. All performance referenced is historical and is no guarantee of future results.

This material was prepared by LPL Financial. All information is believed to be from reliable sources; however LPL Financial makes no representation as to its completeness or accuracy.

Unless otherwise stated LPL Financial and the third-party persons and firms mentioned are not affiliates of each other and make no representation with respect to each other. Any company names noted herein are for educational purposes only and not an indication of trading intent or a solicitation of their products or services.

Asset Class Disclosures

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors. These risks are often heightened for investments in emerging markets.

Bonds are subject to market and interest rate risk if sold prior to maturity.

Municipal bonds are subject and market and interest rate risk and potentially capital gains tax if sold prior to maturity. Interest income may be subject to the alternative minimum tax. Municipal bonds are federally tax-free but other state and local taxes may apply.

Preferred stock dividends are paid at the discretion of the issuing company. Preferred stocks are subject to interest rates and credit risk. They may be subject to call features.

Alternative investments may not be suitable for all investors and involve special risks such as leveraging the investment, potential adverse market forces, regulatory changes, and potentially illiquidity. The strategies employed in the management of alternative investments may accelerate the velocity of potential losses.

Mortgage-backed securities are subject to credit, default, prepayment, extension, market and interest rate risk.

High yield/junk bonds (grade BB or below) are below investment grade securities and are subject to higher interest rate, credit, and liquidity risks than those graded BBB and above. They generally should be part of a diversified portfolio for sophisticated investors.

Precious metal investing involves greater fluctuation and potential for losses.

The fast price swings of commodities will result in significant volatility in an investor’s holdings.

Securities and advisory services offered through LPL Financial, a registered investment advisor and broker-dealer. Member FINRA/SIPC.

Not Insured by FDIC/NCUA or Any Other Government Agency | Not Bank/Credit Union Deposits or Obligations | Not Bank/Credit Union Guaranteed | May Lose Value