Fed Officials Push for More Rate Hikes Without Saying How Big

2022.08.25 19:30

(Bloomberg) — Federal Reserve officials stressed the need to keep raising interest rates even as they reserved judgment on how big they should go at their meeting next month.

Kansas City Fed President Esther George, speaking in Jackson Hole, Wyoming, where she hosts the Fed’s annual policy retreat, said the central bank hasn’t yet increased interest rates to levels that are weighing on the economy and may have to take them above 4% for a time.

“It’s very important that we are clear in our communication about the destination we are headed,” she told Michael McKee and Kathleen Hays in an interview with Bloomberg Television.

“We have to get interest rates higher to slow down demand and bring inflation back to our target,” said George, who votes on monetary policy this year.

George’s comments helped set the stage for a busy two days of Fed speakers, who will be headlined Friday by Chair Jerome Powell with a speech likely to restate his resolve to keep tightening monetary policy to fight inflation.

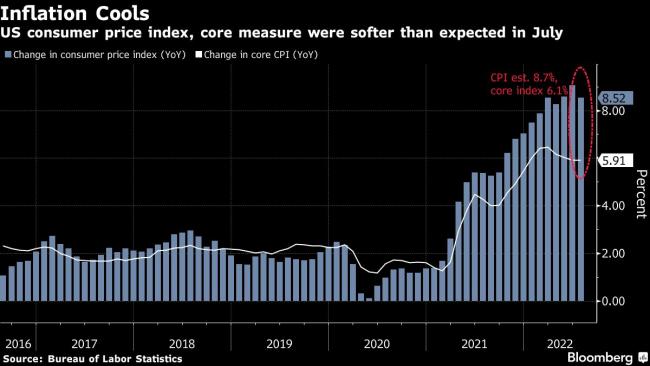

The US central bank is raising interest rates rapidly to curb the hottest price pressures in 40 years. US consumer prices rose 8.5% in the 12 months through July, according to Labor Department data. The Fed aims at a different gauge produced by the Commerce Department, called the personal consumption expenditures price index, which rose 6.8% in the year through June.

Asked how high the Fed should push borrowing costs, George said there was “more room to go” and pushed back against bets in financial markets the central bank would begin cutting rates next year.

“I think we will have to hold — it could be over 4%. I don’t think that’s out of the question,” she said. “You won’t know that, I think, until you begin to watch the data signs.”

Fed officials hiked by 75 basis points at each of their last two meetings and have said the same again could be on the table when they gather next month, depending on the data. They get fresh reads on consumer prices and employment between now and then.

Philadelphia Fed President Patrick Harker, speaking in an interview with CNBC, also said rates need to be lifted into restrictive territory.

“There are glimmers of hope on inflation. I just emphasize glimmer — our job is no way done. So we can take that as a positive, but we need to keep acting to raise rates to get inflation under control,” he said.

He too struck a measured tone, playing down suggestions that if the Fed only moved by a half point next month, that was somehow dovish.

“Since 1983, the Fed has raised rates 86 times — 75 of those were under 50 basis points,” he said. “So whether it’s 50 or 75, I can’t say right now, but let’s not think that 50 is not a substantial move.”

Atlanta Fed President Raphael Bostic, speaking in a separate interview with the Wall Street Journal, said that he had not yet decided whether to back a 50 or 75 basis-point increase at the Sept. 20-21 gathering of the Federal Open Market Committee.

“At this point, I’d toss a coin between the two,” he told the Wall Street Journal. “We all, as policy makers, understand that inflation is a big problem and is a challenge that we’re going to do all that we can to handle.”

Pricing in interest-rate futures markets also show investors view the odds of a 50 or 75 basis point increase as evenly balanced.

He also echoed George’s point that at the current 2.25% to 2.5% target range for the Fed’s benchmark policy rate was not yet in territory where it was slowing down economic activity.

Bostic said he believes neutral rates are close to 3%. The neutral rate is a theoretically level that neither speeds up nor brakes the economy.

Fed officials in June estimated the long-run neutral rate to lie at 2.5%. But minutes of their meeting last month highlighted a debate about whether it could be higher in the short run.

©2022 Bloomberg L.P.