Fed may be at point to ‘hold rates steady,’ Harker says

2023.08.08 10:25

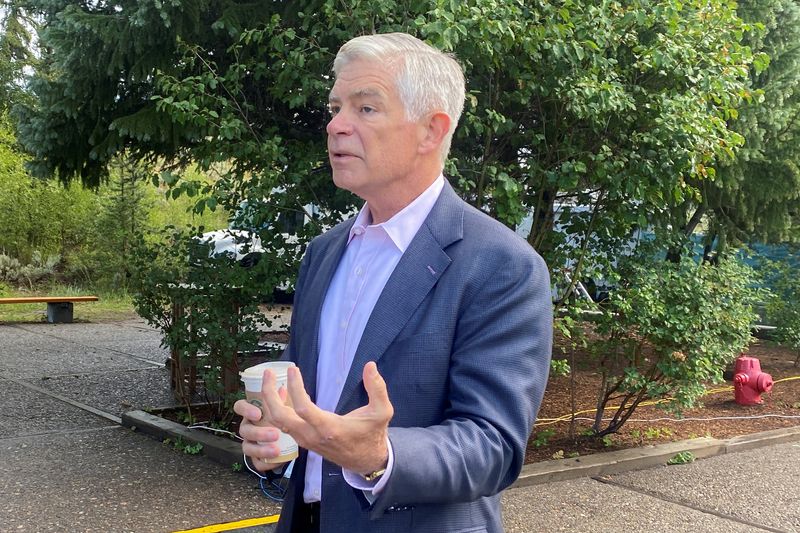

© Reuters. FILE PHOTO: Philadelphia Federal Reserve Bank President Patrick Harker speaks with CNBC’s Steve Liesman (not pictured) after an interview ahead of the annual Kansas City Fed Economic Policy Symposium, in Jackson Hole, Wyoming, U.S., August 25, 2022. REUTE

By Dan Burns

(Reuters) -Barring any abrupt change in the direction of recent economic data, the U.S. Federal Reserve may be at the stage where it can leave interest rates where they are, Philadelphia Fed President Patrick Harker said on Tuesday.

“Absent any alarming new data between now and mid-September, I believe we may be at the point where we can be patient and hold rates steady and let the monetary policy actions we have taken do their work,” Harker said in remarks prepared for delivery at an event in Philadelphia.

Should it be appropriate to cease raising rates, Harker continued, “we will need to be there for a while. The pandemic taught us to never say never, but I do not foresee any likely circumstance for an immediate easing of the policy rate.”

Harker has a vote this year on the rate-setting Federal Open Market Committee and supported last month’s rate increase. His remarks are perhaps the strongest yet from a policy-voting Fed official to indicate an inclination against raising interest rates at the central bank’s Sept. 19-20 meeting.

Atlanta Fed President Raphael Bostic, who does not have a vote on policy this year, has said he believes no more increases are necessary.

Some Fed officials are still leaning the other way, however. Fed Governor Michelle Bowman on Monday said the combination of still-elevated inflation and continued economic growth meant further rate increases are likely.

At the same time, New York Fed President John Williams, who acts as the FOMC’s vice chair and has a permanent vote on the committee, said in a New York Times interview published on Monday, “I think we’re pretty close to what a peak rate would be,” although he stopped short of committing to a position on the issue.

Like other Fed officials, Harker welcomed recent data showing inflation has eased substantially from four-decade highs a year ago at this time, and he expects that to continue. Harker said he now expects the Personal Consumption Expenditures price index, stripped of food and energy costs, to drop to just below 4% by year end and to below 3% in 2024 before “leveling out at our 2% target in 2025.”

The Fed raised its benchmark policy rate by a quarter percentage point at its meeting last month to a range of 5.25% to 5.50%. Projections from policymakers at their June meeting signaled that a majority then expected another increase beyond that, but the recent easing in inflation has kindled a more fulsome debate over the matter.

Harker said he does expect a modest uptick in the unemployment rate, last at 3.5% in July, and a slowing in gross domestic product growth from its recent pace.

“In sum, I expect only a modest slowdown in economic activity to go along with a slow but sure disinflation,” Harker said. “In other words, I do see us on the flight path to the soft landing we all hope for and that has proved quite elusive in the past.”

Fed officials in the weeks ahead will receive a bounty of critical data on inflation, the job market and the wider economy that will fuel the debate when they convene again in September.

Next up is the Consumer Price Index for July due out on Thursday. That is expected to show the first year-over-year acceleration in inflation in a year, though that is seen as primarily driven by so-called “base effects” as readings from a year earlier drop out of the calculation. On a month-to-month basis, consumer prices are seen increasing 0.2%, the same rate as in June and still well below the elevated rates seen through last year.

Asked about the risk that inflation might suddenly re-accelerate, Harker said that’s not his expectation.

“Our forecast is not that inflation might spike back up,” Harker said in response to an audience member’s question.