Fed faces dilemma, hit pause or keep raising rates?

2023.03.20 12:13

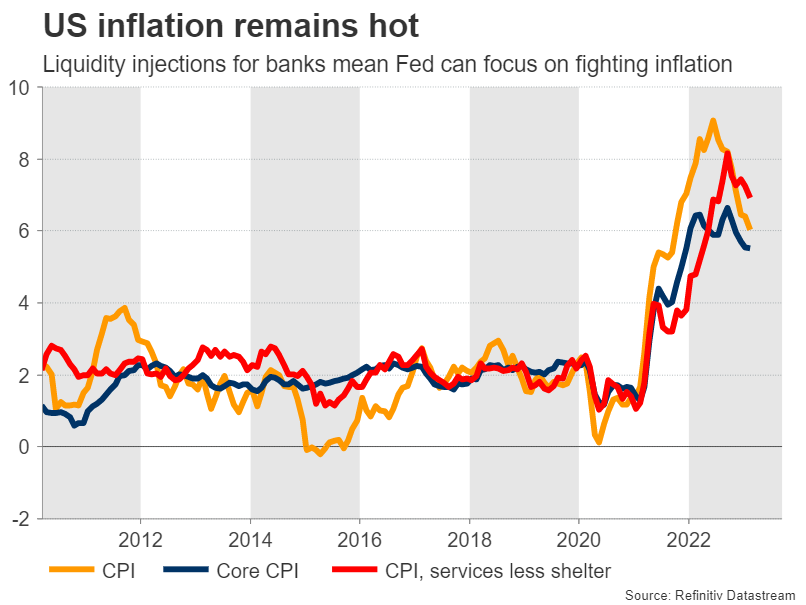

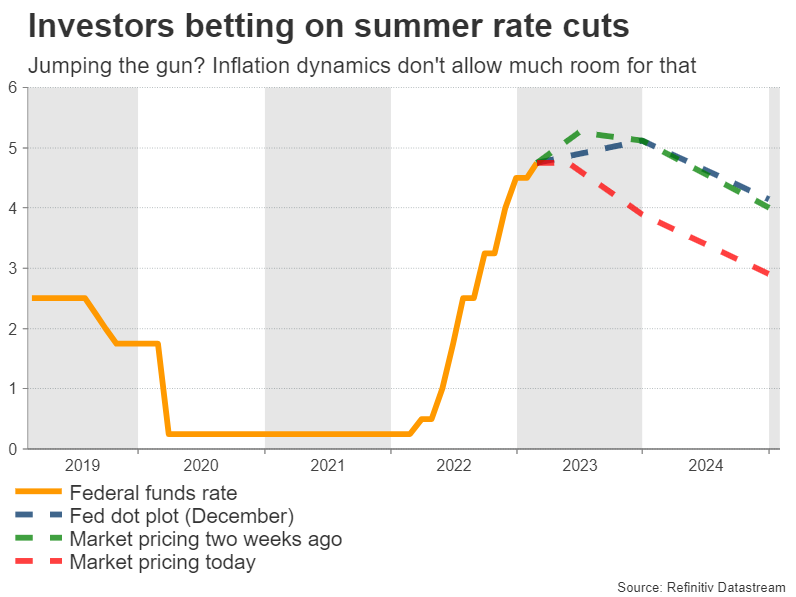

One of the most important Fed decisions in recent history lies ahead on Wednesday. Markets think the banking episode could prevent the Fed from raising rates and are pricing in rate cuts by the summer. This speculation seems overblown. Banks have already been supported and inflation is still raging. That sets the stage for a rate increase and elevated rate projections, which could revive the dollar.

Breaking point

With the banking system under enormous stress, investors believe the Fed will have second thoughts about raising interest rates any further. Markets are pricing this decision almost as a coin toss, assigning roughly 50-50 chances for a quarter-point rate increase or no action at all this week.

Further ahead, rate cuts are now expected to begin in the summer. Traders are essentially betting that if there is a rate increase, it will be the last one of this cycle, and the Fed will be forced to slash rates soon.

Admittedly, this looks like an overreaction. The broader banking system and especially the big institutions are well capitalized, so this is not a 2008 meltdown. Most of the stress is in smaller banks, which the Fed has already rushed to support through its new emergency lending program. For now, these measures seem to have stabilized the crisis.

Meanwhile, the economic data pulse has been strong lately. Inflation is way too hot for the Fed to declare victory, the labor market is in good shape, and consumption has been resilient. This combination certainly argues for more rate increases.

Split decision?

It will be a close decision this week and market pricing reflects as much. It might even be a split decision as some FOMC officials place more weight on safeguarding the financial system while others focus on the strength of the real economy.

The most prudent move would be for the Fed to mimic what the European Central Bank did last week – raise interest rates to fight inflation and highlight that if there is more banking stress, the central bank has different tools to deal with that. This would be the middle-of-the-road solution.

If the Fed raises rates, the spotlight will turn to the new interest rate projections. Back in December, FOMC officials expected rates to end the year above 5% and just a couple of weeks ago, Chairman Powell signaled they might need to raise them even higher. However, market pricing currently sees rates at 3.9% by year-end.

That is a massive gap between Fed and market expectations, which will probably narrow this week, one way or another. Considering the inflation dynamics, there’s a clear risk the Fed maintains the view that rates will end the year near 5%. With market pricing so far away from that point, such a message could ‘shock’ investors.

Market reaction

All told, market participants seem to have jumped the gun, prematurely betting that rate cuts are imminent. Should the Fed push back against this notion, US yields will likely shoot higher, boosting the dollar in the process.

In contrast, the Japanese yen could suffer the most in an environment of rising yields, so dollar/yen could enjoy a particularly sharp reaction. In this scenario, the pair might edge higher to challenge the 134.50 region.

Of course, there’s always a chance Fed officials decide to ‘play it safe’ and do nothing. The problem with this approach is that it sends a message of panic, so it could even backfire by fueling more uncertainty. It also signals that fighting inflation is not the priority, hence why it seems unlikely.

Nevertheless if the Fed chooses this path, dollar/yen would likely fall further, perhaps towards the 129.50 zone.