Fed decision and US inflation data coming up

2023.12.11 11:20

- Fed set to hold interest rates steady on Wednesday

- USD reaction will depend on rate projections for next year

- Latest US inflation report to be released on Tuesday ahead of Fed

How many rate cuts will the Fed signal?

It’s been a great year for the American economy. Real growth is on track to hit 3% with some help from resilient consumer spending and an enormous government deficit. Meanwhile, inflation has been falling steadily, fueling speculation that the economy can achieve the elusive ‘soft landing’ that the Fed has been hoping for.

Against this backdrop, the Federal Reserve will announce its latest decision at 19:00 GMT on Wednesday. Markets are pricing in almost zero chances of a rate increase, so the focus will fall mostly on the updated interest rate projections and Chairman Powell’s commentary in his press conference.

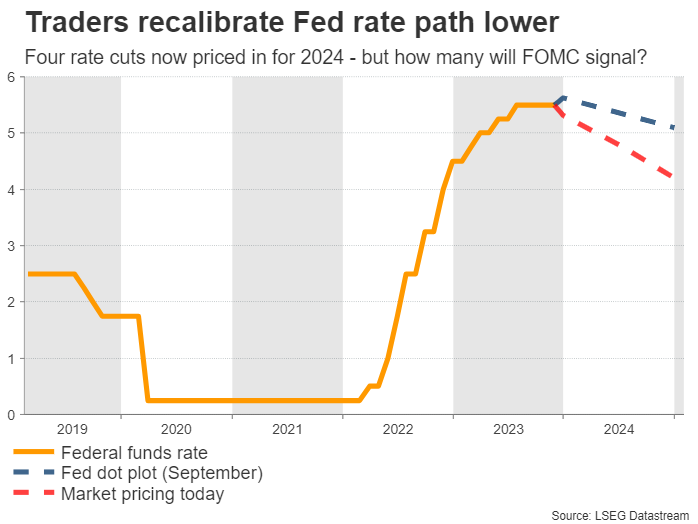

Specifically, the action will depend on whether Fed officials validate market pricing for aggressive rate cuts next year. Market pricing currently points to four rate cuts for the entirety of 2024, which would bring the Federal funds rate down to 4.2% next year.

In contrast, the latest Fed projections back in September showed interest rates closing next year at 5.1%. That’s a huge gap between FOMC forecasts and market pricing, which will probably narrow this time with the Fed coming closer to market expectations.

The question is, exactly how much will the Fed lower its rate projections? Judging by recent comments from various FOMC officials, many of whom have advocated for keeping rates steady for some time, it seems unlikely they will signal anything close to 4.2%. A more reasonable estimate might be around 4.6% instead.

Such a number might be perceived as ‘hawkish’ by investors, as the Fed would be implicitly pushing back against market pricing for such heavy rate cuts. In turn, that could be beneficial for the dollar.

Inflation and retail sales also in focus

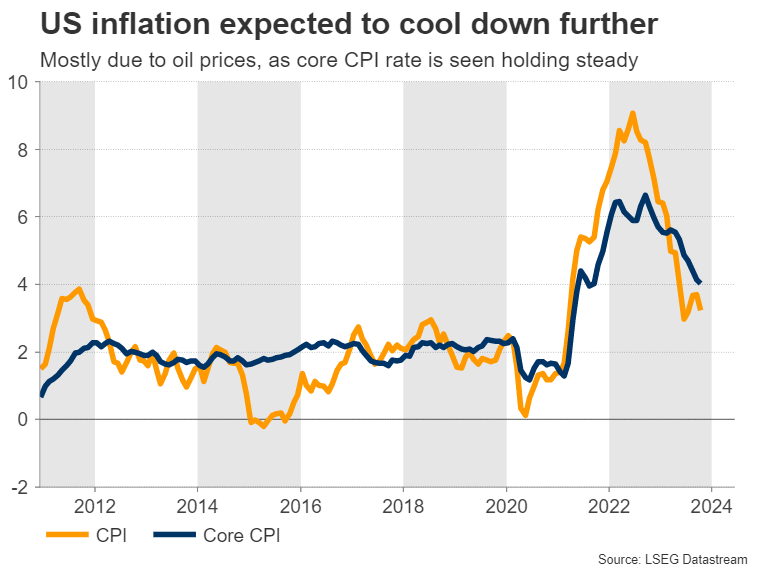

Ahead of the Fed decision, the latest US CPI inflation data will be published at 13:30 GMT on Tuesday. The headline CPI rate is forecast to have declined one tick to 3.1% in yearly terms from 3.2% earlier, mostly because of the recent decline in energy prices, as the core rate that excludes those effects is anticipated to have held steady at 4.0%.

As for any potential surprises, the risks seem tilted towards a hotter-than-expected inflation report, considering the signals from business surveys. Specifically, the S&P Global services PMI showed service providers raising their selling prices at the fastest pace since July, with the increase in prices paid of the ISM manufacturing PMI reflecting something similar.

An upside surprise in inflation could dampen speculation for Fed rate cuts next year, and by extension allow the dollar to gain some ground ahead of the Fed decision. Looking at the euro/dollar chart, a potential drop below 1.0720 could open the door for downside extensions towards the 1.0660 zone.

Beyond that, the other key event will be the release of retail sales on Thursday, in the aftermath of the Fed. Forecasts point to a slight drop in monthly terms, although nothing too serious.

In conclusion, there is some scope for these events to boost the dollar, in case the inflation report exceeds estimates and the Fed signals fewer rate cuts than markets have baked into the cake for next year.