Fed ‘close’ to where it can hold rates steady, Harker says

2023.06.01 13:21

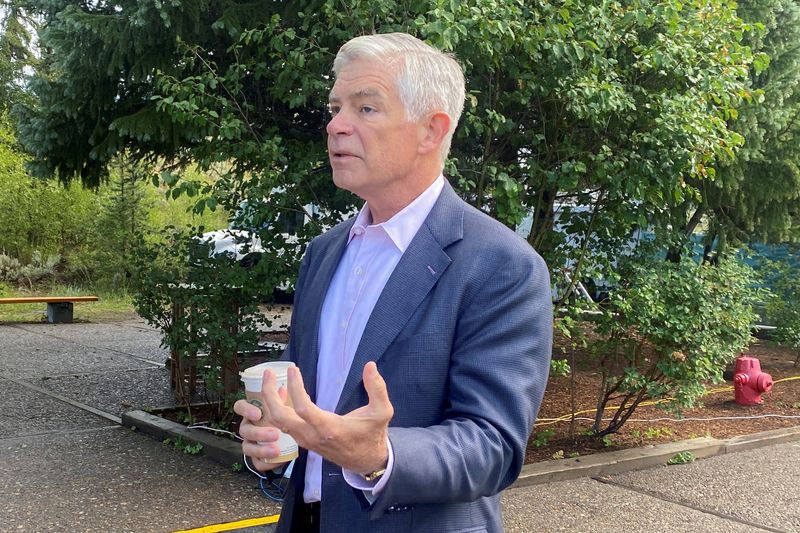

© Reuters. FILE PHOTO: Philadelphia Federal Reserve President Patrick Harker speaks with CNBC’s Steve Liesman (not pictured) after an interview in Jackson Hole, Wyoming, U.S., August 25, 2022. REUTERS/Ann Saphir/

(Reuters) – Philadelphia Federal Reserve President Patrick Harker on Thursday said that while high inflation is coming down at a “disappointingly slow” pace, the U.S. central bank may not need to raise interest rates much to hurry the process along.

“I am closely monitoring incoming data, listening to our contacts and audiences, and evaluating economic conditions to assess whether additional tightening will be needed,” Harker said in remarks prepared for delivery to a National Association for Business Economics webinar.

“I do believe that we are close to the point where we can hold rates in place and let monetary policy do its work to bring inflation back to the target in a timely manner,” Harker said.

The Fed has been raising borrowing costs since March 2022 to battle high inflation, which has fallen from a peak of 7% last summer to a current rate still above 4%, more than twice the central bank’s 2% target.

In early May it lifted its policy rate for a 10th straight time, to a targeted range of 5.00%-5.25%, and policymakers have since signaled they may skip a rate hike at the Fed’s June 13-14 meeting, to give them time to assess the impact of the rate hikes so far and of stresses in the banking sector that may have tightened credit and could slow the economy further.

Harker on Thursday said he sees some promising signs the rate hikes are having a cooling effect, particularly on housing prices.

He expects the economy to grow less than 1% this year, and for the unemployment rate, now at 3.4%, to rise to around 4.4%. Meanwhile he projects inflation to fall to 3.5% this year, 2.5% next year, and only reach the Fed’s 2% goal by 2025.