Factbox-Chipmakers cut spending as demand boom makes way for downturn

2022.11.02 09:19

[ad_1]

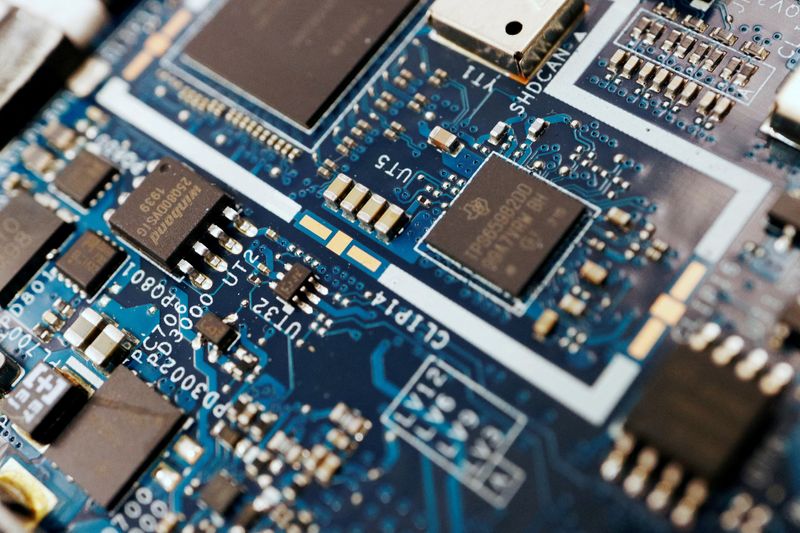

© Reuters. FILE PHOTO: Semiconductor chips are seen on a circuit board of a computer in this illustration picture taken February 25, 2022. REUTERS/Florence Lo/Illustration

(Reuters) – The global chip industry is bracing for a downturn by reining in on investments for the year, in a stark contrast to initial 2022 predictions that pandemic-fueled demand would drive growth.

The sharp reversal of fortune was triggered by a slump in the consumer electronics market due to decades-high inflation, rising interest rates and COVID-19 lockdowns in China.

Here are the top companies that have cut their investments:

Company New target Old estimate Commentary

Intel Corp (NASDAQ:) $25 billion $27 billion “We are planning for the economic uncertainty to persist

into 2023,” said CEO Pat Gelsinger on a post-earnings

call.

TSMC Cuts 2022 investment “We expect probably in 2023 the semiconductor industry

budget by at least 10% will likely decline,” CEO C.C. Wei told a media call.

Micron Technology (NASDAQ:) Expects fiscal 2023 Implies “What has been surprising is the extent of the sharp

capex to be around $8 investment in decline (in demand),” said Sumit Sadana, Micron’s chief

billion 2023 will be business officer, in an interview.

down 30%

year-over-year

United Microelectronics $3 billion $3.6 billion “There’s no tangible sign of recovery in the near term,”

Corp (UMC) (2303.TW) co-president Jason Wang said.

SK Hynix Says investment in 2023 Implies “We are hoping that the market will stabilise to some

will be cut by more investment in extent by second half of next year, but we are not ruling

than 50%. 2023 could out the possibility of a longer downturn,” Kevin Noh,

Investment in 2022 fall below 10 Chief Marketing Officer at SK Hynix, told analysts.

expected to be at the trillion won.

“upper range of 10-20

trillion won ($7-14

billion)

Western Digital Corp (NASDAQ:) For fiscal year 2023, Gross capital “We’re taking the actions around capital investment to

gross capital expenditure of slow down our bit supply in the market to try and get the

expenditure is expected about $3.2 market balance,” said CEO David Goeckeler on the earnings

to be $2.7 billion. billion call. “I think everybody is doing that.”

Aiming to reduce cash

capital expenditure by

20%.

[ad_2]

Source link