Expert View: India central bank hikes key policy rate by 35 basis points

2022.12.07 00:25

[ad_1]

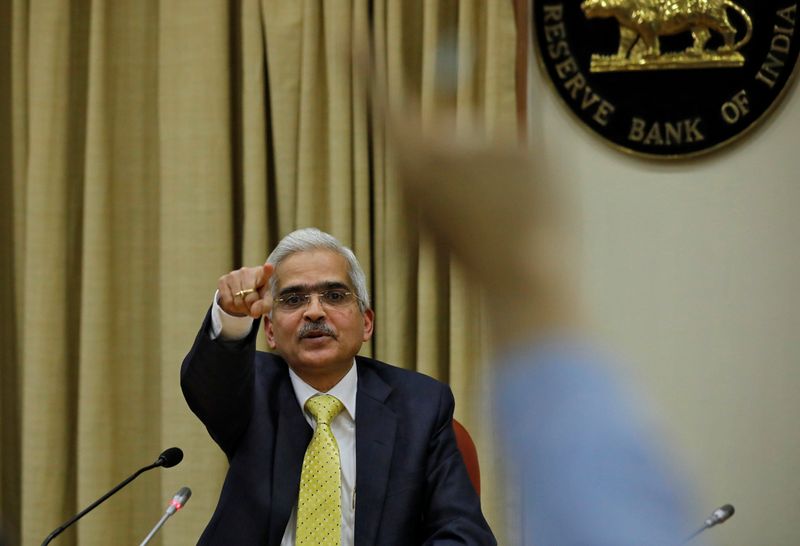

© Reuters. Reserve Bank of India (RBI) Governor Shaktikanta Das takes a question during a news conference in Mumbai, India, December 12, 2018. REUTERS/Danish Siddiqui/Files

BENGALURU (Reuters) – The Reserve Bank of India’s key repo rate was raised by 35 basis points (bps) on Wednesday as widely expected, the fifth straight increase, saying its battle against high inflation is not yet over.

The monetary policy committee (MPC), comprising three members from the RBI and three external members, raised the key lending rate or the repo rate to 6.25% in a majority decision.

Five of the six members voted in favour of the decision.

The standing deposit facility rate and the marginal standing facility rate were also increased by the same quantum to 6.00% and 6.50%, respectively.

COMMENTARY

UPASNA BHARDWAJ, CHIEF ECONOMIST, KOTAK MAHINDRA BANK, MUMBAI

“The MPC delivered the 35 bps hike as expected while retaining the stance as ‘withdrawal of accommodation.’ We continue to expect the focus of MPC to remain in a watchful mode as uncertainties on inflation settle down. We see a possibility of another 25 bps rate hike before a prolonged pause.”

[ad_2]

Source link