Exclusive-Venezuela’s opposition seeks U.S. consultations on Chevron license

2022.10.05 15:50

[ad_1]

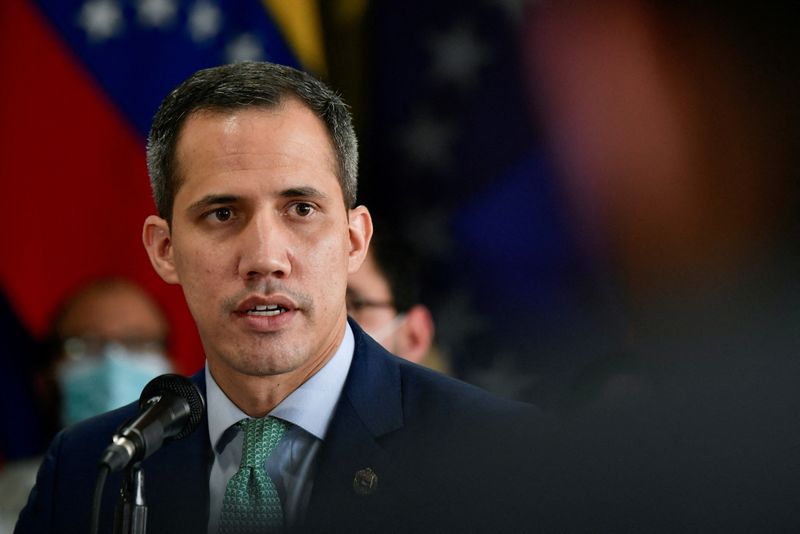

© Reuters. FILE PHOTO: Venezuela’s opposition leader Juan Guaido addresses the media, in Caracas, Venezuela, September 27, 2022. REUTERS/Gaby Oraa/

By Marianna Parraga

HOUSTON (Reuters) – Venezuelan opposition leader Juan Guaido asked the United States for details of Chevron Corp (NYSE:)’s expanded license request to operate in the South American country, according to a letter sent to a senior U.S. official on Monday that also asked to be consulted before any U.S. decisions.

Guaido’s team is concerned an agreement between Chevron and Venezuela’s state oil company PDVSA underlying the license request would not be legal under Venezuelan law, according to people familiar with the matter. Guaido’s envoys are expected to meet this month with U.S. officials in Washington and lay out those reservations.

Chevron, the last major U.S. oil producer still in Venezuela, reached a preliminary technical service agreement with PDVSA this year to revamp their joint ventures. The pact would give Chevron a greater say in operations, trading and procurement, aiming to expanding oil output.

However, no action can be taken until the U.S. government reviews the agreement and rules on Chevron’s request for a broader license to operate in Venezuela under U.S. sanctions on PDVSA and President Nicolas Maduro’s administration. Chevron’s existing U.S. authorization expires Dec. 1.

The United States and other Western nations called Maduro’s 2018 re-election a sham, and recognized Guaido’s interim government as rightful.

A senior U.S. State Department official declined to comment on the request. However, a spokesperson said: “We have previously signaled that we would review our sanctions policies in response to constructive steps by the Maduro regime to restore free and fair elections in Venezuela” through negotiations with the U.S.-recognized interim government and opposition parties.

Chevron did not comment on Guaido’s request for license details, but said in a statement the company continues to conduct business in compliance with the current sanctions framework and remains committed to the “integrity of its joint venture assets, and the company’s social and humanitarian programs.”

The U.S. Treasury Department and PDVSA did not immediately reply to requests for comment.

“It is understood that for some actors this decision may seem to be merely of a commercial nature,” Guaido said in an Oct. 3 letter to Assistant Secretary of State Brian Nichols, seen by Reuters.

“I would like to insist that this issue regarding oil licenses over Venezuela could make the difference between achieving an effective and successful negotiation that will make possible the return of democracy in Venezuela,” he wrote.

The U.S. Treasury Department’s Office of Foreign Assets Control (OFAC) in August asked Chevron for details on its PDVSA deal.

At stake are millions of barrels of Venezuelan oil that could help replace Russian supplies and expected OPEC production cuts. An expanded license could also allow Chevron to recoup at least a portion of billions of dollars in unpaid debts from its four joint ventures.

Washington has pressed to resume dialogue in Mexico between the Venezuelan government and the opposition, a move that so far has failed to deliver a concrete schedule for the talks. Maduro last week released seven Americans held in Venezuelan jails in return for two Venezuelans held in the United States.

President Joe Biden’s administration has said dialogue is a condition for any easing of sanctions, and helped organized meetings that could prompt the Mexico talks: one on Oct. 13 in Panama for opposition parties to discuss topics including elections; and another on Oct. 17 to receive Guaido’s envoy Gerardo Blyde in Washington.

[ad_2]

Source link