Exclusive-Endeavor Energy explores sale for as much as $30 billion -sources

2023.12.08 17:10

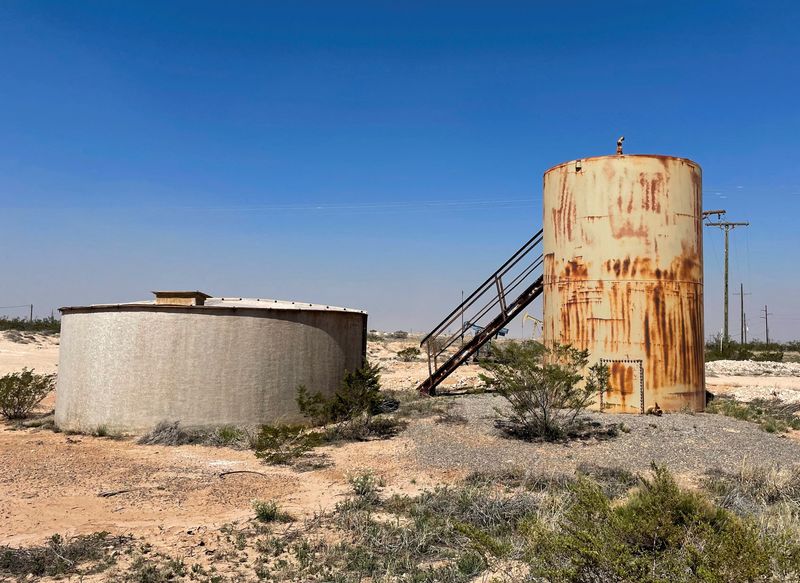

© Reuters. FILE PHOTO: An oil tank is pictured in the Permian basin, Loco Hills regions, New Mexico, U.S., April 6, 2023. REUTERS/Liz Hampton/File Photo

By David French and Anirban Sen

(Reuters) -Endeavor Energy Partners is exploring a sale that could value the largest privately-held oil and gas producer in the Permian basin, the top U.S. oilfield, at between $25 billion and $30 billion, according to people familiar with the matter.

The sale would come almost 45 years after Texas oilman Autry Stephens started the company that would become Endeavor. The 85-year-old wildcatter has decided to capitalize on a wave of mega deals sweeping the sector, the sources said.

Stephens has asked JPMorgan Chase (NYSE:) bankers to prepare to launch a sale process for Endeavor in the first quarter of 2024, the sources said, cautioning no transaction is certain and asking not to be identified because the deliberations are confidential.

Stephens has considered offers from suitors for Endeavor in the past, including in 2018, Reuters has reported. He now wants to settle the company’s future rather than let his estate decide after his death who it should sell it to, the sources said.

Endeavor and JPMorgan declined to comment.

Endeavor’s operations span 350,000 net acres (1,416 square kilometers) in the Midland portion of the Permian shale basin that straddles West Texas and eastern New Mexico.

The universe of potential deep-pocketed buyers for a company the size of Endeavor is limited. However, the consolidation wave hitting the industry, as producers seek to boost scale and lock up the best acreage, shows there would be appetite among the few.

In October, Exxon Mobil (NYSE:) clinched a $60 billion deal to buy Pioneer Natural Resources (NYSE:) and Chevron (NYSE:) announced a $53 billion agreement to buy Hess (NYSE:).

In these transactions, the acquirers are using their stock as currency, rather than tapping into their cash piles. This leaves them with sufficient financial firepower to bid for Endeavor, even as they try to complete and integrate these acquisitions. Exxon is familiar with Endeavor’s operations because the two companies teamed up to drill on some of the latter’s land until 2022.

ConocoPhillips (NYSE:) completed in October a $2.7 billion deal to buy out a 50% stake in the Surmont oil sands project in Canada. It has also shown an interest in CrownRock, which is majority-owned by private equity firm Lime Rock Partners and led by another Texas wildcatter, Timothy Dunn, Reuters has reported. The sale process for CrownRock is ongoing.

It is unclear whether Exxon, Chevron or Conoco will pursue a bid for Endeavor. Exxon and Chevron declined to comment.

There has been outreach from multiple interested parties in recent times, which helped influence the decision to explore a sale of Endeavor, two of the sources said.

Stephens, a former appraisals engineer who became more known through his appearances on the TV documentary series Black Gold, grew Endeavor by acquiring the unloved acreage of his competitors and managing to extract oil and gas profitably.

To lower his production costs, Stephens created and used his own fracking, construction, trucking and other services companies.

Endeavor produced 331,000 barrels of oil equivalent in the second quarter of 2023, up 25% from the corresponding period in 2022, according to Fitch Ratings. The credit ratings agency projected last month that Endeavor will generate about $1 billion of free cash flow in 2024.