Exclusive-China’s Trina Solar plans $400 million Vietnam plant after US sanctions – sources

2023.09.27 02:02

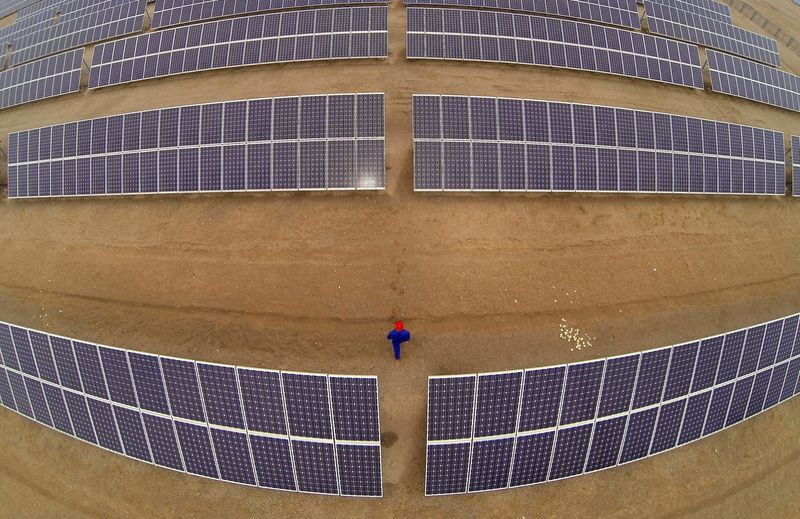

© Reuters. FILE PHOTO: A worker inspects solar panels at a solar farm in Dunhuang, 950km (590 miles) northwest of Lanzhou, Gansu Province September 16, 2013. REUTERS/Carlos Barria/File Photo

By Francesco Guarascio

HANOI (Reuters) – Chinese solar panel maker Trina Solar is planning to build its third factory in Vietnam, three people familiar with the matter told Reuters, a move that would boost exports to the United States following punitive duties to be imposed on products it makes in Thailand.

Trina, one of the world’s biggest solar panel makers by sales, would invest $400 million in the plant that would span 25 hectares of industrial land. Production is set to begin in 2025, one of the sources with direct knowledge of the plan said.

Another person who was involved in discussions with the company said Trina had flagged $600 million in possible investment in Vietnam.

The sources declined to be named because the project details remained confidential. Trina did not reply to requests for comment.

Trina’s Vietnam investment follows an investigation by the U.S. Department of Commerce which concluded last month that Trina was among five Chinese solar firms who used their plants in Thailand and other Southeast Asian countries to dodge punitive tariffs on Chinese-made panels, which the U.S. says benefit from unfair state subsidies.

The tariffs, which are due to come into effect from the middle of next year, only impact Trina’s Thailand operation so far, but the widespread practice of Chinese firms setting up facilities in Southeast Asia for export to the U.S. remains under close scrutiny.

The top producing countries in the region account for about 80% of U.S. panel supplies, with Vietnam providing about one third of all U.S. imports of solar panels in the first quarter of this year, according to S&P Global Market Intelligence.

Trina is already one of the biggest solar panel makers in Vietnam, and its planned investment underscores the growing interest of Chinese businesses in setting up factories there as they seek to avoid escalating geopolitical and trade tensions between Beijing and Washington.

China is the second biggest foreign investor in Vietnam this year, pouring into its neighbour from January to mid-August $2.7 billion, or more than five times the value of investments by U.S. companies during the same period, according to Vietnamese government data.

FENG SHUI MASTER

Trina has two plants in Vietnam: one began making silicon wafers last month with an expected annual output of 6.5 gigawatts (GW), and another one that produces solar cells and panels.

It was not immediately clear what product the new plant would manufacture. One source said it would focus on making solar cells, while another person said silicon wafers.

Sources said the company was looking at various industrial parks. One person said Trina had asked a feng shui expert to be involved in the final decision.

Feng shui is a traditional Chinese geomancy practice that is used to determine which location would be most auspicious.

Another source said Trina Vietnam’s power supply problems were being considered as the company weighed options for its possible expansion.

A heatwave in June hit the output of hydropower, Vietnam’s second biggest source of electricity, forcing factories to temporarily suspend production due to power cuts.