EURUSD turns green but not bullish yet

2023.05.29 06:41

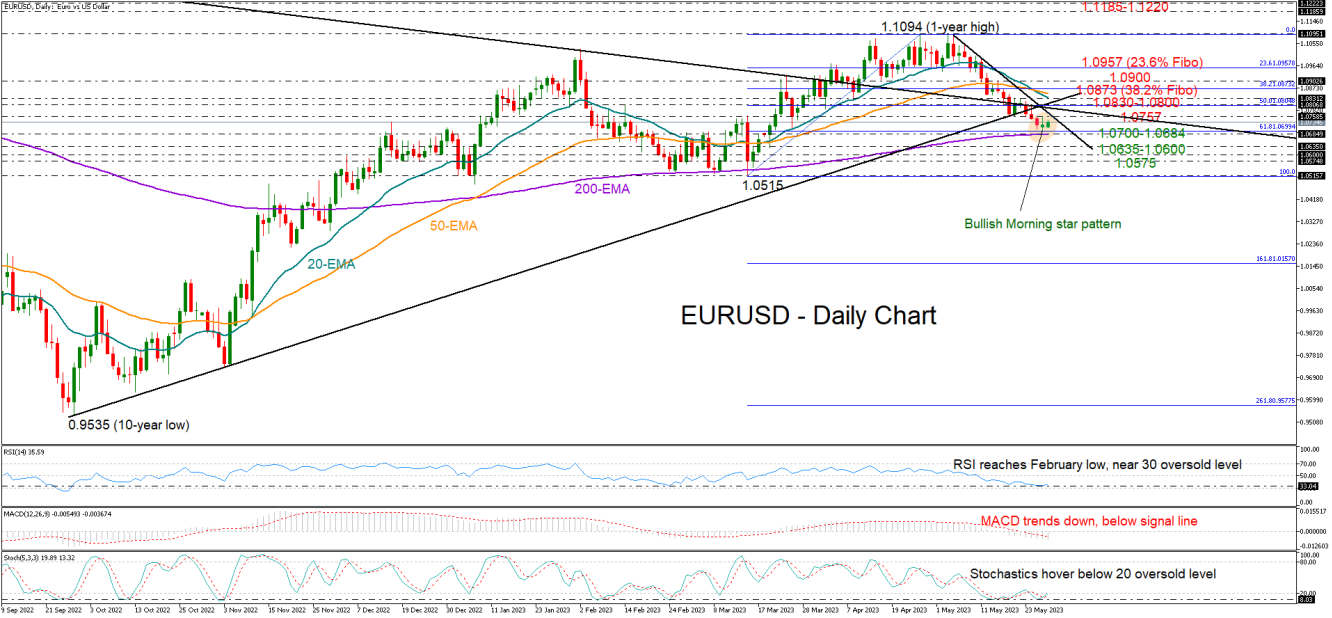

switched to recovery mode after its bearish wave from a one-year high stabilized around a two-month low of 1.0700 on Friday. Interestingly, the 61.8% Fibonacci retracement zone of the previous bullish run cemented that floor.

Technically, the pair needs to create a long green candlestick in order to confirm a bullish three-candle morning star pattern. Ideally, a close above Friday’s high of 1.0757 could boost recovery towards the key constraining zone of 1.0800 formed by September’s broken support trendline and the 50% Fibonacci area. Notably, the resistance line from May 2021 is located in the same region. Not far above, the 20- and 50-day exponential moving averages (EMAs) could be the next challenge, likely delaying an extension towards the 38.2% Fibonacci of 1.0873. If the latter point gives way, we expect the price to face some consolidation around the 1.0900 psychological mark before speeding up to the 23.6% Fibonacci of 1.0957.

Discouragingly, the technical indicators cannot promise a meaningful rally. Even though the RSI has reached its February low near its 30 oversold mark, it’s still comfortably below its 50 neutral mark. Also, the stochastic oscillator has yet to exit the oversold zone. Meanwhile, the MACD is some distance below its red signal line and well below zero.

In trend signals, the 20-day EMA has posted a clear bearish cross with the 50-day EMA for the first time since June 2021, endorsing the short-term negative direction in the market.

Still, sellers may not take control unless the price tumbles below its 200-day EMA at 1.0684. If that proves to be the case, selling pressures may intensify towards the 1.0635-1.0600 region, where the pandemic downfall bottomed out in March 2020. A sharper decline could initially test the 1.0575 barrier before heading for the March 2023 low of 1.0515. Another failure here would downgrade the long-term outlook to negative.

Summing up, although EURUSD seems to be looking for a rebound, a potential bullish climb could prove short-lived if the pair fails to overcome the 1.0800 mark.